Oracle 2008 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2008 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2009

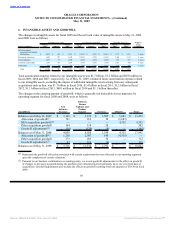

values, we recorded $561 million of goodwill, $573 million of identifiable intangible assets, $106 million of

net tangible assets and $49 million of in-process research and development.

Unaudited Pro Forma Financial Information

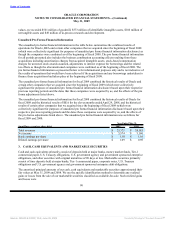

The unaudited pro forma financial information in the table below summarizes the combined results of

operations for Oracle, BEA and certain other companies that we acquired since the beginning of fiscal 2008

(which were collectively significant for purposes of unaudited pro forma financial information disclosure) as

though the companies were combined as of the beginning of fiscal 2008. The pro forma financial information

for all periods presented also includes the business combination accounting effects resulting from these

acquisitions including amortization charges from acquired intangible assets, stock-based compensation

charges for unvested stock awards assumed, adjustments to interest expense for borrowings and the related

tax effects as though the aforementioned companies were combined as of the beginning of fiscal 2008. The

pro forma financial information as presented below is for informational purposes only and is not indicative of

the results of operations that would have been achieved if the acquisitions and any borrowings undertaken to

finance these acquisitions had taken place at the beginning of fiscal 2008.

The unaudited pro forma financial information for fiscal 2009 combined the historical results of Oracle and

certain other companies that we acquired since the beginning of fiscal 2009 (which were collectively

significant for purposes of unaudited pro forma financial information disclosure) based upon their respective

previous reporting periods and the dates that these companies were acquired by us, and the effects of the pro

forma adjustments listed above.

The unaudited pro forma financial information for fiscal 2008 combined the historical results of Oracle for

fiscal 2008 and the historical results of BEA for the eleven months ended April 29, 2008, and the historical

results of certain other companies that we acquired since the beginning of fiscal 2008 (which were

collectively significant for purposes of unaudited pro forma financial information disclosure) based upon their

respective previous reporting periods and the dates these companies were acquired by us, and the effects of

the pro forma adjustments listed above. The unaudited pro forma financial information was as follows for

fiscal 2009 and 2008:

Year Ended May 31,

(in millions, except per share data) 2009 2008

Total revenues $ 23,371 $ 24,185

Net income $ 5,574 $ 5,160

Basic earnings per share $ 1.10 $ 1.01

Diluted earnings per share $ 1.09 $ 0.98

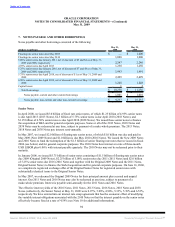

3. CASH, CASH EQUIVALENTS AND MARKETABLE SECURITIES

Cash and cash equivalents primarily consist of deposits held at major banks, money market funds, Tier-1

commercial paper, U.S. Treasury obligations, U.S. government agency and government sponsored enterprise

obligations, and other securities with original maturities of 90 days or less. Marketable securities primarily

consist of time deposits held at major banks, Tier-1 commercial paper, corporate notes, U.S. Treasury

obligations and U.S. government agency and government sponsored enterprise debt obligations.

The amortized principal amounts of our cash, cash equivalents and marketable securities approximated their

fair values at May 31, 2009 and 2008. We use the specific identification method to determine any realized

gains or losses from the sale of our marketable securities classified as available-for-sale. Such realized gains

and losses were

90

Source: ORACLE CORP, 10-K, June 29, 2009 Powered by Morningstar® Document Research℠