Pep Boys 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 31, 2015, February 1, 2014 and February 2, 2013

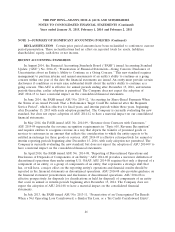

NOTE 6—LEASE AND OTHER COMMITMENTS (Continued)

deferred gain for all sale leaseback transactions is being recognized as a reduction of costs of

merchandise sales and costs of service revenues over the minimum term of these leases.

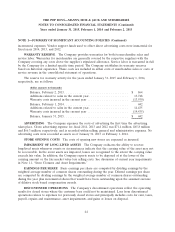

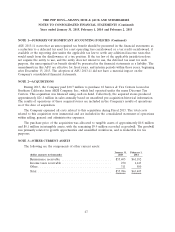

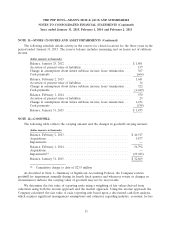

NOTE 7—ASSET RETIREMENT OBLIGATIONS

The Company records asset retirement obligations as incurred and when reasonably estimable,

including obligations for which the timing and/or method of settlement are conditional on a future

event that may or may not be within the control of the Company. The obligation principally represents

the removal of leasehold improvements from stores upon termination of store leases. The obligations

are recorded as liabilities at fair value using discounted cash flows and are accreted over the lease

term. Costs associated with the obligations are capitalized and amortized over the estimated remaining

useful life of the asset.

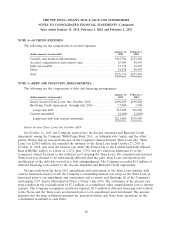

The Company has recorded a liability pertaining to the asset retirement obligation in other

long-term liabilities on its consolidated balance sheet. Changes in assumptions reflect favorable

experience with the rate of occurrence of obligations and expected settlement dates. The liability for

asset retirement obligations activity from February 2, 2013 through January 31, 2015 is as follows:

(dollar amounts in thousands)

Asset retirement obligation at February 2, 2013 ..................... $5,963

Additions ................................................. 245

Change in assumptions ....................................... (287)

Settlements ............................................... (12)

Accretion expense ........................................... 334

Asset retirement obligation at February 1, 2014 ..................... 6,243

Additions ................................................. 113

Change in assumptions ....................................... (734)

Settlements ............................................... (48)

Accretion expense ........................................... 350

Asset retirement obligation at January 31, 2015 ..................... $5,924

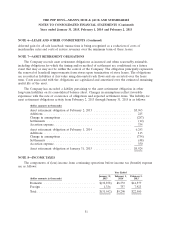

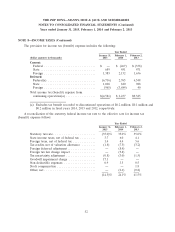

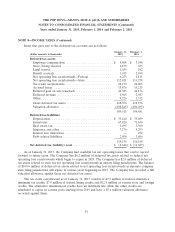

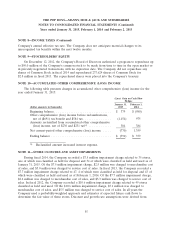

NOTE 8—INCOME TAXES

The components of (loss) income from continuing operations before income tax (benefit) expense

are as follows:

Year Ended

January 31, February 1, February 2,

(dollar amounts in thousands) 2015 2014 2013

Domestic ............................. $(32,878) $8,533 $14,577

Foreign ............................... 1,336 757 7,923

Total ................................. $(31,542) $9,290 $22,500

51