Panera Bread 2015 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2015 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

72

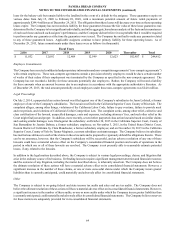

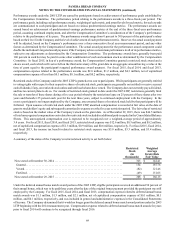

950,000. The ESPP gives eligible employees the option to purchase Class A common stock (total purchases in a year may not

exceed 10 percent of an employee’s current year compensation) at 85 percent of the fair market value of the Class A common

stock at the end of each calendar quarter. There were approximately 24,000, 23,000, and 20,000 shares purchased with a weighted-

average fair value of purchase rights of $26.21, $24.71, and $25.01 during fiscal 2015, fiscal 2014, and fiscal 2013, respectively.

For fiscal 2015, fiscal 2014, and fiscal 2013, the Company recognized expense of approximately $0.6 million, $0.6 million, and

$0.5 million in each of the respective years related to stock purchase plan discounts. Effective June 5, 2014, the Plan was amended

to further increase the number of the Company’s Class A common stock shares authorized for issuance to 1,050,000. Cumulatively,

there were approximately 925,000 shares issued under this plan as of December 29, 2015, 901,000 shares issued under this plan

as of December 30, 2014, and 878,000 shares issued under this plan as of December 31, 2013.

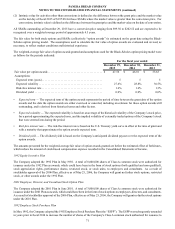

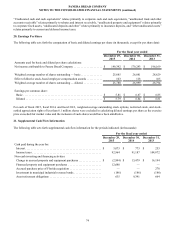

18. Defined Contribution Benefit Plan

The Panera Bread Company 401(k) Savings Plan (the “Plan”) was formed under Section 401(k) of the Internal Revenue Code

(“the Code”). The Plan covers substantially all employees who meet certain service requirements. Participating employees may

elect to defer a percentage of his or her salary on a pre-tax basis, subject to the limitations imposed by the Plan and the Code. The

Plan provides for a matching contribution by the Company equal to 50 percent of the first three percent of the participant’s eligible

pay. All employee contributions vest immediately. Company matching contributions vest beginning in the second year of

employment at 25 percent per year, and are fully vested after five years. The Company contributed $2.3 million, $2.2 million,

and $2.0 million to the Plan in fiscal 2015, fiscal 2014, and fiscal 2013, respectively.

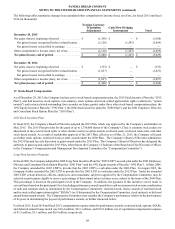

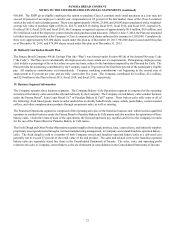

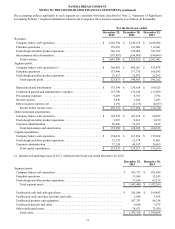

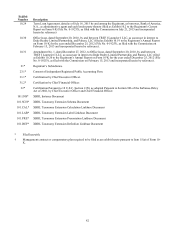

19. Business Segment Information

The Company operates three business segments. The Company Bakery-Cafe Operations segment is comprised of the operating

activities of the bakery-cafes owned directly and indirectly by the Company. The Company-owned bakery-cafes conduct business

under the Panera Bread®, Saint Louis Bread Co.® or Paradise Bakery & Café® names. These bakery-cafes offer some or all of

the following: fresh baked goods, made-to-order sandwiches on freshly baked breads, soups, salads, pasta dishes, custom roasted

coffees, and other complementary products through on-premise sales, as well as catering.

The Franchise Operations segment is comprised of the operating activities of the franchise business unit, which licenses qualified

operators to conduct business under the Panera Bread or Paradise Bakery & Café names and also monitors the operations of these

bakery-cafes. Under the terms of most of the agreements, the licensed operators pay royalties and fees to the Company in return

for the use of the Panera Bread or Paradise Bakery & Café names.

The Fresh Dough and Other Product Operations segment supplies fresh dough, produce, tuna, cream cheese, and indirectly supplies

proprietary sweet goods items through a contract manufacturing arrangement, to Company-owned and franchise-operated bakery-

cafes. The fresh dough is sold to a number of both Company-owned and franchise-operated bakery-cafes at a delivered cost

generally not to exceed 27 percent of the retail value of the end product. The sales and related costs to the franchise-operated

bakery-cafes are separately stated line items in the Consolidated Statements of Income. The sales, costs, and operating profit

related to the sales to Company-owned bakery-cafes are eliminated in consolidation in the Consolidated Statements of Income.