Pep Boys 2014 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2014 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.center improvements and information technology enhancements, included the addition of 21 new

locations, the addition of 47 Speed Shops within existing Supercenters and the conversion of 28

Supercenters to the ‘‘Road Ahead’ format. Capital expenditures in fiscal 2013, included the addition of

29 new locations, the conversion of 11 Supercenters into Superhubs, the addition of 63 Speed Shops

within existing Supercenters. In addition, in the third quarter of 2013 the Company acquired 18

Service & Tire Centers in Southern California for $10.7 million. In the fourth quarter of 2014, the

Company sold three locations for approximately $20.2 million.

Our targeted capital expenditures for fiscal 2015 are approximately $60.0 million, which includes

the planned addition of 15 Service & Tire Centers, one Supercenter, and the conversion of up to 25

stores to the new ‘‘Road Ahead’’ format. These expenditures are expected to be funded from cash on

hand and net cash generated from operating activities. Additional capacity, if needed, exists under our

existing line of credit.

Cash provided by financing activities in fiscal 2014 was $24.2 million as compared to cash used in

financing activities of $19.8 million in fiscal 2013. The cash provided by financing activities in fiscal

2014 was primarily related to net borrowings under our revolving credit facility of $13.5 million and

$11.1 million under our trade payable program, as compared to net borrowings under the revolving

credit facility of $3.5 million and net payments of $19.9 million under the trade payable program in

2013. In addition, in 2013, the Company repurchased 237,624 shares of common stock for $2.8 million.

The trade payable program is funded by various bank participants who have the ability, but not the

obligation, to purchase, directly from our suppliers, account receivables owed by Pep Boys. As of

January 31, 2015 and February 1, 2014, we had an outstanding balance of $140.9 million and

$129.8 million, respectively (classified as trade payable program liability on the consolidated balance

sheet).

We anticipate that cash on hand and cash generated by operating activities will exceed our

expected cash requirements in fiscal 2015. In addition, we expect to have excess availability under our

existing revolving credit agreement during the entirety of fiscal 2015. As of January 31, 2015, we had

availability on our revolving credit facility of $138.4 million. As of January 31, 2015 we had

$38.0 million of cash and cash equivalents on hand.

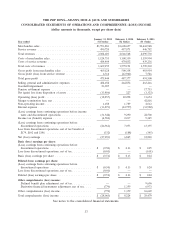

Our working capital was $155.2 million and $131.0 million at January 31, 2015 and February 1,

2014, respectively. Our total debt, net of cash on hand, as a percentage of our net capitalization, was

25.0% and 23.5% at January 31, 2015 and February 1, 2014, respectively.

27