Panera Bread 2015 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2015 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

61

2015, $14.7 million of the 2015 Term Loan's carrying amount is presented as the Current portion of long-term debt in the

Consolidated Balance Sheets.

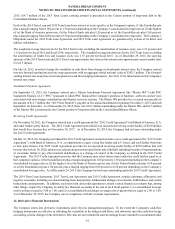

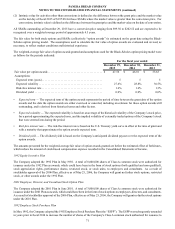

Each of the 2014 Term Loan and 2015 Term Loan bears interest at a rate equal to, at the Company's option, (1) the Eurodollar rate

plus a margin ranging from 1.00 percent to 1.50 percent depending on the Company’s consolidated leverage ratio or (2) the highest

of (a) the Bank of America prime rate, (b) the Federal funds rate plus 0.50 percent or (c) the Eurodollar rate plus 1.00 percent,

plus a margin ranging from 0.00 percent to 0.50 percent depending on the Company’s consolidated leverage ratio. The Company’s

obligations under the 2014 Term Loan Agreement and 2015 Term Loan Agreement are guaranteed by certain of its direct and

indirect subsidiaries.

The weighted-average interest rate for the 2014 Term Loan, excluding the amortization of issuance costs, was 1.21 percent and

1.15 percent for fiscal 2015 and fiscal 2014, respectively. The weighted-average interest rate for the 2015 Term Loan, excluding

the amortization of lender fees and issuance costs, was 1.33 percent for fiscal 2015. As of December 29, 2015, the carrying

amounts of the 2014 Term Loan and 2015 Term Loan approximate fair value as the interest rates approximate current market rates

(Level 2 inputs).

On July 16, 2015, in order to hedge the variability in cash flows from changes in benchmark interest rates, the Company entered

into two forward-starting interest rate swap agreements with an aggregate initial notional value of $242.5 million. The forward-

starting interest rate swaps have been designated as cash flow hedging instruments. See Note 12 for information on the Company's

interest rate swaps.

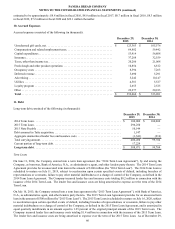

Installment Payment Agreement

On September 15, 2015, the Company entered into a Master Installment Payment Agreement (the “Master IPA”) with PNC

Equipment Finance, LLC (“PNC”) pursuant to which PNC financed the Company's purchase of hardware, software, and services

associated with new storage virtualization and disaster recovery systems. The Master IPA provides for a secured note payable in

the amount of $12.7 million (the “2015 Note Payable”), payable in five annual installments beginning November 1, 2015 and each

September 1st thereafter. As of December 29, 2015, there was $10.1 million outstanding under the Master IPA, and $2.5 million

of the Master IPA is presented as the Current portion of long-term debt in the Consolidated Balance Sheets.

Revolving Credit Agreements

On November 30, 2012, the Company entered into a credit agreement (the "2012 Credit Agreement") with Bank of America, N.A.

and other lenders party thereto. The 2012 Credit Agreement provided for an unsecured revolving credit facility of $250 million

that would have become due on November 30, 2017. As of December 30, 2014, the Company had no loans outstanding under

the 2012 Credit Agreement.

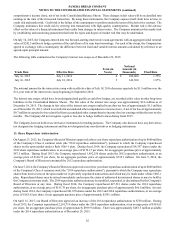

On July 16, 2015, the Company terminated the 2012 Credit Agreement and entered into a new credit agreement (the “2015 Credit

Agreement”), with Bank of America, N.A., as administrative agent, swing line lender and L/C issuer, and each lender from time

to time party thereto. The 2015 Credit Agreement provides for an unsecured revolving credit facility of $250 million that will

become due on July 16, 2020, subject to acceleration upon certain specified events of default, including breaches of representations

or covenants, failure to pay other material indebtedness or a change of control of the Company, as defined in the 2015 Credit

Agreement. The 2015 Credit Agreement provides that the Company may select interest rates under the credit facility equal to, at

the Company's option, (1) the Eurodollar rate plus a margin ranging from 1.00 percent to 1.50 percent depending on the Company’s

consolidated leverage ratio or (2) the highest of (a) the Bank of America prime rate, (b) the Federal funds rate plus 0.50 percent

or (c) the Eurodollar rate plus 1.00 percent, plus a margin ranging from 0.00 percent to 0.50 percent depending on the Company’s

consolidated leverage ratio. As of December 29, 2015, the Company had no loans outstanding under the 2015 Credit Agreement.

The 2014 Term Loan Agreement, 2015 Term Loan Agreement and 2015 Credit Agreement contain customary affirmative and

negative covenants, including covenants limiting liens, dispositions, fundamental changes, investments, indebtedness, and certain

transactions and payments. In addition, such term loan and credit agreements contain various financial covenants that, among

other things, require the Company to satisfy two financial covenants at the end of each fiscal quarter: (1) a consolidated leverage

ratio less than or equal to 3.00 to 1.00, and (2) a consolidated fixed charge coverage ratio of greater than or equal to 2.00 to 1.00.

As of December 29, 2015, the Company was in compliance with all covenant requirements.

12. Derivative Financial Instruments

The Company enters into derivative instruments solely for risk management purposes. To the extent the Company's cash-flow

hedging instruments are effective in offsetting the variability in the hedged cash flows, and otherwise meet the cash flow hedge

accounting criteria, changes in the derivatives' fair value are not included in current earnings but are included in accumulated other