Pep Boys 2014 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2014 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 31, 2015, February 1, 2014 and February 2, 2013

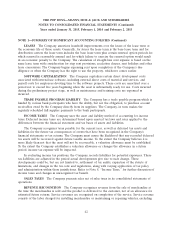

NOTE 1—SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

incremental expenses. Vendor support funds used to offset direct advertising costs were immaterial for

fiscal years 2014, 2013, and 2012.

WARRANTY RESERVE The Company provides warranties for both its merchandise sales and

service labor. Warranties for merchandise are generally covered by the respective suppliers with the

Company covering any costs above the supplier’s stipulated allowance. Service labor is warranted in full

by the Company for a limited specific time period. The Company establishes its warranty reserves

based on historical experience. These costs are included in either costs of merchandise sales or costs of

service revenue in the consolidated statement of operations.

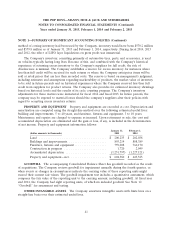

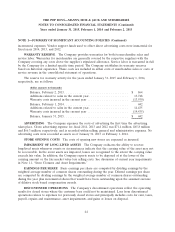

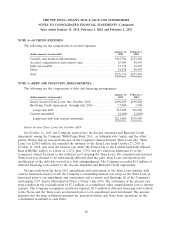

The reserve for warranty activity for the years ended January 31, 2015 and February 1, 2014,

respectively, are as follows:

(dollar amounts in thousands)

Balance, February 2, 2013 .................................... $ 864

Additions related to sales in the current year ...................... 13,748

Warranty costs incurred in the current year ....................... (13,930)

Balance, February 1, 2014 .................................... 682

Additions related to sales in the current year ...................... 14,435

Warranty costs incurred in the current year ....................... (14,435)

Balance, January 31, 2015 .................................... $ 682

ADVERTISING The Company expenses the costs of advertising the first time the advertising

takes place. Gross advertising expense for fiscal 2014, 2013 and 2012 was $71.4 million, $65.8 million

and $66.3 million, respectively, and is recorded within selling, general and administrative expenses. No

advertising costs were recorded as assets as of January 31, 2015 or February 1, 2014.

STORE OPENING COSTS The costs of opening new stores are expensed as incurred.

IMPAIRMENT OF LONG-LIVED ASSETS The Company evaluates the ability to recover

long-lived assets whenever events or circumstances indicate that the carrying value of the asset may not

be recoverable. In the event assets are impaired, losses are recognized to the extent the carrying value

exceeds fair value. In addition, the Company reports assets to be disposed of at the lower of the

carrying amount or the fair market value less selling costs. See discussion of current year impairments

in Note 11, ‘‘Store Closures and Asset Impairments.’’

EARNINGS PER SHARE Basic earnings per share are computed by dividing earnings by the

weighted average number of common shares outstanding during the year. Diluted earnings per share

are computed by dividing earnings by the weighted average number of common shares outstanding

during the year plus incremental shares that would have been outstanding upon the assumed exercise

of dilutive stock based compensation awards.

DISCONTINUED OPERATIONS The Company’s discontinued operations reflect the operating

results for closed stores where the customer base could not be maintained. Loss from discontinued

operations relates to expenses for previously closed stores and principally includes costs for rent, taxes,

payroll, repairs and maintenance, asset impairments, and gains or losses on disposal.

44