Panera Bread 2015 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2015 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

74

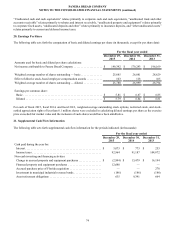

“Unallocated cash and cash equivalents” relates primarily to corporate cash and cash equivalents, “unallocated trade and other

accounts receivable” relates primarily to rebates and interest receivable, “unallocated property and equipment” relates primarily

to corporate fixed assets, “unallocated deposits and other” relates primarily to insurance deposits, and “other unallocated assets”

relates primarily to current and deferred income taxes.

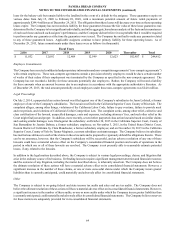

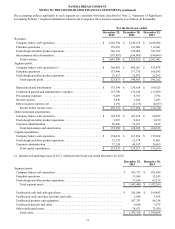

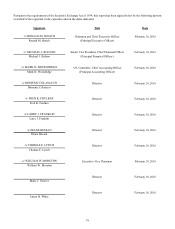

20. Earnings Per Share

The following table sets forth the computation of basic and diluted earnings per share (in thousands, except for per share data):

For the fiscal year ended

December 29,

2015

December 30,

2014

December 31,

2013

Amounts used for basic and diluted per share calculations:

Net income attributable to Panera Bread Company . . . . . . . . . . . . . . . . . . . . $ 149,342 $ 179,293 $ 196,169

Weighted average number of shares outstanding — basic . . . . . . . . . . . . . . . 25,685 26,881 28,629

Effect of dilutive stock-based employee compensation awards . . . . . . . . . . . 103 118 165

Weighted average number of shares outstanding — diluted. . . . . . . . . . . . . . 25,788 26,999 28,794

Earnings per common share:

Basic . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 5.81 $ 6.67 $ 6.85

Diluted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 5.79 $ 6.64 $ 6.81

For each of fiscal 2015, fiscal 2014, and fiscal 2013, weighted-average outstanding stock options, restricted stock, and stock-

settled appreciation rights of less than 0.1 million shares were excluded in calculating diluted earnings per share as the exercise

price exceeded fair market value and the inclusion of such shares would have been antidilutive.

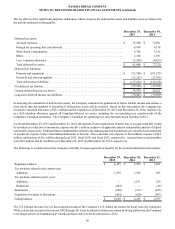

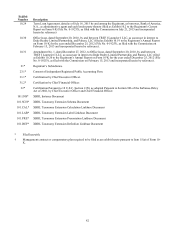

21. Supplemental Cash Flow Information

The following table sets forth supplemental cash flow information for the periods indicated (in thousands):

For the fiscal year ended

December 29,

2015

December 30,

2014

December 31,

2013

Cash paid during the year for:

Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,073 $ 773 $ 253

Income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 92,964 91,187 104,072

Non-cash investing and financing activities:

Change in accrued property and equipment purchases . . . . . . . . . . . . . . . . $ (2,894) $ 15,479 $ 16,194

Financed property and equipment purchases . . . . . . . . . . . . . . . . . . . . . . . 12,680 — —

Accrued purchase price of Florida acquisition . . . . . . . . . . . . . . . . . . . . . . — — 270

Investment in municipal industrial revenue bonds . . . . . . . . . . . . . . . . . . . (186)(186)(186)

Asset retirement obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 635 9,341 664