Panera Bread 2015 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2015 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

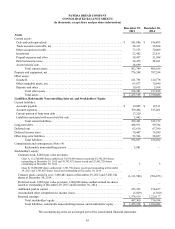

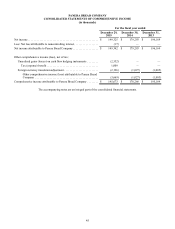

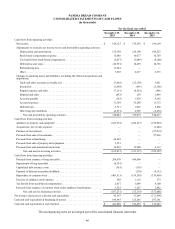

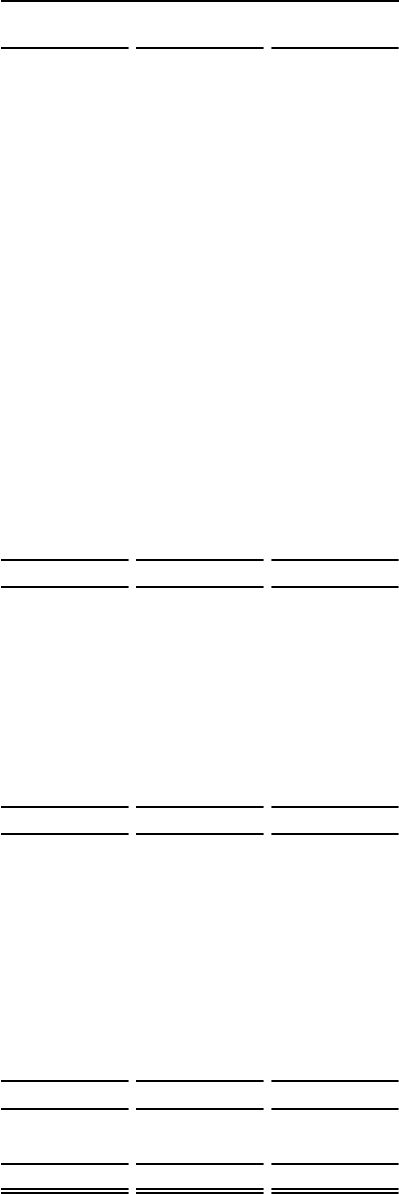

PANERA BREAD COMPANY

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

For the fiscal year ended

December 29,

2015

December 30,

2014

December 31,

2013

Cash flows from operating activities:

Net income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 149,325 $ 179,293 $ 196,169

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation and amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 135,398 124,109 106,523

Stock-based compensation expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15,086 10,077 10,703

Tax benefit from stock-based compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2,057) (3,089) (8,100)

Deferred income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (10,991) 10,459 10,356

Refranchising loss. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12,942 — —

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,505 4,617 6,353

Changes in operating assets and liabilities, excluding the effect of acquisitions and

dispositions:

Trade and other accounts receivable, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3,605) (22,139) 3,021

Inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,698) (895) (2,186)

Prepaid expenses and other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (7,191) (8,524) (841)

Deposits and other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (455) 239 1,449

Accounts payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (183) 1,978 8,162

Accrued expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31,169 35,288 13,372

Deferred rent. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,751 1,067 5,868

Other long-term liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (6,951) 2,599 (2,432)

Net cash provided by operating activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . 318,045 335,079 348,417

Cash flows from investing activities:

Additions to property and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (223,932) (224,217) (192,010)

Acquisitions, net of cash acquired . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (2,446)

Purchase of investments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (97,919)

Proceeds from sale of investments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 97,936

Proceeds from refranchising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46,869 — —

Proceeds from sale of property and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,553 — —

Proceeds from sale-leaseback transactions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,095 12,900 6,132

Net cash used in investing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (165,415) (211,317) (188,307)

Cash flows from financing activities:

Proceeds from issuance of long-term debt. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 299,070 100,000 —

Repayments of long-term debt. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (6,301) — —

Capitalized debt issuance costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (363) (193) —

Payment of deferred acquisition holdback. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (270) (4,112)

Repurchase of common stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (405,513) (159,503) (339,409)

Exercise of employee stock options. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 288 1,116 573

Tax benefit from stock-based compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,057 3,089 8,100

Proceeds from issuance of common stock under employee benefit plans. . . . . . . . . 3,525 3,247 2,842

Net cash used in financing activities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (107,237) (52,514) (332,006)

Net increase (decrease) in cash and cash equivalents. . . . . . . . . . . . . . . . . . . . . . . . . . 45,393 71,248 (171,896)

Cash and cash equivalents at beginning of period . . . . . . . . . . . . . . . . . . . . . . . . . . . . 196,493 125,245 297,141

Cash and cash equivalents at end of period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 241,886 $ 196,493 $ 125,245

The accompanying notes are an integral part of the consolidated financial statements.