Panera Bread 2015 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2015 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

56

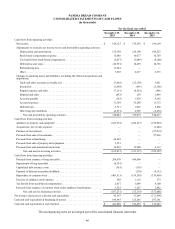

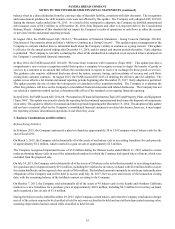

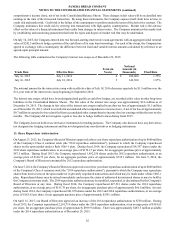

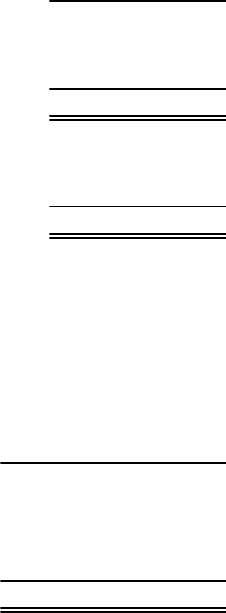

As of December 29, 2015, the Company classified as held for sale the assets and certain liabilities of 35 Company-owned bakery-

cafes the Company expects to sell during the next 12 months. During fiscal 2015, the Company recorded losses on assets held

for sale of $11.0 million. The Company classifies assets as held for sale and ceases depreciation of the assets when those assets

meet the held for sale criteria, as defined in GAAP. The following summarizes the financial statement carrying amounts of assets

and liabilities associated with the bakery-cafes classified as held for sale (in thousands):

December 29, 2015

Inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 738

Property and equipment, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26,462

Goodwill . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,499

Assets held for sale. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 28,699

Deferred rent . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,410

Asset retirement obligation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 535

Liabilities associated with assets held for sale. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,945

Assets held for sale were valued using Level 3 inputs, primarily representing information obtained from signed letters of

intent. Costs to sell are considered in the estimates of fair value for those assets included in assets held for sale in the Company's

Consolidated Balance Sheets.

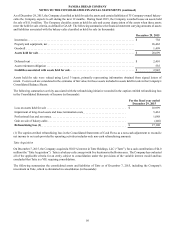

The following summarizes activity associated with the refranchising initiative recorded in the caption entitled refranchising loss

in the Consolidated Statements of Income (in thousands):

For the fiscal year ended

December 29, 2015

Loss on assets held for sale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 10,999

Impairment of long-lived assets and lease termination costs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,461

Professional fees and severance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,088

Gain on sale of bakery-cafes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (440)

Refranchising loss (1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 17,108

(1) The caption entitled refranchising loss in the Consolidated Statements of Cash Flows as a non-cash adjustment to reconcile

net income to net cash provided by operating activities includes only non-cash refranchising amounts.

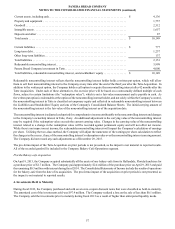

Tatte Acquisition

On December 7, 2015, the Company acquired a 50.01% interest in Tatte Holdings, LLC (“Tatte”), for a cash contribution of $4.0

million (the “Tatte Acquisition”). Tatte is a bakery-cafe concept with five locations in the Boston area. The Company has evaluated

all of the applicable criteria for an entity subject to consolidation under the provisions of the variable interest model and has

concluded that Tatte is a VIE requiring consolidation.

The following summarizes the consolidated assets and liabilities of Tatte as of December 7, 2015, including the Company's

investment in Tatte, which is eliminated in consolidation (in thousands):