Pep Boys 2014 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2014 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.existing Supercenters and support infrastructure. We also operate a handful of legacy DIY only Pep

Express stores.

In fiscal 2014, we opened 19 new Service & Tire Centers, two new Supercenters and converted one

Supercenter into a Service & Tire Center. We also closed eight Service & Tire Centers and six

Supercenters. As of January 31, 2015, we operated 563 Supercenters, 237 Service & Tire Centers and

six Pep Express stores located in 35 states and Puerto Rico.

EXECUTIVE SUMMARY

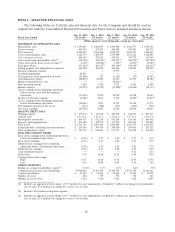

Net loss for fiscal 2014 was $27.3 million, or $0.51 per share, as compared to net earnings of

$6.9 million, or $0.13 per share, reported for fiscal 2013. Fiscal 2014 results included, on a pre-tax basis

a goodwill impairment charge of $23.9 million and a $4.0 million litigation charge, partially offset by a

gain on sale of certain properties of $13.8 million.

Total revenues increased by 0.9%, or $18.0 million, as compared to the same period in the prior

year due to increased contribution from our non-comparable store locations. Our comparable store

sales (sales generated by locations in operation during the same period of the prior year) remained

relatively flat and were comprised of a 4.9% increase in comparable store service revenue offset by a

1.6% decrease in comparable store merchandise sales.

We believe that the industry fundamentals of increasing vehicle complexity and customer

preference for DIFM remain solid over the long-term resulting in consistent demand for maintenance

and repair services. Consistent with this long-term trend, we have adopted a long-term strategy of

growing our automotive service business, while maintaining our DIY customer base by offering the

newest and broadest product assortment in the automotive aftermarket.

In the short-term, however, various factors within the economy affect both our customers and our

industry, including a weak recovery from the recent recession, continued high underemployment and

the tepid growth in real wages. We believe that these factors challenge our customers’ spending relative

to discretionary and deferrable purchases. These spending habits impact miles driven which, in turn,

impact sales of our services and non-discretionary products. Given the nature of these macroeconomic

factors, we cannot predict whether or for how long these trends may continue, nor can we predict to

what degree these trends will affect us in the future.

Over the past few years, we have invested in our business to drive top line sales with investments

in marketing & promotions, new stores (Service & Tire Centers), digital operations and, most recently,

a new market concept that we call the ‘‘Road Ahead.’’ Designed around the shopping habits of our

target customer segments, this concept enhances the entire store—our people, the product assortment,

its exterior and interior look and feel and the marketing programs—to learn how we can be successful

in attracting more of these target customers and earn a greater share of their annual spend in the

automotive aftermarket. While each initiative has produced results, they have also brought added

expense. Total sales growth has been relatively flat due in large part to the decline in our DIY business,

which combined with increased expenses has led to declining profit margins. Accordingly, we continue

to review expenses related to our base business so we can continue to invest in our initiatives. See

‘‘ITEM 1 BUSINESS—BUSINESS STRATEGY.’’

20