Quest Diagnostics 2008 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2008 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

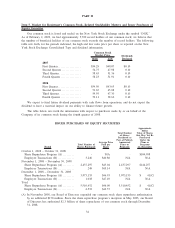

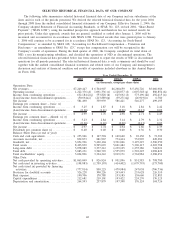

(a) On January 31, 2007, we completed the acquisition of POCT Holding AB, (“HemoCue”). On May 31, 2007,

we completed the acquisition of AmeriPath Group Holdings, Inc., (“AmeriPath”). Consolidated operating

results for 2007 include the results of operations of HemoCue and AmeriPath subsequent to the closing of

the applicable acquisition. See Note 3 to the Consolidated Financial Statements.

(b) On July 3, 2006, we completed the acquisition of Focus Technologies Holding Company, (“Focus

Diagnostics”). On August 31, 2006, we completed the acquisition of Enterix Inc., (“Enterix”). Consolidated

operating results for 2006 include the results of operations of Focus Diagnostics and Enterix subsequent to

the closing of the applicable acquisition. See Note 3 to the Consolidated Financial Statements.

(c) On November 1, 2005, we completed the acquisition of LabOne, Inc., (“LabOne”). Consolidated operating

results for 2005 include the results of operations of LabOne subsequent to the closing of the acquisition.

(d) For 2008, operating income includes $71 million of stock-based compensation expense recorded in

accordance with SFAS 123R and $16.2 million of costs, primarily associated with workforce reductions

recorded during the fourth quarter of 2008.

(e) For 2007, operating income includes $57 million of stock-based compensation expense recorded in

accordance with SFAS 123R, $10.7 million of costs associated with workforce reductions in response to

reduced volume levels and a pre-tax charge of $4 million related to in-process research and development

expense associated with the HemoCue acquisition.

(f) For 2006, operating income includes $55 million of stock-based compensation expense recorded in

accordance with SFAS 123R and $27 million of special charges, primarily associated with integration

activities.

(g) For 2005, operating income includes a $6.2 million charge primarily related to forgiveness of amounts owed

by patients and physicians, and related property damage as a result of hurricanes in the Gulf Coast.

(h) For 2004, operating income includes a $10.3 million charge associated with the acceleration of certain

pension obligations in connection with the succession of our prior CEO.

(i) Includes an $8.9 million charge associated with the write-down of an equity investment recorded during

2008.

(j) Includes income tax benefits of $16.5 million primarily associated with favorable resolutions of certain tax

contingencies in 2008.

(k) Includes a $4.0 million charge associated with the write-down of an equity investment recorded during 2007.

(l) Includes net charges of $10 million related to net investment losses recorded during 2006.

(m) Includes a $7.1 million charge associated with the write-down of an investment during 2005.

(n) Includes a $2.9 million charge during 2004 representing the write-off of deferred financing costs associated

with the refinancing of our then existing bank debt and credit facility.

(o) During 2008, we recorded charges of $75 million related to the government investigation of NID. See Note

14 and Note 15 to the Consolidated Financial Statements.

(p) During 2007, we recorded charges of $241 million related to the government investigation of NID. See Note

14 and Note 15 to the Consolidated Financial Statements.

(q) During 2006, we recorded $32 million in charges related to the wind down of NID’s operations. See Note

15 to the Consolidated Financial Statements.

(r) During 2005, we recorded a $16 million charge to write-off certain assets in connection with a product hold

at NID.

(s) Previously reported basic and diluted earnings per share have been restated to give retroactive effect of our

two-for-one stock split effected on June 20, 2005.

(t) Potentially dilutive common shares primarily include the dilutive effect of our 1

3

⁄

4

% contingent convertible

debentures issued November 26, 2001, which were redeemed principally through a conversion into common

shares as of January 18, 2005, and outstanding stock options, performance share units, restricted common

shares and restricted stock units granted under our Amended and Restated Employee Long-Term Incentive

Plan and our Amended and Restated Director Long-Term Incentive Plan.

41