Pep Boys 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 31, 2015, February 1, 2014 and February 2, 2013

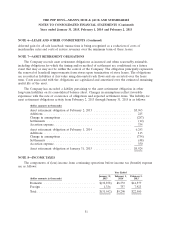

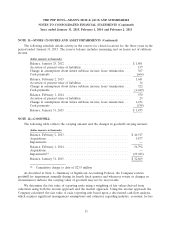

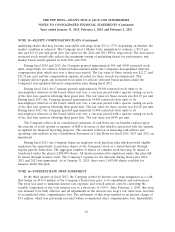

NOTE 14—BENEFIT PLANS (Continued)

match in the Company’s stock are issued from its treasury account. On January 31, 2014, the Company

amended the deferred compensation plan to eliminate the automatic matching employer contributions

effective for fiscal 2014.

RABBI TRUST

The Company establishes and maintains a deferred liability for the non-qualified deferred

compensation plan and the Account Plan. The Company plans to fund this liability by remitting the

officers’ deferrals to a Rabbi Trust where these are invested in variable life insurance policies. These

assets are included in non-current other assets and are considered to be a Level 2 measure within the

fair value hierarchy. Accordingly, all gains and losses on these underlying investments, which are held

in the Rabbi Trust to fund the deferred liability, are recognized in the Company’s Consolidated

Statement of Operations. Under these plans, there were liabilities of $5.1 million at January 31, 2015

and $6.9 million at February 1, 2014, respectively, which are recorded primarily in other long-term

liabilities.

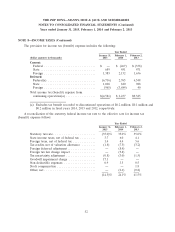

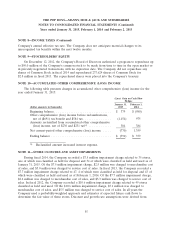

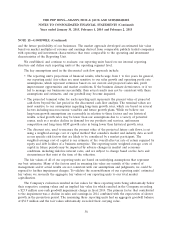

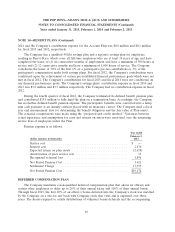

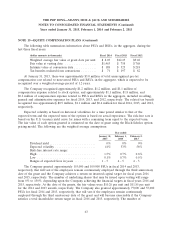

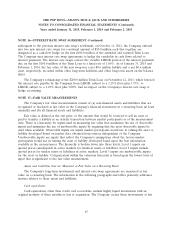

NOTE 15—EQUITY COMPENSATION PLANS

The Company has a stock-based compensation plan (the ‘‘Stock Incentive Plan’’) under which it

has previously granted, and may continue to grant, non-qualified stock options, incentive stock options,

restricted stock units (‘‘RSUs’’), and Performance Share Units (‘‘PSUs’’) to key employees and

members of its Board of Directors. As of January 31, 2015, there were 2,643,520 awards outstanding

and 2,455,697 awards available for grant under the Stock Incentive Plan.

Incentive stock options and non-qualified stock options granted to non-officers vest fully on the

third anniversary of their grant date and to officers vest in equal tranches over three year periods. All

currently outstanding options carry an expiration date of seven years. RSUs previously granted to

non-officers vest fully on the third anniversary of their grant date. RSUs previously granted to officers

vest in equal tranches over three year periods. PSUs granted to officers vest on the third anniversary of

their grant date if, and only if, certain predetermined performance targets are achieved.

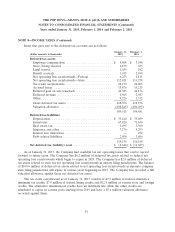

The Company has also granted RSUs under the Stock Incentive Plan in conjunction with its

non-qualified deferred compensation plan. Under the deferred compensation plan, through fiscal 2013,

the first 20% of an officer’s bonus deferred into the Company’s stock fund was matched by the

Company on a one-for-one basis with RSUs that vest over a three-year period, with one third vesting

on each of the first three anniversaries of the grant date. On January 31, 2014, the Company amended

and restated the deferred compensation plan to eliminate the automatic matching employer

contributions effective for fiscal 2014.

The terms and conditions applicable to future grants under the Stock Incentive Plan are generally

determined by the Board of Directors, provided that the exercise price of stock options must be at least

100% of the quoted market price of the common stock on the grant date. The Company currently

satisfies all share requirements resulting from RSU and PSU conversions and option exercises from its

treasury stock. The Company believes its treasury share balance at January 31, 2015 is adequate to

satisfy such activity during the next twelve-month period.

61