Panera Bread 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

64

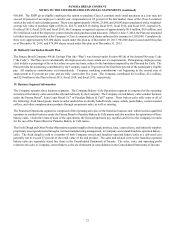

lease for the bakery-cafe but remain liable to the landlord in the event of a default by the assignee. These guarantees expire on

various dates from July 15, 2020 to February 28, 2049, with a maximum potential amount of future rental payments of

approximately $244.4 million as of December 29, 2015. The obligation from these leases will decrease over time as these operating

leases expire. The Company has not recorded a liability for these guarantees because the fair value of these lease guarantees was

determined by the Company to be insignificant individually, and in the aggregate, based on an analysis of the facts and circumstances

of each such lease and each such assignee’s performance, and the Company did not believe it was probable that it would be required

to perform under any guarantees at the time the guarantees were issued. The Company has not had to make any payments related

to any of these guaranteed leases. Applicable assignees continue to have primary liability for these operating leases. As of

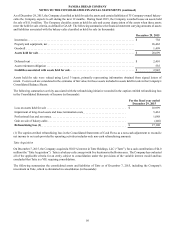

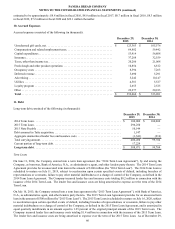

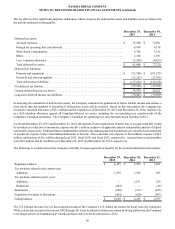

December 29, 2015, future commitments under these leases were as follows (in thousands):

Fiscal Years

2,016 2017 2018 2019 2020 Thereafter Total

$ 11,832 12,092 12,409 12,549 12,623 182,907 $ 244,412

Employee Commitments

The Company has executed confidential and proprietary information and non-competition agreements (“non-compete agreements”)

with certain employees. These non-compete agreements contain a provision whereby employees would be due a certain number

of weeks of their salary if their employment was terminated by the Company as specified in the non-compete agreement. The

Company has not recorded a liability for these amounts potentially due employees. Rather, the Company will record a liability

for these amounts when an amount becomes due to an employee in accordance with the appropriate authoritative literature. As

of December 29, 2015, the total amount potentially owed employees under these non-compete agreements was $24.8 million.

Legal Proceedings

On July 2, 2014, a purported class action lawsuit was filed against one of the Company's subsidiaries by Jason Lofstedt, a former

employee of one of the Company's subsidiaries. The lawsuit was filed in the California Superior Court, County of Riverside. The

complaint alleges, among other things, violations of the California Labor Code, failure to pay overtime, failure to provide meal

and rest periods, and violations of California's Unfair Competition Law. The complaint seeks, among other relief, collective and

class certification of the lawsuit, unspecified damages, costs and expenses, including attorneys’ fees, and such other relief as the

Court might find just and proper. In addition, more recently, several other purported class action lawsuits based on similar claims

and seeking similar damages were filed against the subsidiary: on October 30, 2015 in the California Superior Court, County of

San Bernardino by Jazmin Dabney, a former subsidiary employee; on November 3, 2015, in the United States District Court,

Eastern District of California by Clara Manchester, a former subsidiary employee; and on November 30, 2015 in the California

Superior Court, County of Yolo by Tanner Maginnis, a current subsidiary assistant manager. The Company believes its subsidiary

has meritorious defenses to each of the claims in these lawsuits and is prepared to vigorously defend the allegations therein. There

can be no assurance, however, that the Company's subsidiary will be successful, and an adverse resolution of any one of these

lawsuits could have a material adverse effect on the Company's consolidated financial position and results of operations in the

period in which one or all of these lawsuits are resolved. The Company is not presently able to reasonably estimate potential

losses, if any, related to the lawsuits.

In addition to the legal matters described above, the Company is subject to various legal proceedings, claims, and litigation that

arise in the ordinary course of its business. Defending lawsuits requires significant management attention and financial resources

and the outcome of any litigation, including the matter described above, is inherently uncertain. The Company does not believe

the ultimate resolution of these actions will have a material adverse effect on its consolidated financial statements. However, a

significant increase in the number of these claims, or one or more successful claims under which the Company incurs greater

liabilities than is currently anticipated, could materially and adversely affect its consolidated financial statements.

Other

The Company is subject to on-going federal and state income tax audits and sales and use tax audits. The Company does not

believe the ultimate resolution of these actions will have a material adverse effect on its consolidated financial statements. However,

a significant increase in the number of these audits, or one or more audits under which the Company incurs greater liabilities than

is currently anticipated, could materially and adversely affect its consolidated financial statements. The Company believes reserves

for these matters are adequately provided for in its consolidated financial statements.