Quest Diagnostics 2008 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2008 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

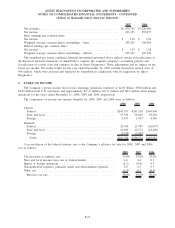

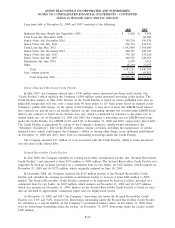

In addition to the amortizable intangibles noted above, $53.8 million was allocated to tradenames, which is

not subject to amortization, and $4.0 million was allocated to in-process research and development (“IPR&D”).

The IPR&D was expensed in the Company’s results of operations during the first quarter of 2007, in accordance

with FASB Interpretation No. 4, “Applicability of FASB Statement No. 2 to Business Combinations Accounted

for by the Purchase Method,” and is included in “other operating (income) expense, net” within the consolidated

statements of operations.

Supplemental pro forma combined financial information has not been presented as the acquisition is not

material to the Company’s consolidated results of operations.

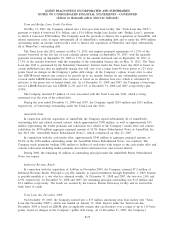

Acquisition of AmeriPath

On May 31, 2007, the Company completed its acquisition of AmeriPath, in an all-cash transaction valued at

approximately $2.0 billion, including approximately $780 million of assumed debt and related accrued interest.

AmeriPath is a leading provider of anatomic pathology, including dermatopathology, and esoteric testing and

generated annual revenues of approximately $800 million.

Through the acquisition, the Company acquired all of AmeriPath’s operations. AmeriPath, with its team of

approximately 400 board certified pathologists, operates 40 outpatient anatomic pathology testing locations and

provides inpatient anatomic pathology and medical director services for approximately 200 hospitals throughout

the United States. The Company financed the all-cash purchase price and related transaction costs, together with

the repayment of approximately $780 million of principal and related accrued interest representing substantially

all of AmeriPath’s debt, as well as the refinancing of the term loan used to finance the acquisition of HemoCue,

with $1.6 billion of borrowings under a five-year term loan facility, $780 million of borrowings under a one-year

bridge loan, and cash on-hand. In June 2007, the Company completed an $800 million senior notes offering. The

net proceeds of the senior notes offering were used to repay the $780 million bridge loan. See Note 9 for further

descriptions of the Company’s debt outstanding.

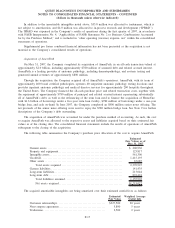

The acquisition of AmeriPath was accounted for under the purchase method of accounting. As such, the cost

to acquire AmeriPath was allocated to the respective assets and liabilities acquired based on their estimated fair

values as of the closing date. The consolidated financial statements include the results of operations of AmeriPath

subsequent to the closing of the acquisition.

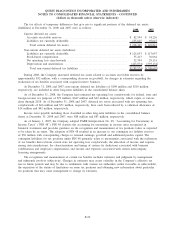

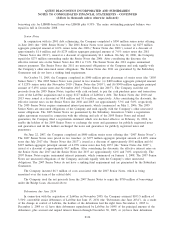

The following table summarizes the Company’s purchase price allocation of the cost to acquire AmeriPath:

Estimated

Fair Values as of

May 31, 2007

Current assets............................................................ $ 200,930

Property and equipment . . . ............................................... 125,817

Intangible assets . ........................................................ 561,300

Goodwill ................................................................ 1,415,193

Other assets ............................................................. 67,685

Total assets acquired . ............................................... 2,370,925

Current liabilities ........................................................ 141,435

Long-term liabilities...................................................... 213,044

Long-term debt . . ........................................................ 801,424

Total liabilities assumed ............................................. 1,155,903

Net assets acquired . . . ............................................... $1,215,022

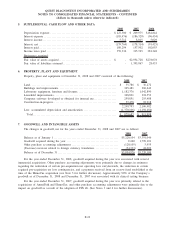

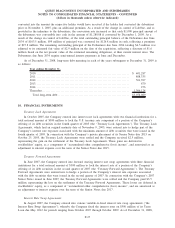

The acquired amortizable intangibles are being amortized over their estimated useful lives as follows:

Estimated

Fair Value

Weighted Average

Useful Life

Customer relationships ...................................... $327,500 20 years

Non-compete agreement. .................................... 5,800 5 years

Tradename ................................................. 2,500 2 years

F-17

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)