Pep Boys 2014 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2014 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 31, 2015, February 1, 2014 and February 2, 2013

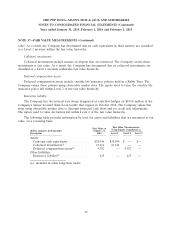

NOTE 17—FAIR VALUE MEASUREMENTS (Continued)

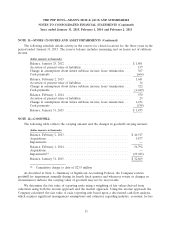

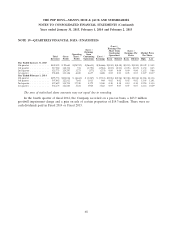

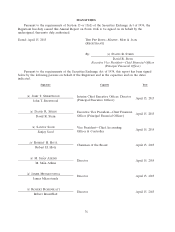

Fair Value Measurements

Fair Value at Using Inputs Considered as

(dollar amounts in thousands) February 1,

Description 2014 Level 1 Level 2 Level 3

Assets:

Cash and cash equivalents ............ $33,431 $33,431 $ — $—

Collateral investments(a) .............. 21,611 21,611 ——

Deferred compensation assets(a) ........ 4,242 — 4,242 —

Other assets

Derivative asset(a) .................. 606 — 606 —

(a) included in other long-term assets

(b) included in other long-term liabilities

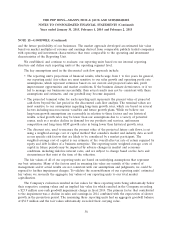

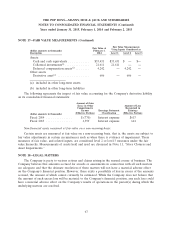

The following represents the impact of fair value accounting for the Company’s derivative liability

on its consolidated financial statements:

Amount of Gain

(Loss) in Other Amount of Loss

Comprehensive Recognized in

Income Earnings Statement Earnings

(Effective Portion) Classification (Effective Portion)

(dollar amounts in thousands)

Fiscal 2014 ............... $(770) Interest expense $613

Fiscal 2013 ............... 1,359 Interest expense 614

Non-financial assets measured at fair value on a non-recurring basis:

Certain assets are measured at fair value on a non-recurring basis, that is, the assets are subject to

fair value adjustments in certain circumstances such as when there is evidence of impairment. These

measures of fair value, and related inputs, are considered level 2 or level 3 measures under the fair

value hierarchy. Measurements of assets held and used are discussed in Note 11, ‘‘Store Closures and

Asset Impairments.’’

NOTE 18—LEGAL MATTERS

The Company is party to various actions and claims arising in the normal course of business. The

Company believes that amounts accrued for awards or assessments in connection with all such matters

are adequate and that the ultimate resolution of these matters will not have a material adverse effect

on the Company’s financial position. However, there exists a possibility of loss in excess of the amounts

accrued, the amount of which cannot currently be estimated. While the Company does not believe that

the amount of such excess loss will be material to the Company’s financial position, any such loss could

have a material adverse effect on the Company’s results of operations in the period(s) during which the

underlying matters are resolved.

67