Pep Boys 2014 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2014 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

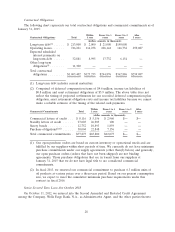

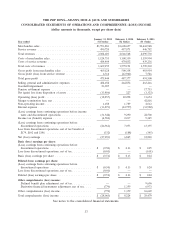

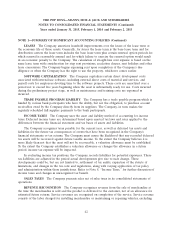

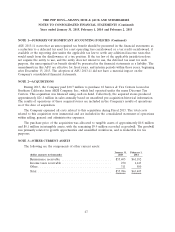

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(dollar amounts in thousands, except share data)

Accumulated

Additional Other Total

Common Stock Treasury Stock

Paid-in Retained Comprehensive Stockholders’

Shares Amount Capital Earnings Shares Amount (Loss)/Income Equity

Balance, January 28, 2012 ............ 68,557,041 $68,557 $296,462 $423,437 (15,803,322) $(266,478) $(17,649) $504,329

Comprehensive income:

Net earnings .................. 12,810 12,810

Changes in net unrecognized other

postretirement benefit costs, net of tax of

$5,729 ..................... 9,696 9,696

Fair market value adjustment on

derivatives, net of tax of $4,208 ...... 6,973 6,973

Total comprehensive income .......... 29,479

Effect of stock options and related tax

benefits ..................... 375 (5,494) 274,769 7,418 2,299

Effect of employee stock purchase plan .... (605) 39,552 1,067 462

Effect of restricted stock unit conversions . . . (2,457) 92,703 2,503 46

Stock compensation expense .......... 1,299 1,299

Treasury stock repurchases ........... (35,000) (342) (342)

Balance, February 2, 2013 ............ 68,557,041 $68,557 $295,679 $430,148 (15,431,298) $(255,832) $ (980) $537,572

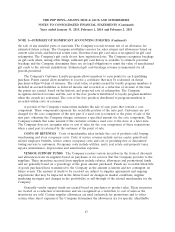

Comprehensive income:

Net earnings .................. 6,865 6,865

Fair market value adjustment on

derivatives, net of tax of $814 ....... 1,359 1,359

Total comprehensive income .......... 8,224

Effect of stock options and related tax

benefits ..................... (135) (3,742) 188,652 5,093 1,216

Effect of employee stock purchase plan .... (939) 62,547 1,688 749

Effect of restricted stock unit conversions . . . (1,527) 58,851 1,589 62

Stock compensation expense .......... 2,992 2,992

Treasury stock repurchases ........... (237,624) (2,750) (2,750)

Balance, February 1, 2014 ............ 68,557,041 $68,557 $297,009 $432,332 (15,358,872) $(250,212) $ 379 $548,065

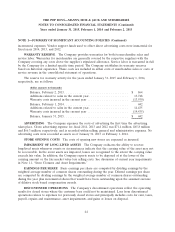

Comprehensive income:

Net loss ..................... (27,293) (27,293)

Fair market value adjustment on

derivatives, net of tax benefit of $460 . . . (770) (770)

Total comprehensive loss ............ (28,063)

Effect of stock options and related tax

benefits ..................... (8) (5,933) 255,023 6,886 945

Effect of employee stock purchase plan .... (1,216) 73,058 1,972 756

Effect of restricted stock unit conversions . . . (959) 42,586 1,149 190

Stock compensation expense .......... 2,257 2,257

Balance, January 31, 2015 ............ 68,557,041 $68,557 $298,299 $397,890 (14,988,205) $(240,205) $ (391) $524,150

See notes to the consolidated financial statements.

38