Quest Diagnostics 2008 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2008 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

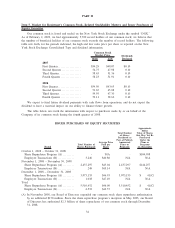

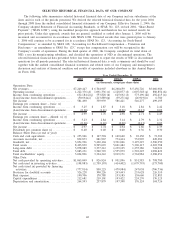

SELECTED HISTORICAL FINANCIAL DATA OF OUR COMPANY

The following table summarizes selected historical financial data of our Company and our subsidiaries at the

dates and for each of the periods presented. We derived the selected historical financial data for the years 2004

through 2008 from the audited consolidated financial statements of our Company. Effective January 1, 2006, the

Company adopted Statement of Financial Accounting Standards, or SFAS, No. 123, revised 2004, “Share-Based

Payment” (“SFAS 123R”), using the modified prospective approach and therefore has not restated results for

prior periods. Under this approach, awards that are granted, modified or settled after January 1, 2006 will be

measured and accounted for in accordance with SFAS 123R. Unvested awards that were granted prior to January

1, 2006 will continue to be accounted for in accordance SFAS No. 123, “Accounting for Stock-Based

Compensation,” as amended by SFAS 148, “Accounting for Stock-Based Compensation – Transition and

Disclosure – an amendment to SFAS No. 123,” except that compensation cost will be recognized in the

Company’s results of operations. During the third quarter of 2006, the Company completed its wind down of

NID, a test kit manufacturing subsidiary, and classified the operations of NID as discontinued operations. The

selected historical financial data presented below has been restated to report the results of NID as discontinued

operations for all periods presented. The selected historical financial data is only a summary and should be read

together with the audited consolidated financial statements and related notes of our Company and management’s

discussion and analysis of financial condition and results of operations included elsewhere in this Annual Report

on Form 10-K.

2008 2007(a) 2006(b) 2005(c) 2004

Year Ended December 31,

(in thousands, except per share data)

Operations Data:

Net revenues .................................. $7,249,447 $ 6,704,907 $6,268,659 $ 5,456,726 $5,066,986

Operating income . . . .......................... 1,222,376 (d) 1,091,336 (e) 1,128,077 (f) 1,007,548 (g) 880,854 (h)

Income from continuing operations ............. 632,184 (i)(j) 553,828 (k) 625,692 (l) 573,196 (m) 492,415 (n)

(Loss)/income from discontinued operations..... (50,694)(o) (213,889)(p) (39,271)(q) (26,919)(r) 6,780

Net income ................................... 581,490 339,939 586,421 546,277 499,195

Earnings per common share – basic: (s)

Income from continuing operations ............. $ 3.25 $ 2.87 $ 3.18 $ 2.84 $ 2.42

(Loss)/income from discontinued operations..... (0.26) (1.11) (0.20) (0.13) 0.03

Net income ................................... $ 2.99 $ 1.76 $ 2.98 $ 2.71 $ 2.45

Earnings per common share – diluted: (s) (t)

Income from continuing operations ............. $ 3.23 $ 2.84 $ 3.14 $ 2.79 $ 2.32

(Loss)/income from discontinued operations..... (0.26) (1.10) (0.20) (0.13) 0.03

Net income ................................... $ 2.97 $ 1.74 $ 2.94 $ 2.66 $ 2.35

Dividends per common share (s) ............... $ 0.40 $ 0.40 $ 0.40 $ 0.36 $ 0.30

Balance Sheet Data (at end of year):

Cash and cash equivalents ..................... $ 253,946 $ 167,594 $ 149,640 $ 92,130 $ 73,302

Accounts receivable, net ....................... 832,873 881,967 774,414 732,907 649,281

Goodwill, net ................................. 5,054,926 5,220,104 3,391,046 3,197,227 2,506,950

Total assets ................................... 8,403,830 8,565,693 5,661,482 5,306,115 4,203,788

Long-term debt................................ 3,078,089 3,377,212 1,239,105 1,255,386 724,021

Total debt. .................................... 3,083,231 3,540,793 1,555,979 1,592,225 1,098,822

Total stockholders’ equity...................... 3,604,896 3,324,242 3,019,171 2,762,984 2,288,651

Other Data:

Net cash provided by operating activities ....... $1,063,049 $ 926,924 $ 951,896 $ 851,583 $ 798,780

Net cash used in investing activities ............ (198,883) (1,759,193) (414,402) (1,079,793) (173,700)

Net cash (used in) provided by financing

activities.................................... (777,814) 850,223 (479,984) 247,038 (706,736)

Provision for doubtful accounts ................ 326,228 300,226 243,443 233,628 226,310

Rent expense.................................. 190,706 170,788 153,185 139,660 132,883

Capital expenditures . .......................... 212,681 219,101 193,422 224,270 176,125

Depreciation and amortization. ................. 264,593 237,879 197,398 176,124 168,726

40