Panera Bread 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

57

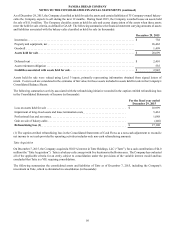

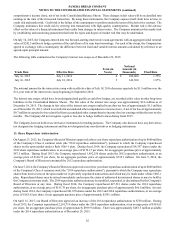

Current assets, including cash. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,136

Property and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,757

Goodwill . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,512

Intangible assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,657

Deposits and other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 87

Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 10,149

Current liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 777

Long-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,237

Other long-term liabilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 137

Total liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,151

Redeemable noncontrolling interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,998

Panera Bread Company investment in Tatte. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,000

Total liabilities, redeemable noncontrolling interest, and stockholders' equity . . . . . . . . . . . . . . . . $ 10,149

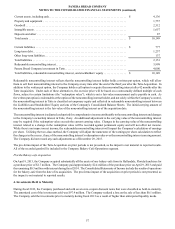

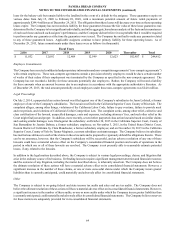

Redeemable noncontrolling interest reflects that the noncontrolling interest holder holds a written put option, which will allow

them to sell their noncontrolling interest to the Company at any time after the end of the third year after the Tatte Acquisition. In

addition to the written put option, the Company holds a call option to acquire the noncontrolling interest after 42 months after the

Tatte Acquisition. Under each of these alternatives, the exercise price will be based on a contractually defined multiple of cash

flows, subject to certain limitations (the “redemption value”), which is not a fair value measurement and is payable in cash. As

the written put option is redeemable at the option of the noncontrolling interest holder, and not solely within the Company's control,

the noncontrolling interest in Tatte is classified as temporary equity and reflected in redeemable noncontrolling interest between

the Liabilities and Stockholders' Equity sections of the Company's Consolidated Balance Sheets. The initial carrying amount of

the noncontrolling interest is the fair value of the noncontrolling interest as of the acquisition date.

The noncontrolling interest is adjusted each period for comprehensive income attributable to the noncontrolling interest and changes

in the Company's ownership interest in Tatte, if any. An additional adjustment to the carrying value of the noncontrolling interest

may be required if the redemption value exceeds the current carrying value. Changes in the carrying value of the noncontrolling

interest related to a change in the redemption value will be recorded against permanent equity and will not affect net income.

While there is no impact on net income, the redeemable noncontrolling interest will impact the Company's calculation of earnings

per share. Utilizing the two-class method, the Company will adjust the numerator of the earnings per share calculation to reflect

the changes in the excess, if any, of the noncontrolling interest's redemption value over the noncontrolling interest carrying amount.

The Company did not record any such adjustments as of December 29, 2015.

The pro-forma impact of the Tatte Acquisition on prior periods is not presented, as the impact is not material to reported results.

All of the recorded goodwill is included in the Company Bakery-Cafe Operations segment.

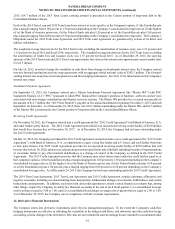

Florida Bakery-cafe Acquisition

On April 9, 2013, the Company acquired substantially all the assets of one bakery-cafe from its Hallandale, Florida franchisee for

a purchase price of $2.7 million. The Company paid approximately $2.4 million of the purchase price on April 9, 2013 and paid

the remaining $0.3 million with interest during fiscal 2014. The Consolidated Statements of Income include the results of operations

for the bakery-cafe from the date of its acquisition. The pro-forma impact of the acquisition on prior periods is not presented, as

the impact is not material to reported results.

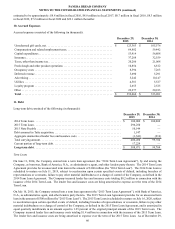

4. Investments Held to Maturity

During fiscal 2013, the Company purchased and sold seven zero-coupon discount notes that were classified as held-to-maturity.

The amortized cost of the investments sold was $97.9 million. The Company realized a loss on the sale of less than $0.1 million.

The Company sold the investments prior to maturity during fiscal 2013 as a result of higher than anticipated liquidity needs.