Pep Boys 2014 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2014 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Total service revenue increased 2.5%, or $11.1 million, to $457.9 million for fiscal 2013 from

$446.8 million for fiscal 2012. Excluding the fifty-third week in 2012, total service revenue increased

4.5%, or $19.6 million, while comparable service revenue increased by 1.6%, or $6.9 million. Our

non-comparable store locations contributed an additional $12.7 million of service revenues in fiscal

2013. The increase in comparable store service revenue was primarily due to an increase in the average

transaction amount per customer.

In our retail business, we believe that the difficult macroeconomic conditions continue to impact

our customers and led to the comparable store customer counts decline of 4.9%, while we experienced

an increase in the average transaction amount per customer resulting from higher selling prices of

1.8%. In our service business, we believe that we experienced a slight increase in comparable store

customer counts due to the strength of our service offering and our promotion of oil changes.

However, this shift in service sales mix towards lower cost oil changes slightly reduced the average

transaction amount per service customer.

Total gross profit decreased by $4.1 million, or 0.8%, to $487.4 million for fiscal 2013 from

$491.5 million for fiscal 2012. Total gross profit margin increased to 23.6% for fiscal 2013 from 23.5%

for fiscal 2012. Total gross profit for fiscal 2013 and 2012 included an asset impairment charge of

$7.7 million and $10.6 million, respectively. Excluding this item from both years, total gross profit

margin remained relatively flat at 24.0%.

Gross profit from merchandise sales increased by $16.4 million, or 3.4%, to $500.3 million for

fiscal 2013 from $484.0 million for fiscal 2012. Gross profit margin from merchandise sales increased to

31.1% for fiscal 2013 from 29.4% in fiscal 2012. Gross profit from merchandise sales in fiscal 2013 and

2012 included an asset impairment charge of $2.3 million and $5.1 million, respectively. Excluding this

item from both years, gross profit margin from merchandise sales improved to 31.3% in fiscal 2013

from 29.8% in the prior year. The improvement over the prior year was primarily due to improved

product margins in tires, brakes, batteries and oil.

Gross margin loss from service revenue for fiscal 2013 widened by $20.5 million to a loss of

$13.0 million from profit of $7.5 million for fiscal 2012. In accordance with GAAP, service revenue is

limited to labor sales (excludes any revenue from installed parts and materials) and costs of service

revenues includes the fully loaded service center payroll and related employee benefits and service

center occupancy costs (rents, utilities and building maintenance). Excluding impairment charges of

$5.3 million and $5.4 million in fiscal 2013 and 2012, respectively, gross margin from service revenue

decreased by 460 basis points to a 1.7% loss in fiscal 2013 from 2.9% profit in fiscal 2012. The decrease

in service revenue gross profit margin was primarily due to higher payroll and related expense of 320

basis points and higher occupancy costs of 154 basis points (depreciation and rent).

Selling, general and administrative expenses as a percentage of total revenues increased to 22.5%

for fiscal year 2013 from 22.2% for fiscal 2012. Selling, general and administrative expenses for fiscal

2013 increased $1.4 million, or 0.3%, to $464.9 million from $463.4 million for fiscal 2012. The increase

as a percentage of sales reflects de-leveraging of selling, general and administrative expenses through

reduced sales in fiscal 2013(fiscal 2012 included 53 weeks).

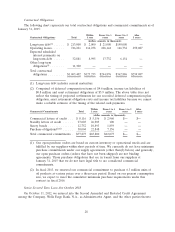

In the fourth quarter of fiscal 2012, in accordance with Internal Revenue Service and Pension

Benefit Guaranty Corporation requirements, we contributed $14.1 million to fully fund our Defined

Benefit Pension Plan on a termination basis and incurred a settlement charge of $17.8 million (see

Note 14 to the Consolidated Financial Statements).

In the fourth quarter of fiscal 2012, we sold our regional administration building in Los

Angeles, CA, which resulted in a gain from disposition of assets, net of expenses, of $1.3 million.

24