Pep Boys 2014 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2014 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

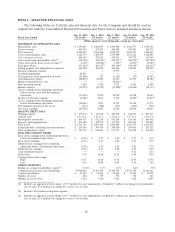

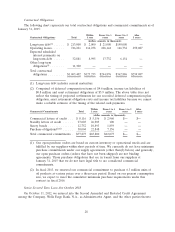

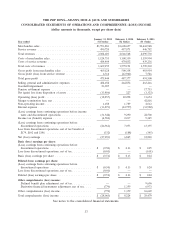

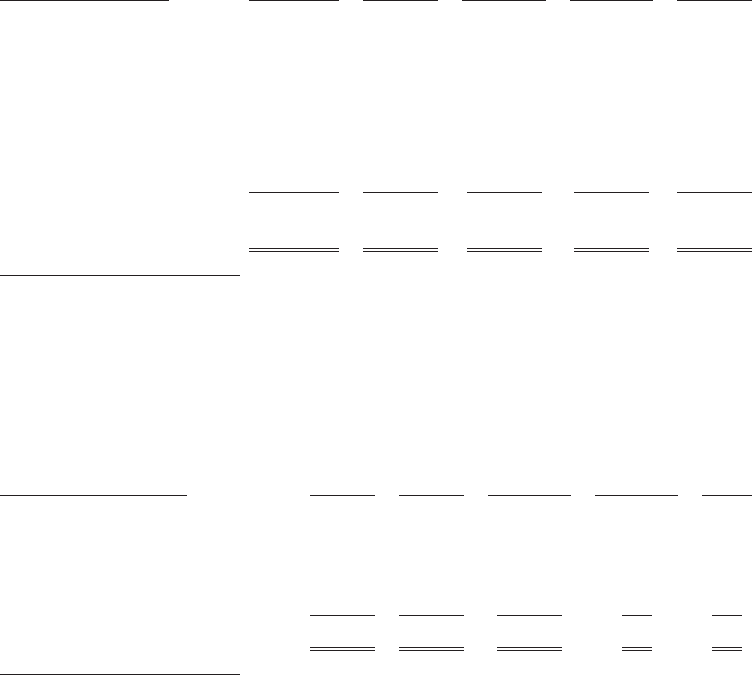

Contractual Obligations

The following chart represents our total contractual obligations and commercial commitments as of

January 31, 2015:

Within From 1 to 3 From 3 to 5 After

Contractual Obligations Total 1 year years years 5 years

(dollars amounts in thousands)

Long-term debt(1) ...... $ 213,000 $ 2,000 $ 21,000 $190,000 —

Operating leases ....... 746,221 114,258 206,144 166,732 259,087

Expected scheduled

interest payments on

long-term debt ...... 32,881 8,995 17,732 6,154 —

Other long-term

obligations(2) ........ 11,300 —— ——

Total contractual

obligations ......... $1,003,402 $125,253 $244,876 $362,886 $259,087

(1) Long-term debt includes current maturities.

(2) Comprised of deferred compensation items of $4.6 million, income tax liabilities of

$0.8 million and asset retirement obligations of $5.9 million. The above table does not

reflect the timing of projected settlements for our recorded deferred compensation plan

obligation, asset retirement obligation costs and income tax liabilities because we cannot

make a reliable estimate of the timing of the related cash payments.

Within From 1 to 3 From 3 to 5 After

Commercial Commitments Total 1 year years years 5 years

(dollar amounts in thousands)

Commercial letters of credit . . . $ 8,116 $ 5,156 $ 2,960 $— $—

Standby letters of credit ...... 27,003 26,903 100 ——

Surety bonds .............. 12,752 10,893 1,859 ——

Purchase obligations(1)(2) ...... 30,004 22,848 7,156 ——

Total commercial commitments . $77,875 $65,800 $12,075 $— $—

(1) Our open purchase orders are based on current inventory or operational needs and are

fulfilled by our suppliers within short periods of time. We currently do not have minimum

purchase commitments under our supply agreements (other than(2) below) and generally,

our open purchase orders (orders that have not been shipped) are not binding

agreements. Those purchase obligations that are in transit from our suppliers at

January 31, 2015 that we do not have legal title to are considered commercial

commitments.

(2) In fiscal 2013, we renewed our commercial commitment to purchase 6.3 million units of

oil products at various prices over a three-year period. Based on our present consumption

rate, we expect to meet the cumulative minimum purchase requirements under this

contract in fiscal 2016.

Senior Secured Term Loan due October 2018

On October 11, 2012, we entered into the Second Amended and Restated Credit Agreement

among the Company, Wells Fargo Bank, N.A., as Administrative Agent, and the other parties thereto

28