Pep Boys 2014 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2014 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 31, 2015, February 1, 2014 and February 2, 2013

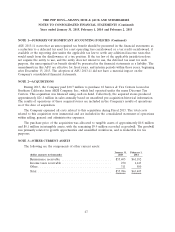

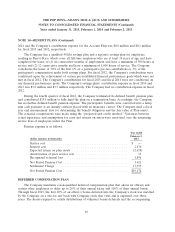

NOTE 8—INCOME TAXES (Continued)

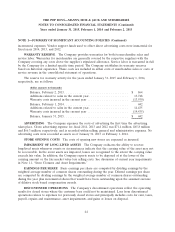

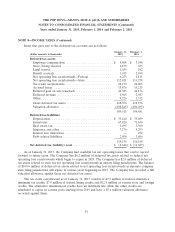

The provision for income tax (benefit) expense includes the following:

Year Ended

January 31, February 1, February 2,

(dollar amounts in thousands) 2015 2014 2013

Current:

Federal ............................. $ —$ (267) $ (338)

State ............................... 689 451 471

Foreign ............................. 1,383 2,132 1,636

Deferred:

Federal(a) ........................... (6,716) 2,765 6,548

State ............................... 1,028 840 988

Foreign ............................. (965) (3,684) 40

Total income tax (benefit) expense from

continuing operations(a) ................. $(4,581) $ 2,237 $9,345

(a) Excludes tax benefit recorded to discontinued operations of $0.2 million, $0.1 million and

$0.2 million in fiscal years 2014, 2013 and 2012, respectively.

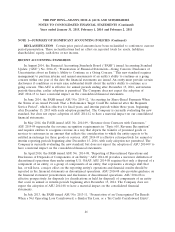

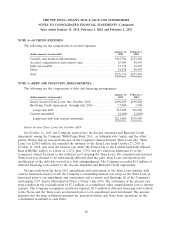

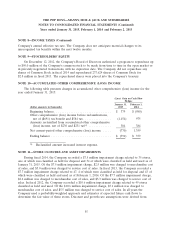

A reconciliation of the statutory federal income tax rate to the effective rate for income tax

(benefit) expense follows:

Year Ended

January 31, February 1, February 2,

2015 2014 2013

Statutory tax rate ........................ (35.0)% 35.0% 35.0%

State income taxes, net of federal tax ......... 3.7 6.0 4.1

Foreign taxes, net of federal tax ............. 1.4 4.4 5.6

Tax credits, net of valuation allowance ........ (1.8) (7.5) (3.2)

Foreign deferred adjustment ................ —(8.4) —

Foreign tax law change impact .............. —(3.8) —

Tax uncertainty adjustment ................. (0.8) (3.0) (1.5)

Goodwill impairment charge ............... 17.1 ——

Non deductible expenses .................. 0.9 3.5 0.5

Stock compensation ...................... ——1.8

Other, net ............................. —(2.1) (0.8)

(14.5)% 24.1% 41.5%

52