Panera Bread 2015 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2015 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

60

estimated to be approximately: $8.8 million in fiscal 2016, $8.8 million in fiscal 2017, $8.7 million in fiscal 2018, $8.3 million

in fiscal 2019, $7.2 million in fiscal 2020 and $22.1 million thereafter.

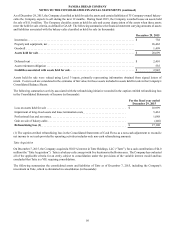

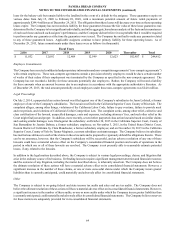

10. Accrued Expenses

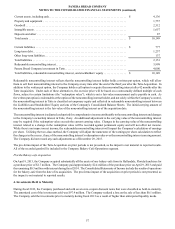

Accrued expenses consisted of the following (in thousands):

December 29,

2015

December 30,

2014

Unredeemed gift cards, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 123,363 $ 105,576

Compensation and related employment taxes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 64,882 59,442

Capital expenditures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53,914 56,808

Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37,208 32,559

Taxes, other than income tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20,206 21,068

Fresh dough and other product operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,854 6,812

Occupancy costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,594 7,263

Deferred revenue. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,690 5,291

Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,242 10,147

Utilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,581 5,527

Loyalty program . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,653 2,525

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22,277 20,183

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 359,464 $ 333,201

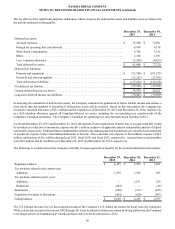

11. Debt

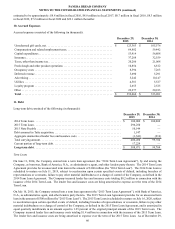

Long-term debt consisted of the following (in thousands):

December 29,

2015

December 30,

2014

2014 Term Loan . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 100,000 $ 100,000

2015 Term Loan . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 296,250 —

2015 Note Payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,144 —

Debt assumed in Tatte acquisition. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,147 —

Aggregate unamortized lender fees and issuance costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,341)(216)

Total carrying amount. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 406,200 99,784

Current portion of long-term debt. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17,229 —

Long-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 388,971 $ 99,784

Term Loans

On June 11, 2014, the Company entered into a term loan agreement (the “2014 Term Loan Agreement”), by and among the

Company, as borrower, Bank of America, N.A., as administrative agent, and other lenders party thereto. The 2014 Term Loan

Agreement provides for an unsecured term loan in the amount of $100 million (the "2014 Term Loan"). The 2014 Term Loan is

scheduled to mature on July 11, 2019, subject to acceleration upon certain specified events of default, including breaches of

representations or covenants, failure to pay other material indebtedness or a change of control of the Company, as defined in the

2014 Term Loan Agreement. The Company incurred lender fees and issuance costs totaling $0.2 million in connection with the

issuance of the 2014 Term Loan. The lender fees and issuance costs are being amortized to expense over the term of the 2014

Term Loan.

On July 16, 2015, the Company entered into a term loan agreement (the “2015 Term Loan Agreement”), with Bank of America,

N.A., as administrative agent, and other lenders party thereto. The 2015 Term Loan Agreement provides for an unsecured term

loan in the amount of $300 million (the "2015 Term Loan"). The 2015 Term Loan is scheduled to mature on July 16, 2020, subject

to acceleration upon certain specified events of default, including breaches of representations or covenants, failure to pay other

material indebtedness or a change of control of the Company, as defined in the 2015 Term Loan Agreement, and is amortized in

equal quarterly installments in an amount equal to 1.25 percent of the original principal amount of the 2015 Term Loan. The

Company incurred lender fees and issuance costs totaling $1.4 million in connection with the issuance of the 2015 Term Loan.

The lender fees and issuance costs are being amortized to expense over the term of the 2015 Term Loan. As of December 29,