Panera Bread 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

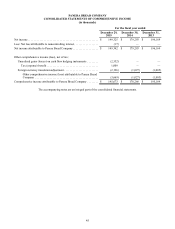

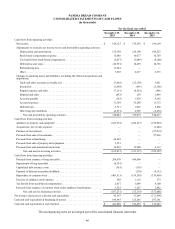

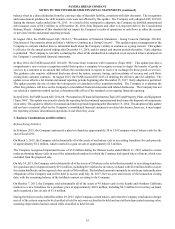

PANERA BREAD COMPANY

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY AND REDEEMABLE NONCONTROLLING INTEREST

(in thousands)

Common Stock

Additional

Paid-in

Capital

Retained

Earnings

Accumulated

Other

Comprehensive

Income (Loss)

Redeemable

Noncontrolling

Interest

Class A Class B Treasury Stock

Shares Amount Shares Amount Shares Amount Total

Balance, December 25, 2012.28,209 $ 3 1,384 $ — 2,250 $ (207,161) $ 174,690 $ 853,715 $ 672 $821,919 $ —

Net income . . . . . . . . . . . . . . . — — — — — — — 196,169 — 196,169 —

Other comprehensive income

(loss) . . . . . . . . . . . . . . . . . . . . ————— — — — (1,005)(1,005)—

Issuance of common stock . . . 20 — — — — — 2,841 — — 2,841 —

Stock-based compensation

expense . . . . . . . . . . . . . . . . . . — — — — — — 10,703 — — 10,703 —

Repurchase of common stock .(2,033) — — — 2,033 (339,409)— — —

(339,409)—

Tax benefit from exercise of

stock options . . . . . . . . . . . . . . — — — — — — 8,100 — — 8,100 —

Other . . . . . . . . . . . . . . . . . . . . 94 — (2) — — — 574 — — 574 —

Balance, December 31, 2013.26,290 $ 3 1,382 $ — 4,283 $ (546,570) $ 196,908 $ 1,049,884 $ (333) $699,892 $ —

Net income . . . . . . . . . . . . . . . — — — — — — — 179,293 — 179,293 —

Other comprehensive income

(loss) . . . . . . . . . . . . . . . . . . . . ————— — — — (1,027)(1,027)—

Issuance of common stock . . . 23 — — — — — 3,247 — — 3,247 —

Stock-based compensation

expense . . . . . . . . . . . . . . . . . . — — — — — — 10,077 — — 10,077 —

Repurchase of common stock .(978) — — — 978 (159,503)— — —

(159,503)—

Tax benefit from exercise of

stock options . . . . . . . . . . . . . . — — — — — — 3,089 — — 3,089 —

Other . . . . . . . . . . . . . . . . . . . . 108 — — — — — 1,116 — — 1,116 —

Balance, December 30, 2014.25,443 $ 3 1,382 $ — 5,261 $ (706,073) $ 214,437 $ 1,229,177 $ (1,360) $736,184 $ —

Net income (loss) . . . . . . . . . . — — — — — — — 149,342 — 149,342 (17)

Other comprehensive income

(loss) . . . . . . . . . . . . . . . . . . . . ————— — — — (3,669)(3,669)—

Issuance of common stock . . . 23 — — — — — 3,527 — — 3,527 —

Stock-based compensation

expense . . . . . . . . . . . . . . . . . . — — — — — — 15,086 — — 15,086 —

Repurchase of common stock .(2,229) — — — 2,229 (405,513)— — —

(405,513)—

Tax benefit from exercise of

stock options . . . . . . . . . . . . . . — — — — — — 2,057 — — 2,057 —

Redeemable noncontrolling

interest resulting from

acquisition . . . . . . . . . . . . . . . . — — — — — — — — — — 3,998

Other . . . . . . . . . . . . . . . . . . . . 109 — — — — — 286 — — 286 —

Balance, December 29, 2015.23,346 $ 3 1,382 $ — 7,490 $ (1,111,586) $ 235,393 $ 1,378,519 $ (5,029) $497,300 $ 3,981

The accompanying notes are an integral part of the consolidated financial statements.