Panera Bread 2015 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2015 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.40

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Commodity Risk

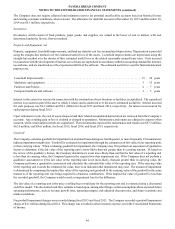

We manage our commodity risk in several ways. We purchase certain commodities, such as flour, coffee, and proteins, for use in

our business. These commodities are sometimes purchased under agreements with terms of one month to one year, usually at a

fixed price. As a result, we are subject to market risk that current market prices may be above or below our contractual price.

These agreements qualify as normal purchases and are not recorded at fair value on our Consolidated Balance Sheets. In fiscal

2015, 2014, and 2013, we did not utilize derivative instruments in managing commodity risk.

Interest Rate Risk

We are exposed to market risk primarily from fluctuations in interest rates on our $400 million term loan borrowings and any

borrowings we may make under our credit facility of $250 million. Under the 2015 Credit Agreement, 2014 Term Loan Agreement

and 2015 Term Loan Agreement, we may select interest rates equal to (1) the Eurodollar rate plus a margin ranging from 1.00

percent to 1.50 percent depending on our consolidated leverage ratio or (2) the Base Rate (which is defined as the highest of the

Bank of America prime rate, the Federal funds rate plus 0.50 percent, or the Eurodollar rate plus 1.00 percent) plus the applicable

margin for Base Rate loans (which is an amount ranging from 0.00 percent to 0.50 percent for the term loans and 0.00 percent to

1.00 percent for the credit facility depending on our consolidated leverage ratio). An increase in the present interest rate of 100

basis points on the term loan borrowings would increase annual interest expense by approximately $4.0 million.

On July 16, 2015, in order to hedge the variability in cash flows from changes in benchmark interest rates, we entered into two

forward-starting interest rate swap agreements with an aggregate initial notional value of $242.5 million. The forward-starting

interest rate swaps have been designated as cash flow hedging instruments and effectively convert variable rate term loan borrowings

to a fixed rate.

See Note 11, Debt, and Note 12, Derivative Financial Instruments, to the consolidated financial statements included in Part II,

Item 8 of this Annual Report on Form 10-K for details of the components of our long-term debt and further discussion on our

interest rate swap agreements, respectively, as of December 29, 2015.

Foreign Currency Exchange Risk

As of December 29, 2015, we had 11 Canadian Company-owned bakery-cafes, one Canadian Company-owned fresh dough facility,

and six Canadian franchise-operated bakery-cafes. As a result, certain of our operating revenues, expenses, and capital purchasing

activities are subject to fluctuations in the exchange rate of the Canadian Dollar. To date, we have not entered into any hedging

contracts, although we may do so in the future. Fluctuations in currency exchange rates could affect our business in the future.