Panera Bread 2015 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2015 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

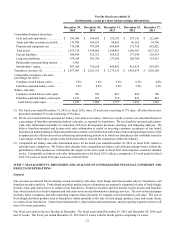

21

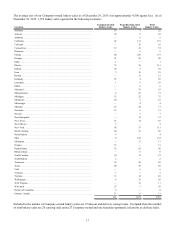

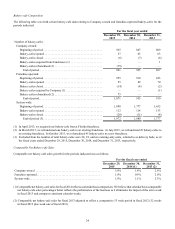

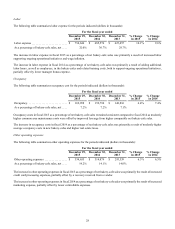

For the fiscal year ended (1)

(in thousands, except per share and percentage information)

December 29,

2015

December 30,

2014

December 31,

2013

December 25,

2012

December 27,

2011

Consolidated balance sheet data:

Cash and cash equivalents . . . . . . . . . . . $ 241,886 $ 196,493 $ 125,245 $ 297,141 $ 222,640

Trade and other accounts receivable . . . 115,786 106,653 84,602 86,262 54,709

Property and equipment, net . . . . . . . . . 776,248 787,294 669,409 571,754 492,022

Total assets. . . . . . . . . . . . . . . . . . . . . . . 1,475,318 1,390,686 1,180,862 1,268,163 1,027,322

Current liabilities . . . . . . . . . . . . . . . . . . 399,443 352,712 303,325 277,540 238,334

Long-term liabilities . . . . . . . . . . . . . . . 574,594 301,790 177,645 168,704 133,912

Redeemable noncontrolling interest . . . 3,981————

Stockholders’ equity . . . . . . . . . . . . . . . 497,300 736,184 699,892 821,919 655,076

Franchisee revenues (2) . . . . . . . . . . . . . . $ 2,477,963 $ 2,281,755 $ 2,175,155 $ 1,981,674 $ 1,828,188

Comparable net bakery-cafe sales

percentage for (2)(3):

Company-owned bakery-cafes . . . . . . . 3.0% 1.4% 2.6% 6.5% 4.9%

Franchise-operated bakery-cafes . . . . . . 1.0% 0.9% 2.0% 5.0% 3.4%

Bakery-cafe data:

Company-owned bakery-cafes open . . . 901 925 867 809 740

Franchise-operated bakery-cafes open . 1,071 955 910 843 801

Total bakery-cafes open . . . . . . . . . . . 1,972 1,880 1,777 1,652 1,541

(1) The fiscal year ended December 31, 2013, or fiscal 2013, was a 53 week year consisting of 371 days. All other fiscal years

presented contained 52 weeks consisting of 364 days.

(2) We do not record franchise-operated net bakery-cafe sales as revenues. However, royalty revenues are calculated based on

a percentage of franchise-operated net bakery-cafe sales, as reported by franchisees. We use franchise-operated and system-

wide sales information internally in connection with store development decisions, planning, and budgeting analyses. We

believe franchise-operated and system-wide sales information is useful in assessing consumer acceptance of our brand,

facilitates an understanding of financial performance and the overall direction and trends of sales and operating income, helps

us appreciate the effectiveness of our advertising and marketing initiatives to which our franchisees also contribute based on

a percentage of their sales, and provides information that is relevant for comparison within the industry.

(3) Comparable net bakery-cafe sales information above for the fiscal year ended December 30, 2014, or fiscal 2014, reflects a

calendar basis comparison. We believe that calendar basis comparable net bakery-cafe sales percentages better reflects the

performance of the business as it eliminates the impact of the extra week in fiscal 2013 and compares consistent calendar

weeks. Comparable net bakery-cafe sales information above for fiscal 2013 reflects a comparative 53 week period in fiscal

2012 (52 weeks in fiscal 2012 plus week one of fiscal 2013).

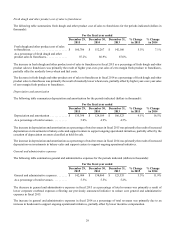

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF CONSOLIDATED FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

General

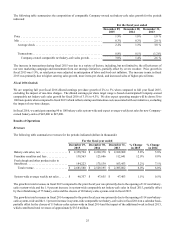

Our revenues are derived from Company-owned net bakery-cafe sales, fresh dough and other product sales to franchisees, and

franchise royalties and fees. Fresh dough and other product sales to franchisees are primarily comprised of sales of fresh dough,

produce, tuna, and cream cheese to certain of our franchisees. Franchise royalties and fees include royalty income and franchise

fees, which include fees for development and real estate services and information technology services. The cost of food and paper

products, labor, occupancy, and other operating expenses relate primarily to Company-owned net bakery-cafe sales. The cost of

fresh dough and other product sales to franchisees relates primarily to the sale of fresh dough, produce, tuna, and cream cheese

to certain of our franchisees. General and administrative, depreciation and amortization, and pre-opening expenses relate to all

areas of revenue generation.

Our fiscal year ends on the last Tuesday in December. The fiscal years ended December 29, 2015 and December 30, 2014 each

had 52 weeks. The fiscal year ended December 31, 2013 had 53 weeks with the fourth quarter comprising 14 weeks.