Panera Bread 2015 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2015 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

Liquidity and Capital Resources

Cash and cash equivalents were $241.9 million at December 29, 2015 compared to $196.5 million at December 30, 2014. This

$45.4 million increase was primarily a result of cash generated from operations of $318.0 million, proceeds from the issuance of

long-term debt of $299 million, and proceeds from refranchising, sale-leaseback transactions, and the sale of property and equipment

totaling $58.5 million, partially offset by the use of $405.5 million to repurchase shares of our Class A common stock and capital

expenditures of $223.9 million. We finance our activities through cash flow generated through operations and term loan borrowings.

We also have the ability to further borrow up to $250 million under a credit facility, as described below. Historically, our principal

requirements for cash have primarily resulted from the cost of food and paper products, employee labor, the repurchase of shares

of our Class A common stock, and our capital expenditures for the development of new Company-owned bakery-cafes, for

maintaining or remodeling existing Company-owned bakery-cafes, for purchasing existing franchise-operated bakery-cafes or

ownership interests in other restaurant or bakery-cafe concepts, for developing, maintaining, or remodeling fresh dough facilities,

and for other capital needs such as enhancements to information systems and other infrastructure to support ongoing operational

initiatives.

Excluding assets held for sale and liabilities associated with assets held for sale, we had positive working capital of $77.6 million

at December 29, 2015 compared to positive working capital of $53.5 million at December 30, 2014. The increase in working

capital resulted primarily from the previously described increase in cash and cash equivalents of $45.4 million, an increase in trade

and other accounts receivable of $9.1 million, and an increase in prepaid expenses and other of $7.9 million, partially offset by

an increase in accrued expenses of $26.3 million and the $17.2 million balance at December 29, 2015 of the current portion of

long-term debt. We believe that cash provided by our operations, our term loan borrowings, and available borrowings under our

credit facility will be sufficient to fund our cash requirements for the foreseeable future. We have not required significant working

capital because customers generally pay using cash or credit and debit cards and because our operations do not require significant

receivables, nor do they require significant inventories due, in part, to our use of various fresh ingredients.

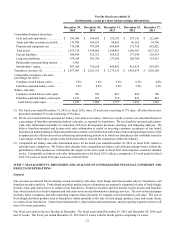

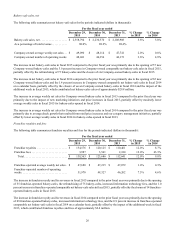

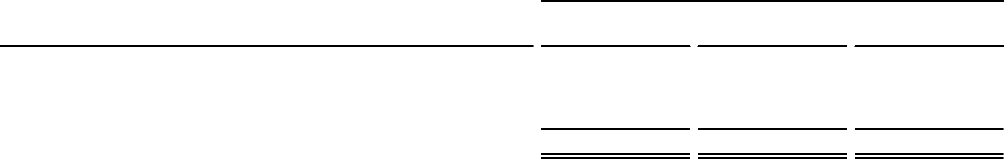

A summary of our cash flows, for the periods indicated, are as follows (in thousands):

For the fiscal year ended

Cash provided by (used in):

December 29,

2015

December 30,

2014

December 31,

2013

Operating activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 318,045 $ 335,079 $ 348,417

Investing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (165,415)(211,317)(188,307)

Financing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (107,237)(52,514)(332,006)

Net increase (decrease) in cash and cash equivalents . . . . . . . . . . $ 45,393 $ 71,248 $ (171,896)

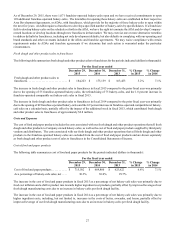

Operating Activities

Cash provided by operating activities was $318.0 million, $335.1 million, and $348.4 million in fiscal 2015, fiscal 2014, and fiscal

2013, respectively. Cash provided by operating activities consists primarily of net income, adjusted for non-cash expenses such

as depreciation and amortization, and the net change in operating assets and liabilities.

Cash provided by operating activities in fiscal 2015 consisted primarily of net income adjusted for non-cash expenses, including

charges related to our refranchising initiative, and an increase in accrued expenses, partially offset by a decrease in the net deferred

income tax liability and an increase in prepaid expenses and other. The increase in accrued expenses was primarily due to an

increase in the balance of outstanding gift cards. The decrease in the net deferred income tax liability relates primarily to tax

depreciation. The increase in prepaid expenses was primarily due to an increase in prepaid insurance amounts.

Cash provided by operating activities in fiscal 2014 consisted primarily of net income adjusted for non-cash expenses and an

increase in accrued expenses, partially offset by an increase in trade and other accounts receivable. The increase in accrued

expenses was primarily due to an increase in the balance of outstanding gift cards. The increase in trade and other accounts

receivable was primarily due to an increase in refundable income taxes due to the timing of payments and an increase in other

receivables.

Cash provided by operating activities in fiscal 2013 consisted primarily of net income adjusted for non-cash expenses and an

increase in accrued expenses and accounts payable. The increase in accrued expenses was primarily due to an increase in the

balance of outstanding gift cards. The increase in accounts payable was primarily due to the timing of payments.