Panera Bread 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

62

comprehensive income (loss), net of tax in the Consolidated Balance Sheets. These changes in fair value will be reclassified into

earnings at the time of the forecasted transaction. By using these instruments, the Company exposes itself, from time to time, to

credit risk and market risk. Credit risk is the failure of the counterparty to perform under the terms of the derivative contract. The

Company minimizes this credit risk by entering into transactions with high-quality counterparties. Market risk is the adverse

effect on the value of a financial instrument that results from changes in interest rates. The Company minimizes this market risk

by establishing and monitoring parameters that limit the types and degree of market risk that may be undertaken.

On July 16, 2015, the Company entered into two forward-starting interest rate swap agreements with an aggregate initial notional

value of $242.5 million to hedge a portion of the cash flows of its term loan borrowings. For each of the swaps, the Company has

agreed to exchange with a counterparty the difference between fixed and variable interest amounts calculated by reference to an

agreed-upon principal amount.

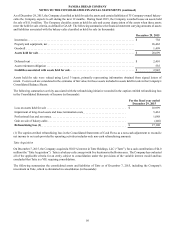

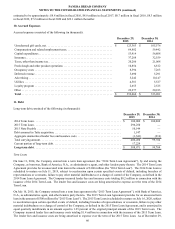

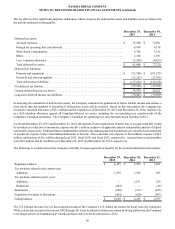

The following table summarizes the Company's interest rate swaps as of December 29, 2015:

Trade Date Effective Date

Term (in

Years)

Notional

Amount (in

thousands) Fixed Rate

July 16, 2015 July 11, 2016 4 $ 100,000 1.75%

July 16, 2015 July 18, 2016 5 142,500 1.97%

The notional amount for the interest rate swap with an effective date of July 18, 2016 decreases quarterly by $1.9 million over the

five-year term of the interest rate swap beginning in September 2016.

The interest rate swaps, which have been designated and qualify as cash flow hedges, are recorded at fair value in other long-term

liabilities in the Consolidated Balance Sheets. The fair value of the interest rate swaps was approximately $2.6 million as of

December 29, 2015. The change in fair value of the interest rate swaps resulted in an after-tax loss of approximately $1.5 million

as of December 29, 2015, which is recorded in accumulated other comprehensive income (loss). A net of tax loss of approximately

$0.7 million is expected to be reclassified from accumulated other comprehensive income (loss) to earnings within the next twelve

months. The Company did not recognize a gain or loss due to hedge ineffectiveness during fiscal 2015.

The Company does not hold or use derivative instruments for trading purposes. The Company also does not have any derivatives

not designated as hedging instruments and has not designated any non-derivatives as hedging instruments.

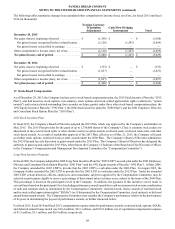

13. Share Repurchase Authorization

On August 23, 2012, the Company's Board of Directors approved a three year share repurchase authorization of up to $600 million

of the Company's Class A common stock (the "2012 repurchase authorization"), pursuant to which the Company repurchased

shares on the open market under a Rule 10b5-1 plan. During fiscal 2014, the Company repurchased 514,357 shares under the

2012 share repurchase authorization, at an average price of $170.15 per share, for an aggregate purchase price of approximately

$87.5 million. During fiscal 2013, the Company repurchased 1,992,250 shares under the 2012 repurchase authorization, at an

average price of $166.73 per share, for an aggregate purchase price of approximately $332.1 million. On June 5, 2014, the

Company's Board of Directors terminated the 2012 repurchase authorization.

On June 5, 2014, the Company's Board of Directors approved a new three year share repurchase authorization of up to $600 million

of the Company's Class A common stock (the "2014 repurchase authorization"), pursuant to which the Company may repurchase

shares from time to time on the open market or in privately negotiated transactions and which may be made under a Rule 10b5-1

plan. Repurchased shares may be retired immediately and resume the status of authorized but unissued shares or may be held by

the Company as treasury stock. The 2014 repurchase authorization may be modified, suspended, or discontinued by the Company's

Board of Directors at any time. During fiscal 2014, the Company repurchased 427,521 shares under the 2014 repurchase

authorization, at an average price of $155.78 per share, for an aggregate purchase price of approximately $66.6 million. In total,

during fiscal 2014, the Company repurchased 941,878 shares under the 2012 and 2014 repurchase authorizations, at an average

price of $163.62 per share, for an aggregate purchase price of approximately $154.1 million.

On April 15, 2015, our Board of Directors approved an increase of the 2014 repurchase authorization to $750 million. During

fiscal 2015, the Company repurchased 2,201,719 shares under the 2014 repurchase authorization, at an average price of $181.65

per share, for an aggregate purchase price of approximately $399.9 million. There was approximately $283.5 million available

under the 2014 repurchase authorization as of December 29, 2015.