Pep Boys 2014 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2014 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 31, 2015, February 1, 2014 and February 2, 2013

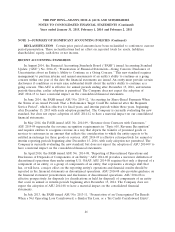

NOTE 5—DEBT AND FINANCING ARRANGEMENTS (Continued)

contingently liable for $27.0 million and $30.9 million in outstanding standby letters of credit as of

January 31, 2015 and February 1, 2014, respectively.

The Company is also contingently liable for surety bonds in the amount of approximately

$12.8 million and $10.6 million as of January 31, 2015 and February 1, 2014, respectively. The surety

bonds guarantee certain payments (for example utilities, easement repairs, licensing requirements and

customs fees).

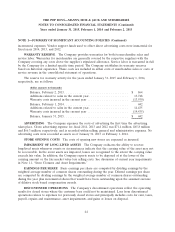

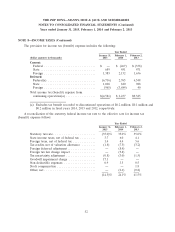

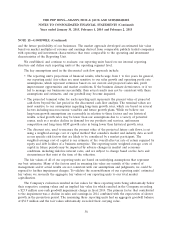

The annual maturities of long-term debt, for the next five fiscal years are:

(dollar amounts in thousands) Long-Term Debt

Fiscal Year

2015 ................................................ $ 2,000

2016 ................................................ 19,000

2017 ................................................ 2,000

2018 ................................................ 190,000

2019 ................................................ —

Thereafter ........................................... —

Total ............................................... $213,000

Interest rates that are currently available to the Company for issuance of debt with similar terms

and remaining maturities are used to estimate fair value for debt obligations and are considered a

level 2 measure under the fair value hierarchy. The estimated fair value of long-term debt including

current maturities was $211.0 million and $203.7 million as of January 31, 2015 and February 1, 2014,

respectively.

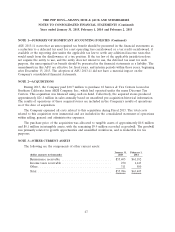

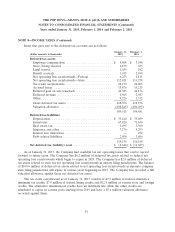

NOTE 6—LEASE AND OTHER COMMITMENTS

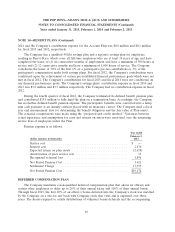

The aggregate minimum rental payments for all leases having initial terms of more than one year

are as follows:

Operating

(dollar amounts in thousands) Leases

Fiscal Year

2015 ................................................... $114,258

2016 ................................................... 106,774

2017 ................................................... 99,370

2018 ................................................... 87,919

2019 ................................................... 78,813

Thereafter ............................................... 259,087

Aggregate minimum lease payments ............................ $746,221

Rental expense incurred for operating leases in fiscal 2014, 2013, and 2012 was $108.2 million,

$102.3 million and $97.9 million, respectively, and are recorded primarily in cost of revenues. The

50