Quest Diagnostics 2008 Annual Report Download - page 106

Download and view the complete annual report

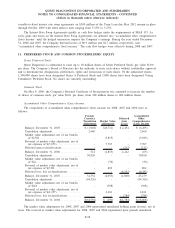

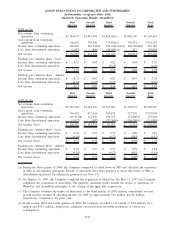

Please find page 106 of the 2008 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.During the fourth quarter of 2005, NID instituted its second voluntary product hold within a six-month

period, due to quality issues, which adversely impacted the operating performance of NID. As a result, the

Company evaluated a number of strategic options for NID, and on April 19, 2006, decided to cease operations at

NID. Upon completion of the wind down of operations in the third quarter of 2006, the operations of NID were

classified as discontinued operations. During the third quarter of 2006, the government issued two additional

subpoenas, one to NID and one to the Company. The subpoenas covered various records, including records

related to tests and test kits in addition to PTH.

During the third quarter of 2007, the government and the Company began settlement discussions. In the

course of those discussions, the government disclosed to the Company certain of the government’s legal theories

regarding the amount of damages allegedly incurred by the government, which include alleged violations of civil

and criminal statutes including the False Claims Act and the Food, Drug and Cosmetics Act. Violations of these

statutes and related regulations could lead to a warning letter, injunction, fines or penalties, exclusion from

federal healthcare programs and/or criminal prosecution, as well as claims by third parties. The Company

analyzed the government’s position and presented its own analysis which argued against many of the

government’s claims. In light of that analysis and based on the status of settlement discussions, during 2007 the

Company established a reserve, in accordance with generally accepted accounting principles, reflected in

discontinued operations, of $241 million in connection with these claims. During 2007, the Company recorded a

deferred tax benefit associated with that portion of the reserve that it expected would be tax deductible.

During 2008, the Company continued discussions with the United States Attorney’s Office to resolve the

investigation. During the third quarter of 2008, the Company and the United States Attorney’s Office reached an

agreement in principle to resolve these claims. As part of the agreement, NID, which was closed in 2006, is

expected to enter a guilty plea to a single count of felony misbranding. The terms of the settlement are subject to

the final negotiation and execution of definitive agreements, which is expected to include a corporate integrity

agreement, and the approval by the United States Department of Justice and the United States Department of

Health and Human Services and satisfactory resolution of related state claims. There can be no assurance,

however, when or whether a settlement may be finalized, or as to its terms. If a settlement is not finalized, the

Company would defend itself and NID and could incur significant costs in doing so.

As a result of the agreement in principle in 2008, the Company recorded charges of $75 million in

discontinued operations to increase its reserve for the settlement and related matters. As of December 31, 2008,

the total reserve was $316 million. The Company has recorded deferred tax benefits of $58 million on the

reserve, reflecting the Company’s current estimate of the portion of the reserve expected to be deductible for tax

purposes. The reserve reflects the Company’s current estimate of the expected probable loss with respect to these

matters, assuming the settlement is finalized. If a settlement is not finalized, the eventual losses related to these

matters could be materially different than the amount reserved and could be material to the Company’s results of

operations, cash flows and financial condition in the period that such matters are determined or paid.

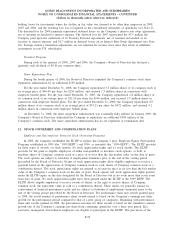

Other Matters

The Company has in the past entered into several settlement agreements with various government and

private payers relating to industry-wide billing and marketing practices that had been substantially discontinued.

The federal or state governments may bring additional claims based on new theories as to the Company’s

practices which management believes to be in compliance with law. In addition, certain federal and state statutes,

including the qui tam provisions of the federal False Claims Act, allow private individuals to bring lawsuits

against healthcare companies on behalf of government or private payers alleging inappropriate billing practices.

The Company is aware of certain pending lawsuits, including a class action lawsuit, and has received several

subpoenas related to billing practices.

During the second quarter of 2005, the Company received a subpoena from the United States Attorney’s

Office for the District of New Jersey. The subpoena seeks the production of business and financial records

regarding capitation and risk sharing arrangements with government and private payers for the years 1993 through

1999. Also, during the third quarter of 2005, the Company received a subpoena from the United States

Department of Health and Human Services, Office of the Inspector General. The subpoena seeks the production

of various business records including records regarding our relationship with health maintenance organizations,

independent physician associations, group purchasing organizations, and preferred provider organizations relating

F-34

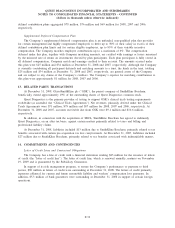

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)