Pep Boys 2014 Annual Report Download - page 25

Download and view the complete annual report

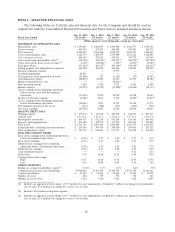

Please find page 25 of the 2014 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(4) Includes an aggregate pretax charge of $10.6 million for asset impairment, of which $5.1 million was charged to

merchandise cost of sales, $5.5 million was charged to service cost of sales.

(5) In fiscal 2012, we recorded settlement proceeds, net of merger related costs of $42.8 million, resulting from the termination

of the ‘‘go private’’ transaction.

(6) Includes $11.2 million of fees associated with debt refinancing.

(7) Includes an aggregate pretax charge of $1.6 million for asset impairment, of which $0.6 million was charged to merchandise

cost of sales, $1.0 million was charged to service cost of sales.

(8) Includes a tax benefit of $3.6 million and $2.2 million in Fiscal 2011 and Fiscal 2010, respectively, due to the release of

valuation allowances on state net operating loss carryforwards and credits.

(9) Includes a pretax benefit of $5.9 million due to the reduction in reserve for excess inventory which reduced merchandise

cost of sales and an aggregate pretax charge of $1.0 million for asset impairment, of which $0.8 million was charged to

merchandise cost of sales and $0.2 million was charged to service cost of sales.

(10) Gross profit from merchandise sales includes the cost of products sold, buying, warehousing and store occupancy costs.

Gross profit from service revenue includes the cost of installed products sold, buying, warehousing, service payroll and

related employee benefits and occupancy costs. Occupancy costs include utilities, rents, real estate and property taxes,

repairs and maintenance and depreciation and amortization expenses. Our gross profit may not be comparable to those of

our competitors due to differences in industry practice regarding the classification of certain costs.

(11) Return on average stockholders’ equity is calculated by dividing net earnings (loss) for the period by average stockholders’

equity for the year.

ITEM 7 MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

OVERVIEW

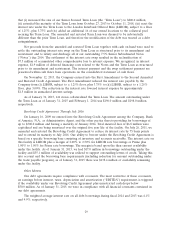

The following discussion and analysis explains the results of our operations for fiscal 2014 and

2013 and developments affecting our financial condition as of January 31, 2015. This discussion and

analysis below should be read in conjunction with Item 6 ‘‘Selected Consolidated Financial Data,’’ and

our consolidated financial statements and the notes included elsewhere in this report. The discussion

and analysis contains ‘‘forward looking statements’’ within the meaning of The Private Securities

Litigation Reform Act of 1995. Forward looking statements include management’s expectations

regarding implementation of its long-term strategic plan, future financial performance, automotive

aftermarket trends, levels of competition, business development activities, future capital expenditures,

financing sources and availability and the effects of regulation and litigation. Actual results may differ

materially from the results discussed in the forward looking statements due to a number of factors

beyond our control, including those set forth under the section entitled ‘‘Item 1A Risk Factors’’

elsewhere in this report.

Introduction

The Pep Boys—Manny, Moe & Jack (and subsidiaries, the ‘‘Company’’) has been the best place to

shop and care for your car since it began operations in 1921. Approximately 19,000 associates are

focused on delivering the best customer service in the automotive aftermarket industry across 806

locations located throughout the United States and Puerto Rico. Pep Boys satisfies all of a customer’s

automotive needs through our unique offering of service, tires, parts and accessories.

Our stores are organized into a hub and spoke network consisting of Supercenters and Service &

Tire Centers. Supercenters average approximately 20,000 square feet (our new Supercenter format is

approximately 14,000 square feet) and combine do-it-for-me service labor, installed merchandise and

tire offerings (‘‘DIFM’’) with do-it-yourself parts and accessories (‘‘DIY’’). Most of our Supercenters

also have a commercial sales program that provides prompt delivery of parts, tires and equipment to

automotive repair shops and dealers. Service & Tire Centers, which average approximately 5,000 square

feet, provide DIFM services in neighborhood locations that are conveniently located where our

customers live or work. Service & Tire Centers are designed to capture market share and leverage our

19