Panera Bread 2015 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2015 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

71

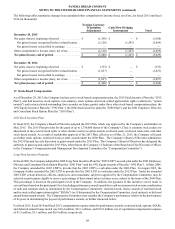

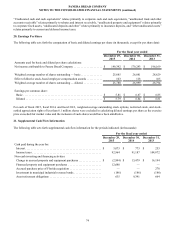

(2) Intrinsic value for activities other than conversions is defined as the difference between the grant price and the market value

on the last day of fiscal 2015 of $197.08 for those SSARs where the market value is greater than the conversion price. For

conversions, intrinsic value is defined as the difference between the grant price and the market value on the date of conversion.

All SSARs outstanding at December 29, 2015 have a conversion price ranging from $99.30 to $202.52 and are expected to be

recognized over a weighted-average period of approximately 4.5 years.

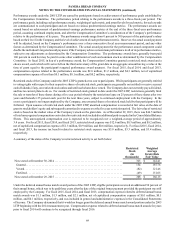

The fair value for both stock options and SSARs (collectively “option awards”) is estimated on the grant date using the Black-

Scholes option pricing model. The assumptions used to calculate the fair value of option awards are evaluated and revised, as

necessary, to reflect market conditions and historical experience.

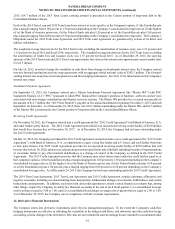

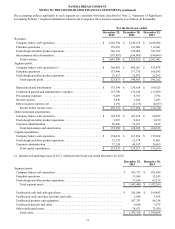

The weighted-average fair value of option awards granted and assumptions used for the Black-Scholes option pricing model were

as follows for the periods indicated:

For the fiscal year ended

December 29,

2015

December 30,

2014

December 31,

2013

Fair value per option awards. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 47.56 $ 46.01 $ 55.63

Assumptions:

Expected term (years) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 5 5

Expected volatility . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27.6% 28.8% 36.5%

Risk-free interest rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.6% 1.6% 1.3%

Dividend yield . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.0% 0.0% 0.0%

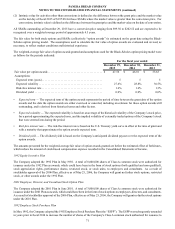

• Expected term — The expected term of the option awards represents the period of time between the grant date of the option

awards and the date the option awards are either exercised or canceled, including an estimate for those option awards still

outstanding, and is derived from historical terms and other factors.

• Expected volatility — The expected volatility is based on an average of the historical volatility of the Company’s stock price,

for a period approximating the expected term, and the implied volatility of externally traded options of the Company’s stock

that were entered into during the period.

• Risk-free interest rate — The risk-free interest rate is based on the U.S. Treasury yield curve in effect at the time of grant and

with a maturity that approximates the option awards expected term.

• Dividend yield — The dividend yield is based on the Company’s anticipated dividend payout over the expected term of the

option awards.

The amounts presented for the weighted-average fair value of option awards granted are before the estimated effect of forfeitures,

which reduce the amount of stock-based compensation expense recorded in the Consolidated Statements of Income.

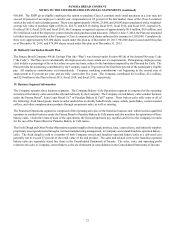

1992 Equity Incentive Plan

The Company adopted the 1992 Plan in May 1992. A total of 8,600,000 shares of Class A common stock were authorized for

issuance under the 1992 Plan as awards, which could have been in the form of stock options (both qualified and non-qualified),

stock appreciation rights, performance shares, restricted stock, or stock units, to employees and consultants. As a result of

stockholder approval of the 2006 Plan, effective as of May 25, 2006, the Company will grant no further stock options, restricted

stock, or other awards under the 1992 Plan.

2001 Employee, Director, and Consultant Stock Option Plan

The Company adopted the 2001 Plan in June 2001. A total of 3,000,000 shares of Class A common stock were authorized for

issuance under the 2001 Plan as awards, which could have been in the form of stock options to employees, directors, and consultants.

As a result of stockholder approval of the 2006 Plan, effective as of May 25, 2006, the Company will grant no further stock options

under the 2001 Plan.

1992 Employee Stock Purchase Plan

In May 1992, the Company adopted the 1992 Employee Stock Purchase Plan (the “ESPP”). The ESPP was subsequently amended

in years prior to fiscal 2014 to increase the number of shares of the Company's Class A common stock authorized for issuance to