Panera Bread 2015 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2015 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

Refranchising loss

In February 2015, we announced a plan to refranchise approximately 50 to 150 bakery-cafes by the end of fiscal 2015. As of

December 29, 2015, we had completed the refranchising of 75 bakery-cafes and classified as held for sale the assets and certain

liabilities of 35 bakery-cafes we expect to sell during the next 12 months.

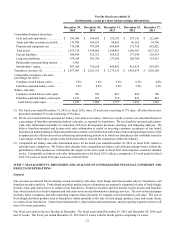

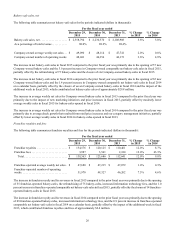

The following table summarizes activity associated with the refranchising initiative for fiscal 2015 (dollars in thousands):

For the fiscal year ended

December 29, 2015

Loss on assets held for sale. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 10,999

Impairment of long-lived assets and lease termination costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,461

Professional fees and severance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,088

Gain on sale of bakery-cafes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (440)

Refranchising loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 17,108

During fiscal 2015, we recorded losses on assets held for sale of $11.0 million. We also recognized impairment losses and lease

termination costs totaling $5.5 million during fiscal 2015 related to certain under-performing bakery-cafes. On March 3, 2015,

we sold substantially all of the assets of one bakery-cafe to an existing franchisee for cash proceeds of approximately $3.2 million,

which resulted in a gain on sale of approximately $2.6 million. On July 14, 2015, we sold substantially all of the assets of 29

bakery-cafes in the Boston market to an existing franchisee for a purchase price of approximately $19.6 million, including $0.5

million for inventory on hand, with $2.0 million held in escrow for certain holdbacks, and recognized a loss on sale of $0.6 million.

On October 7, 2015, we sold substantially all of the assets of 45 bakery-cafes in the Seattle and Northern California markets to a

new franchisee for a purchase price of approximately $26.8 million, including $0.9 million for inventory on hand, and recognized

a loss on sale of $1.6 million.

Other (income) expense, net

Other (income) expense, net in fiscal 2015 decreased to $1.2 million of expense from $3.2 million of income in fiscal 2014. Other

(income) expense, net for fiscal 2015 was primarily comprised of immaterial items. Other (income) expense, net for fiscal 2014

was primarily comprised of a $3.2 million benefit from a favorable resolution of an insurance coverage matter and other immaterial

items, partially offset by a goodwill impairment charge of $2.1 million.

Other (income) expense, net in fiscal 2014 decreased to $3.2 million of income from $4.0 million of income in fiscal 2013. Other

(income) expense, net for fiscal 2014 was primarily comprised of a $3.2 million benefit from a favorable resolution of an insurance

coverage matter and other immaterial items, partially offset by a goodwill impairment charge of $2.1 million. Other (income)

expense, net for fiscal 2013 was primarily comprised of a $2.2 million benefit from favorable resolution of legal and sales and

use tax matters, and immaterial items.

Income taxes

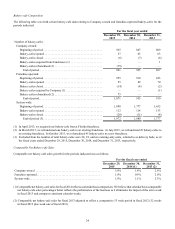

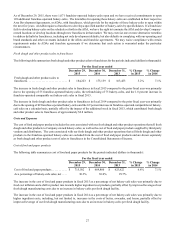

The following table summarizes income taxes for the periods indicated (dollars in thousands):

For the fiscal year ended

December 29,

2015

December 30,

2014

December 31,

2013

% Change

in 2015

% Change

in 2014

Income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . $ 87,247 $ 98,001 $ 116,551 (11.0)% (15.9)%

Effective tax rate . . . . . . . . . . . . . . . . . . . . . . . 36.9% 35.3% 37.3%

The increase in the effective tax rate from fiscal 2014 to fiscal 2015 was primarily driven by certain discrete income tax benefits

reported during fiscal 2014 related to additional federal and state tax credits and an increased deduction for domestic production

activities. The decrease in the effective tax rate from fiscal 2013 to fiscal 2014 was primarily driven by certain discrete income

tax benefit items reported during fiscal 2014 related to additional federal and state tax credits and an increased deduction for

domestic production activities.