Quest Diagnostics 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

totaling $254 million and dividend payments of $78 million. The $254 million of treasury stock purchases

represents 5.5 million shares of our common stock purchased at an average price of $46.09 per share.

Net cash provided by financing activities in 2007 was $850 million, primarily associated with new

borrowings and repayments related to the acquisitions of AmeriPath and HemoCue.

During the first quarter of 2007, we entered into an interim credit facility (the “Interim Credit Facility”) and

borrowed $450 million to finance the acquisition of HemoCue and to repay substantially all of HemoCue’s

outstanding debt.

During the second quarter of 2007, we borrowed $1.6 billion under a five-year term loan facility and $780

million under a bridge loan facility to finance the acquisition of AmeriPath and repay the Interim Credit Facility

used to finance the HemoCue acquisition.

In connection with the acquisition of AmeriPath, we repaid substantially all of AmeriPath’s outstanding debt

and related accrued interest. On May 21, 2007, we commenced a cash tender offer and consent solicitation for

the $350 million aggregate principal amount of 10.5% Senior Subordinated Notes of AmeriPath, Inc. due 2013

(the “AmeriPath senior subordinated notes”). In conjunction with the cash tender offer, approximately $348

million in aggregate principal amount, or 99.4% of the $350 million outstanding under the AmeriPath senior

subordinated notes, was tendered. We made payments of $386 million to holders with respect to the cash tender

offer and consent solicitation, including tender premium and related solicitation fees and accrued interest.

We completed an $800 million senior notes offering in June 2007 (the “2007 Senior Notes”). The 2007

Senior Notes were sold in two tranches: (a) $375 million of 6.40% senior notes due 2017; and (b) $425 million

of 6.95% senior notes due 2037. We used the net proceeds from the 2007 Senior Notes offering to repay the

$780 million of borrowings under the bridge loan facility. The 2007 Senior Notes, term loans and the bridge loan

are further described in Note 9 to the Consolidated Financial Statements.

Net cash provided by financing activities for the year ended December 31, 2007 also included $95 million in

proceeds from the exercise of stock options, including related tax benefits, offset by purchases of treasury stock

totaling $146 million and dividend payments of $77 million. The $146 million of treasury stock purchases

represents 2.8 million shares of our common stock purchased at an average price of $52.14 per share.

Dividend Program

During each of the quarters of 2008 and 2007, our Board of Directors declared a quarterly cash dividend of

$0.10 per common share. We expect to fund future dividend payments with cash flows from operations, and do

not expect the dividend to have a material impact on our ability to finance future growth.

Share Repurchase Plan

For the year ended December 31, 2008, we repurchased 5.5 million shares of our common stock at an

average price of $46.09 per share for $254 million. Through December 31, 2008, we have repurchased 49.6

million shares of our common stock at an average price of $45.43 for $2 billion under our share repurchase

program. During the fourth quarter of 2008, our Board of Directors expanded our share repurchase authorization

by an additional $150 million, which together with the amounts remaining from previous authorizations, was fully

utilized prior to December 31, 2008. In January 2009, our Board of Directors authorized $500 million of

additional share repurchases.

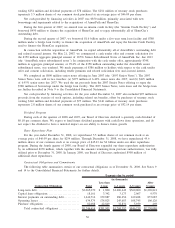

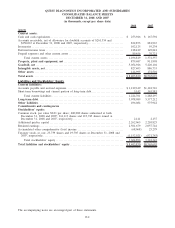

Contractual Obligations and Commitments

The following table summarizes certain of our contractual obligations as of December 31, 2008. See Notes 9

and 14 to the Consolidated Financial Statements for further details.

Contractual Obligations Total

Less than

1 year 1–3 years 3–5 years

After

5 years

(in thousands)

Payments due by period

Long-term debt ................................. $3,065,070 $ 1,800 $1,206,449 $560,000 $1,296,821

Capital lease obligations......................... 18,161 3,342 3,173 2,067 9,579

Interest payments on outstanding debt............ 1,446,716 159,887 280,256 169,488 837,085

Operating leases ................................ 634,579 174,025 245,683 108,745 106,126

Purchase obligations . . . ......................... 82,088 42,849 32,831 5,939 469

Total contractual obligations ................ $5,246,614 $381,903 $1,768,392 $846,239 $2,250,080

56