Panera Bread 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

50

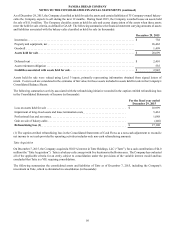

Other Intangible Assets, net

Other intangible assets, net consist primarily of favorable lease agreements, re-acquired territory rights, and trademarks. The

Company amortizes the fair value of favorable lease agreements over the remaining related lease terms at the time of the acquisition,

which ranged from approximately four years to 19 years as of December 29, 2015. The fair value of re-acquired territory rights

was based on the present value of the acquired bakery-cafe cash flows. The Company amortizes the fair value of re-acquired

territory rights over the remaining contractual terms of the re-acquired territory rights at the time of the acquisition, which ranged

from approximately five years to 20 years as of December 29, 2015. The fair value of trade names and trademarks is amortized

over their estimated useful life of eight years and 22 years, respectively.

The Company reviews intangible assets with finite lives for impairment when events or circumstances indicate these assets might

be impaired. When warranted, the Company tests intangible assets with finite lives for impairment using historical cash flows

and other relevant facts and circumstances as the primary basis for an estimate of future cash flows. There were no other intangible

asset impairment charges recorded during fiscal 2015, fiscal 2014, and fiscal 2013. There can be no assurance that future intangible

asset impairment tests will not result in a charge to earnings.

Impairment of Long-Lived Assets

The Company evaluates whether events and circumstances have occurred that indicate the remaining estimated useful life of long-

lived assets may warrant revision or that the remaining balance of an asset may not be recoverable. The Company compares

anticipated undiscounted cash flows from the related long-lived assets of a bakery-cafe or fresh dough facility with their respective

carrying values to determine if the long-lived assets are recoverable. If the sum of the anticipated undiscounted cash flows for

the long-lived assets is less than their carrying value, an impairment loss is recognized for the difference between the anticipated

discounted cash flows, which approximates fair value, and the carrying value of the long-lived assets. In performing this analysis,

management estimates cash flows based upon, among other things, certain assumptions about expected future operating

performance, such as revenue growth rates, operating margins, risk-adjusted discount rates, and future economic and market

conditions. Estimates of cash flow may differ from actual cash flow due to, among other things, economic conditions, changes

to the Company's business model or changes in operating performance. The long-term financial forecasts that management utilizes

represent the best estimate that management has at this time and management believes that the underlying assumptions are

reasonable.

The Company recognized impairment losses of $3.8 million, $0.9 million, and $0.8 million during fiscal 2015, fiscal 2014, and

fiscal 2013, respectively, related to distinct, underperforming Company-owned bakery-cafes. For fiscal 2015, the impairment loss

was recorded in refranchising loss in the Consolidated Statements of Income. For fiscal 2014 and fiscal 2013, these impairment

losses were recorded in other operating expenses in the Consolidated Statements of Income.

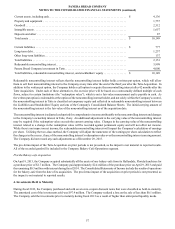

Self-Insurance Reserves

The Company is self-insured for a significant portion of its workers’ compensation, group health, and general, auto, and property

liability insurance with varying deductibles of as much as $0.8 million for individual claims, depending on the type of claim. The

Company also purchases aggregate stop-loss and/or layers of loss insurance in many categories of loss. The Company utilizes

third party actuarial experts’ estimates of expected losses based on statistical analyses of the Company's actual historical data and

historical industry data to determine required self-insurance reserves. The assumptions are closely reviewed, monitored, and

adjusted when warranted by changing circumstances. The estimated accruals for these liabilities could be affected if actual

experience related to the number of claims and cost per claim differs from these assumptions and historical trends. Based on

information known at December 29, 2015, the Company believes it has provided adequate reserves for its self-insurance exposure.

As of December 29, 2015 and December 30, 2014, self-insurance reserves were $37.2 million and $32.6 million, respectively,

and were included in accrued expenses in the Consolidated Balance Sheets. The total amounts expensed for self-insurance were

$54.3 million, $50.7 million, and $46.9 million for fiscal 2015, fiscal 2014, and fiscal 2013, respectively.

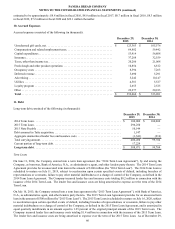

Income Taxes

The Company recognizes deferred tax assets and liabilities for the future tax consequences attributable to differences between the

financial statement carrying amounts of existing assets and liabilities and their respective tax basis. Deferred tax assets and

liabilities are measured using enacted income tax rates expected to apply to taxable income in the years in which those temporary

differences are expected to be recovered or settled. Any effect on deferred tax assets and liabilities from a change in tax rates is

recognized in income in the period that includes the enactment date. A valuation allowance is recognized if the Company determines

it is more likely than not that all or some portion of the deferred tax asset will not be recognized. As of December 29, 2015 and

December 30, 2014 the Company had recorded a valuation allowance related to deferred tax assets of the Company's Canadian

operations of $5.3 million and $4.6 million, respectively.