Panera Bread 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

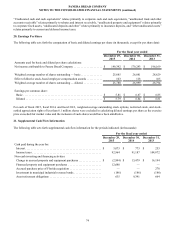

COMPARISON OF CUMULATIVE TOTAL RETURN

(Assumes $100 Investment on December 28, 2010)

The following graph and chart compares the cumulative annual stockholder return on our Class A common stock over

the period commencing December 28, 2010 and ending on December 29, 2015, to that of the total return for The NASDAQ

Composite Index, the Standard & Poor’s (S&P) 500 Consumer Discretionary Sector, and the S&P MidCap Restaurants Index,

assuming an investment of $100 on December 28, 2010. In 2015, we conducted a review of the comparison indices to

determine if the indices were reflective of those companies we believe we compete for investment capital. After completing

the review, the determination was made to include the S&P 500 Consumer Discretionary Sector and to drop the S&P MidCap

Restaurants Index due to the small number of public restaurant companies comprising that index. In calculating cumulative

total annual stockholder return, reinvestment of dividends, if any, is assumed. The indices are included for comparative

purposes only. They do not necessarily reflect management’s opinion that such indices are an appropriate measure of the

relative performance of our Class A common stock and are not intended to forecast or be indicative of future performance of

our Class A common stock. The following graph and related information shall not be deemed “soliciting material” or to be

“filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference in any of our

filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made

before or after the date hereof and irrespective of any general incorporation language in any such filing. We obtained

information used on the graph from Research Data Group, Inc., a source we believe to be reliable.

$0

$50

$100

$150

$200

$250

$300

Panera Bread Company NASDAQ Composite

S&P 500 Consumer Discretionary S&P MidCap Restaurants

*$100 invested on 12/28/2010 in stock or 12/31/2010 in index, including reinvestment of

dividends. Indexes calculated on month-end basis.

12/28/10 12/27/11 12/25/12 12/31/13 12/30/14 12/29/15

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Panera Bread Company, the NASDAQ Composite Index,

the S&P 500 Consumer Discretionary Sector, and S&P MidCap Restaurants Index

December 28,

2010

December 27,

2011

December 25,

2012

December 31,

2013

December 30,

2014

December 29,

2015

Panera Bread Company $100.00 138.10 155.07 173.04 171.28 193.01

NASDAQ Composite Index $100.00 100.62 116.97 166.27 188.90 200.15

S&P 500 Consumer

Discretionary Sector $100.00 106.13 131.51 188.17 206.39 227.25

S&P MidCap Restaurants

Index $100.00 127.19 151.62 232.62 270.39 277.56

For the S&P 500 Consumer Discretionary Sector, S&P MidCap Restaurants Index, and the NASDAQ Composite Index,

the total return to stockholders is based on the values of such indices as of the last trading day of the applicable calendar year,

which may be different from the end of our fiscal year.