Pep Boys 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 31, 2015, February 1, 2014 and February 2, 2013

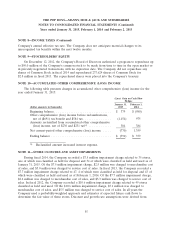

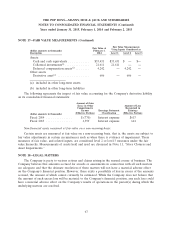

NOTE 15—EQUITY COMPENSATION PLANS (Continued)

underlying shares that may become exercisable will range from 0% to 175% depending on whether the

market condition is achieved. The Company used a Monte Carlo simulation to estimate a $9.13 per

unit and $13.41 per unit grant date fair value for the 2014 and 2013 PSUs, respectively. The non-vested

restricted stock award table reflects the maximum vesting of underlying shares for performance and

market based awards granted in both 2014 and 2013.

During fiscal 2014 and 2013, the Company granted approximately 900 and 4,000 restricted stock

units, respectfully, for officers’ deferred bonus matches under the Company’s non-qualified deferred

compensation plan, which vest over a three-year period. The fair value of these awards was $12.27 and

$11.25 per unit and the compensation expense recorded for these awards was immaterial. The

Company did not grant any restricted stock units for officers’ deferred bonus matches under the

Company’s non-qualified deferred compensation plan during fiscal 2012.

During fiscal 2014, the Company granted approximately 58,000 restricted stock units to its

non-employee directors of the board, which vest over a one-year period with a quarter vesting on each

of the first four quarters following their grant date. The fair value for these awards was $11.25 per unit.

During fiscal 2013, the Company granted approximately 54,000 restricted stock units to its

non-employee directors of the board, which vest over a one-year period with a quarter vesting on each

of the first four quarters following their grant date. The fair value for these awards was $12.05 per unit.

During fiscal 2012, the Company granted approximately 33,000 restricted stock units to its

non-employee directors of the board, which vest over a one-year period with a quarter vesting on each

of the first four quarters following their grant date. The fair value was $9.98 per unit.

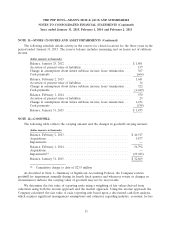

The Company reflects in its consolidated statement of cash flows any tax benefits realized upon

the exercise of stock options or issuance of RSUs in excess of that which is associated with the expense

recognized for financial reporting purposes. The amounts reflected as financing cash inflows and

operating cash outflows in the Consolidated Statement of Cash Flows for fiscal 2014, 2013 and 2012 are

immaterial.

During fiscal 2011, the Company began an employee stock purchase plan which provides eligible

employees the opportunity to purchase shares of the Company’s stock at a stated discount through

regular payroll deductions. The aggregate number of shares of common stock that may be issued or

transferred under the plan is 2,000,000 shares. All shares purchased by employees under this plan will

be issued through treasury stock. The Company’s expense for the discount during fiscal years 2014,

2013 and 2012 was immaterial. As of January 31, 2015, there were 1,803,880 shares available for

issuance under this plan.

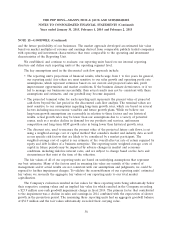

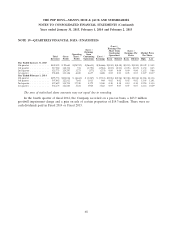

NOTE 16—INTEREST RATE SWAP AGREEMENT

In the third quarter of fiscal 2012, the Company settled its interest rate swap designated as a cash

flow hedge on $145.0 million of the Company’s Term Loan prior to its amendment and restatement.

The swap was used to minimize interest rate exposure and overall interest costs by converting the

variable component of the total interest rate to a fixed rate of 5.04%. Since February 1, 2008, this swap

was deemed to be fully effective and all adjustments in the interest rate swap’s fair value were recorded

to accumulated other comprehensive loss. The settlement of this swap resulted in an interest charge of

$7.5 million, which was previously recorded within accumulated other comprehensive loss. Immediately

64