Pep Boys 2014 Annual Report Download - page 39

Download and view the complete annual report

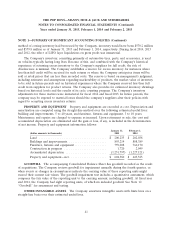

Please find page 39 of the 2014 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Uncertainties about an Entity’s Ability to Continue as a Going Concern.’’ This new standard requires

management to perform interim and annual assessments of an entity’s ability to continue as a going

concern within one year of the date the financial statements are issued. An entity must provide certain

disclosures if conditions or events raise substantial doubt about the entity’s ability to continue as a

going concern. This ASU is effective for annual periods ending after December 15, 2016, and interim

periods thereafter; earlier adoption is permitted. The Company does not expect the adoption of

ASU 2014-15 to have a material impact on the consolidated financial statements.

In June 2014, the FASB issued ASU No. 2014-12, ‘‘Accounting for Share-Based Payments When

the Terms of an Award Provide That a Performance Target Could Be Achieved after the Requisite

Service Period’’, which is effective for fiscal years, and interim periods within those years, beginning

after December 15, 2015 with early adoption permitted. The Company is currently evaluating the new

standard, but does not expect adoption of ASU 2014-12 to have a material impact on our consolidated

financial statements.

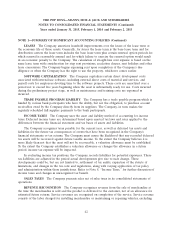

In May 2014, the FASB issued ASU No. 2014-09, ‘‘Revenue from Contracts with Customers.’’

ASU 2014-09 supersedes the revenue recognition requirements in ‘‘Topic 605, Revenue Recognition’’

and requires entities to recognize revenue in a way that depicts the transfer of promised goods or

services to customers in an amount that reflects the consideration to which the entity expects to be

entitled in exchange for those goods or services. ASU 2014-09 is effective retrospectively for annual or

interim reporting periods beginning after December 15, 2016, with early adoption not permitted. The

Company is currently evaluating the new standard, but does not expect the adoption of ASU 2014-09 to

have a material impact on the consolidated financial statements.

In April 2014, the FASB issued ASU No. 2014-08, ‘‘Reporting of Discontinued Operations and

Disclosures of Disposals of Components of an Entity.’’ ASU 2014-08 provides a narrower definition of

discontinued operations than under existing U.S. GAAP. ASU 2014-08 requires that only a disposal of a

component of an entity, or a group of components of an entity, that represents a strategic shift that

has, or will have, a major effect on the reporting entity’s operations and financial results should be

reported in the financial statements as discontinued operations. ASU 2014-08 also provides guidance on

the financial statement presentations and disclosures of discontinued operations. ASU 2014-08 is

effective prospectively for disposals (or classifications as held for disposal) of components of an entity

that occur in annual or interim periods beginning after December 15, 2014. The Company does not

expect the adoption of ASU 2014-08 to have a material impact on the consolidated financial

statements.

In July 2013, the FASB issued ASU No. 2013-11, ‘‘Presentation of an Unrecognized Tax Benefit

When a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists’’.

ASU 2013-11 states that an unrecognized tax benefit should be presented in the financial statements as

a reduction to a deferred tax asset for a net operating loss carryforward or a tax credit carryforward, if

available at the reporting date under the applicable tax law to settle any additional income taxes that

would result from the disallowance of a tax position. If the tax law of the applicable jurisdiction does

not require the entity to use, and the entity does not intend to use, the deferred tax asset for such

purpose, the unrecognized tax benefit should be presented in the financial statements as a liability. The

amendments in this ASU are effective for fiscal years, and interim periods within those years, beginning

after December 15, 2013. The adoption of ASU 2013-11 did not have a material impact on the

Company’s consolidated financial statements.

ITEM 7A QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We have market rate exposure in our financial instruments due to changes in interest rates and

prices.

33