Pep Boys 2014 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2014 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 31, 2015, February 1, 2014 and February 2, 2013

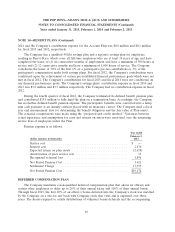

NOTE 14—BENEFIT PLANS (Continued)

2014 and the Company’s contribution expense for the Account Plan was $0.8 million and $0.1 million

for fiscal 2013 and 2012, respectively.

The Company has a qualified 401(k) savings plan and a separate savings plan for employees

residing in Puerto Rico, which cover all full-time employees who are at least 18 years of age and have

completed the lesser of (1) six consecutive months of employment and have a minimum of 500 hours of

service and (2) 12 consecutive months and have a minimum of 1,000 hours of service. The Company

contributes the lesser of 50% of the first 6% of a participant’s pre-tax contributions or 3% of the

participant’s compensation under both savings plans. For fiscal 2012, the Company’s contributions were

conditional upon the achievement of certain pre-established financial performance goals which were not

met in fiscal 2012. The Company’s contributions for fiscal 2013 and fiscal 2014 were not conditional on

any financial performance goals. The Company’s savings plans’ contribution expense in fiscal 2014 and

2013 was $3.2 million and $3.5 million respectively. The Company had no contribution expense in fiscal

2012.

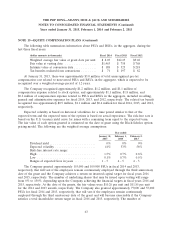

During the fourth quarter of fiscal 2012, the Company terminated its defined benefit pension plan

and contributed $14.1 million to fully fund the plan on a termination basis. Accordingly, the Company

has no further defined benefit pension expense. The participants’ benefits were converted into a lump

sum cash payment or an annuity contract placed with an insurance carrier. The Company used a fiscal

year end measurement date for determining the benefit obligation and the fair value of Plan assets.

The actuarial computations were made using the ‘‘projected unit credit method.’’ Variances between

actual experience and assumptions for costs and returns on assets were amortized over the remaining

service lives of employees under the Plan.

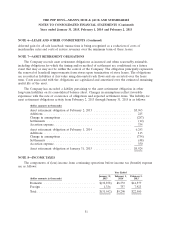

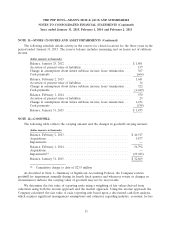

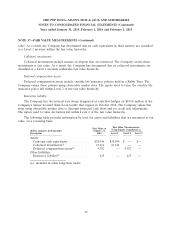

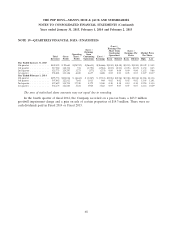

Pension expense is as follows:

Year ended

February 2,

(dollar amounts in thousands) 2013

Service cost ............................................. $ —

Interest cost ............................................. 2,170

Expected return on plan assets ............................... (2,658)

Amortization of prior service cost ............................. 13

Recognized actuarial loss ................................... 1,896

Net Period Pension Cost .................................... 1,421

Settlement Charge ........................................ 17,753

Net Period Pension Cost .................................... $19,174

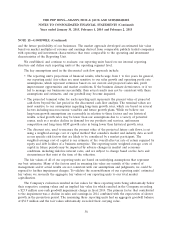

DEFERRED COMPENSATION PLAN

The Company maintains a non-qualified deferred compensation plan that allows its officers and

certain other employees to defer up to 20% of their annual salary and 100% of their annual bonus.

Through fiscal 2013, the first 20% of an officer’s bonus deferred into the Company’s stock was matched

by the Company on a one-for-one basis with Company stock that vests and is expensed over three

years. The shares required to satisfy distributions of voluntary bonus deferrals and the accompanying

60