Panera Bread 2015 Annual Report Download - page 49

Download and view the complete annual report

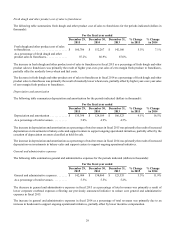

Please find page 49 of the 2015 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.39

increased labor costs can be reflected in our prices or that increased prices will be absorbed by consumers without diminishing to

some degree consumer spending at the bakery-cafes.

Recent Accounting Pronouncements

In November 2015, the Financial Accounting Standards Board, or the FASB, issued Accounting Standards Update, or ASU,

2015-17, “Balance Sheet Classification of Deferred Taxes”. This update requires that deferred tax liabilities and assets be classified

as noncurrent in a classified statement of financial position. This update is effective for annual and interim reporting periods

beginning after December 15, 2016. Early adoption is permitted. We plan on adopting this guidance in the first quarter of fiscal

2016.

In September 2015, the FASB issued ASU, 2015-16, “Business Combinations (Topic 805): Simplifying the Accounting for

Measurement-Period Adjustments”. This update eliminates the requirement for an acquirer in a business combination to account

for measurement-period adjustments retrospectively. Acquirers would now recognize measurement-period adjustments during

the period in which they determine the amount of the adjustment. This update is effective for annual and interim reporting periods

beginning after December 15, 2015, including interim periods within those fiscal years, and should be applied prospectively to

adjustments for provisional amounts that occur after the effective date with early adoption permitted for financial statements that

have not been issued. The adoption of this guidance is not expected to have a material effect on our consolidated financial statements.

In July 2015, the FASB issued ASU 2015-11, “Inventory (Topic 330): Simplifying the Measurement of Inventory”. This update

provides guidance on the subsequent measurement of inventory, which changes the measurement from lower of cost or market to

lower of cost and net realizable value. This update is effective for annual and interim periods beginning after December 15, 2016.

The adoption of this guidance is not expected to have a material effect on our consolidated financial statements.

In April 2015, the FASB issued ASU 2015-03, “Interest – Imputation of Interest (Subtopic 835-30): Simplifying the Presentation

of Debt Issuance Costs”. This update requires debt issuance costs related to a recognized debt liability to be presented in the

balance sheet as a direct deduction from the carrying value of that debt liability, consistent with debt discounts. The recognition

and measurement guidance for debt issuance costs are not affected by this update. We early adopted ASU 2015-03 during the

thirteen weeks ended June 30, 2015. As a result of the retrospective adoption, we reclassified unamortized debt issuance costs of

$0.2 million as of December 30, 2014 from deposits and other to long-term debt on our Consolidated Balance Sheets. Adoption

of this standard did not impact our results of operations or cash flows in the current or previous interim and annual reporting

periods.

In August 2014, the FASB issued ASU 2014-15, “Presentation of Financial Statements - Going Concern (Subtopic 205-40):

Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern”. This update requires management to

evaluate whether there is substantial doubt about our ability to continue as a going concern. This update is effective for the annual

period ending after December 15, 2016, and for annual and interim periods thereafter. Early adoption is permitted. We are currently

evaluating the effect of the standard but its adoption is not expected to have an impact on our consolidated financial statements.

In May 2014, the FASB issued ASU 2014-09, “Revenue from Contracts with Customers (Topic 606)”. This update provides a

comprehensive new revenue recognition model that requires a company to recognize revenue to depict the transfer of goods or

services to a customer at an amount that reflects the consideration it expects to receive in exchange for those goods or services.

The guidance also requires additional disclosure about the nature, amount, timing, and uncertainty of revenue and cash flows

arising from customer contracts. In August 2015, the FASB issued ASU 2015-14 delaying the effective date for adoption. The

update is now effective for interim and annual reporting periods beginning after December 15, 2017. Early adoption is permitted.

The update permits the use of either the retrospective or cumulative effect transition method. We are evaluating the effect this

guidance will have on our consolidated financial statements and related disclosures. We have not yet selected a transition method

nor have we determined the effect of the standard on our ongoing financial reporting.

In April 2014, the FASB issued ASU 2014-08, “Presentation of Financial Statements (Topic 205) and Property, Plant, and Equipment

(Topic 360)”. This update was issued to clarify the reporting for discontinued operations and disclosures for disposals of components

of an entity. This update is effective for annual and interim periods beginning after December 15, 2014. The adoption of this update

did not have a material effect on our consolidated financial statements or related disclosures; however, it may impact the reporting

of future discontinued operations if and when they occur.