Oracle 2008 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2008 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2009

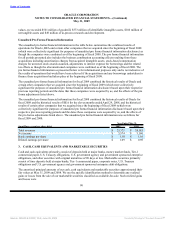

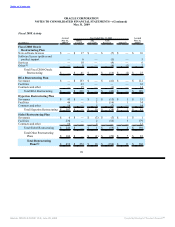

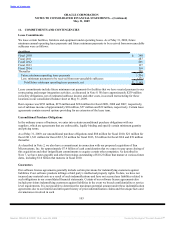

7. NOTES PAYABLE AND OTHER BORROWINGS

Notes payable and other borrowings consisted of the following:

May 31, May 31,

(Dollars in millions) 2009 2008

Floating rate senior notes due May 2009 $ — $ 1,000

Floating rate senior notes due May 2010 1,000 1,000

5.00% senior notes due January 2011, net of discount of $3 and $4 as of May 31,

2009 and 2008, respectively 2,247 2,246

4.95% senior notes due April 2013 1,250 1,250

5.25% senior notes due January 2016, net of discount of $7 and $9 as of May 31,

2009 and 2008, respectively 1,993 1,991

5.75% senior notes due April 2018, net of discount of $1 as of May 31, 2009 and

2008 2,499 2,499

6.50% senior notes due April 2038, net of discount of $2 as of May 31, 2009 and

2008 1,248 1,248

Capital leases 1 2

Total borrowings $ 10,238 $ 11,236

Notes payable, current and other current borrowings $ 1,001 $ 1,001

Notes payable, non-current and other non-current borrowings $ 9,237 $ 10,235

Senior Notes

In April 2008, we issued $5.0 billion of fixed rate senior notes, of which $1.25 billion of 4.95% senior notes

is due April 2013 (2013 Notes), $2.5 billion of 5.75% senior notes is due April 2018 (2018 Notes), and

$1.25 billion of 6.50% senior notes is due April 2038 (2038 Notes). We issued these senior notes to finance

the acquisition of BEA and for general corporate purposes. Some or all of the 2013 Notes, 2018 Notes and

2038 Notes may be redeemed at any time, subject to payment of a make-whole premium. The 2013 Notes,

2018 Notes and 2038 Notes pay interest semi-annually.

In May 2007, we issued $2.0 billion of floating rate senior notes, of which $1.0 billion was due and paid in

May 2009 (New 2009 Notes) and $1.0 billion is due May 2010 (2010 Notes). We issued the New 2009 Notes

and 2010 Notes to fund the redemption of the $1.5 billion of senior floating rate notes that we issued in fiscal

2006 (see below) and for general corporate purposes. The 2010 Notes bear interest at a rate of three-month

USD LIBOR plus 0.06% with interest payable quarterly. The 2010 Notes may not be redeemed prior to their

maturity.

In January 2006, we issued $5.75 billion of senior notes consisting of $1.5 billion of floating rate senior notes

due 2009 (Original 2009 Notes), $2.25 billion of 5.00% senior notes due 2011 (2011 Notes) and $2.0 billion

of 5.25% senior notes due 2016 (2016 Notes and together with the Original 2009 Notes and the 2011 Notes,

Original Senior Notes) to finance the Siebel acquisition and for general corporate purposes. On June 16, 2006,

we completed a registered exchange offer of the Original Senior Notes for registered senior notes with

substantially identical terms to the Original Senior Notes.

In May 2007, we redeemed the Original 2009 Notes for their principal amount plus accrued and unpaid

interest. Our 2011 Notes and 2016 Notes may also be redeemed at any time, subject to payment of a

make-whole premium. Interest is payable semi-annually for the 2011 Notes and 2016 Notes.

The effective interest yields of the 2010 Notes, 2011 Notes, 2013 Notes, 2016 Notes, 2018 Notes and 2038

Notes (collectively, the Senior Notes) at May 31, 2009 were 0.97%, 5.08%, 4.96%, 5.33%, 5.76% and 6.52%,

respectively. We have entered into an interest rate swap agreement that has the economic effect of modifying

the variable interest obligations associated with the 2010 Notes so that the interest payable on the senior notes

effectively became fixed at a rate of 4.59% (see Note 10 for additional information).

94

Source: ORACLE CORP, 10-K, June 29, 2009 Powered by Morningstar® Document Research℠