Panera Bread 2015 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2015 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

53

• the improvement is fairly generic;

• the improvement increases the fair value of the property to the lessor; and

• the useful life of the improvement is longer than the lease term.

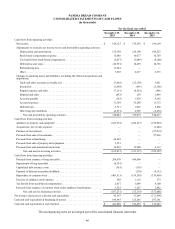

The Company reports the period to period change in the landlord receivable within the operating activities section of its Consolidated

Statements of Cash Flows.

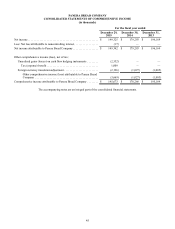

Earnings Per Share

Basic earnings per share is computed by dividing net income by the weighted-average number of shares of common stock

outstanding during the fiscal year. Diluted earnings per common share is computed by dividing net income by the weighted-

average number of shares of common stock outstanding and dilutive securities outstanding during the year.

Foreign Currency Translation

The Company has 11 Company-owned bakery-cafes, one Company-owned fresh dough facility, and six franchise-operated bakery-

cafes in Canada which use the Canadian Dollar as their functional currency. Assets and liabilities are translated into U.S. dollars

using the current exchange rate in effect at the balance sheet date, while revenues and expenses are translated at the weighted-

average exchange rate during the fiscal period. The resulting translation adjustments are recorded as a separate component of

accumulated other comprehensive income in the Consolidated Balance Sheets and Consolidated Statements of Changes in Equity

and Redeemable Noncontrolling Interest. Gains and losses resulting from foreign currency transactions have not historically been

significant and are included in other (income) expense, net in the Consolidated Statements of Income.

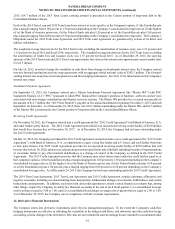

Derivative Instruments

The Company records all derivatives in the Consolidated Balance Sheets at fair value. The Company does not enter into derivative

instruments for trading purposes. For derivative instruments that are designated and qualify as cash flow hedges, the effective

portion of the derivative's gain or loss is reported as component of other comprehensive income and recorded in accumulated other

comprehensive income, net of tax in the Consolidated Balance Sheets. The gain or loss is subsequently reclassified into earnings

when the hedged exposure affects earnings. To the extent that the change in the fair value of the contract corresponds to the change

in the value of the anticipated transaction, the hedge is considered effective. The remaining change in fair value of the contract

represents the ineffective portion, which is immediately recorded in interest expense in the Consolidated Statements of Income.

Once established, cash flow hedges generally remain designated as such until the hedged item impacts earnings, or the anticipated

transaction is no longer likely to occur.

Fair Value of Financial Instruments

The carrying amounts of cash, accounts receivable, accounts payable, and other accrued expenses approximate their fair values

due to the short-term nature of these assets and liabilities. The fair value of the Company's interest rate swaps are determined

based on a discounted cash flow analysis on the expected future cash flows of each derivative. This analysis reflects the contractual

terms of the derivatives and uses observable market-based inputs, including interest rate curves and credit spreads.

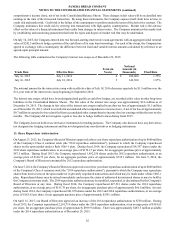

Stock-Based Compensation

The Company accounts for stock-based compensation in accordance with the accounting standard for stock-based compensation,

which requires the Company to measure and record compensation expense in the Company’s consolidated financial statements

for all stock-based compensation awards using a fair value method. The Company maintains several stock-based incentive plans

under which the Company may grant incentive stock options, non-statutory stock options and stock settled appreciation rights

(collectively, “option awards”) and restricted stock and restricted stock units to certain directors, officers, employees and

consultants. The Company also offers a stock purchase plan where employees may purchase the Company’s common stock each

calendar quarter through payroll deductions at 85 percent of market value on the purchase date and the Company recognizes

compensation expense on the 15 percent discount.

For option awards, fair value is determined using the Black-Scholes option pricing model, while restricted stock is valued using

the closing stock price on the date of grant. The Black-Scholes option pricing model requires the input of subjective assumptions.

These assumptions include estimating the expected term until the option awards are either exercised or canceled; the expected

volatility of the Company’s stock price, for a period approximating the expected term; the risk-free interest rate with a maturity

that approximates the option awards expected term; and the dividend yield based on the Company’s anticipated dividend payout

over the expected term of the option awards. These assumptions are evaluated and revised, as necessary, to reflect market conditions