Oracle 2008 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2008 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

positions as an increase or decrease to goodwill, regardless of the time that had elapsed since the acquisition

date. Statement 141(R) will no longer permit this accounting and generally will require any such changes to

be recorded in current period income tax expense, unless any such change is identified during the

measurement period and it relates to new information obtained about facts and circumstances that existed as

of the acquisition date. Such estimate revisions that do not qualify as measurement period adjustments will be

recorded to our provision for income taxes in our consolidated statement of operations in the period the

revision is made and could have a material impact on our consolidated financial statements.

Fiscal 2008 Compared to Fiscal 2007: Provision for income taxes increased in fiscal 2008 and fiscal 2007

due primarily to higher earnings before taxes.

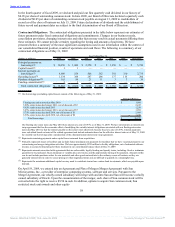

Liquidity and Capital Resources

As of May 31,

(Dollars in millions) 2009 Change 2008 Change 2007

Working capital $ 9,432 17% $ 8,074 131% $ 3,496

Cash, cash equivalents and marketable

securities $ 12,624 14% $ 11,043 57% $ 7,020

Working Capital: The increase in working capital as of May 31, 2009 in comparison to May 31, 2008 was

due to the favorable impact to our net current assets, primarily our cash, cash equivalents and marketable

securities balances, resulting from our net income generated during fiscal 2009. This increase in working

capital was partially offset by an increase in our stock repurchases during fiscal 2009 in comparison to the

prior year (we used $4.0 billion of cash for stock repurchases during fiscal 2009 in comparison to $2.0 billion

used for stock repurchases during fiscal 2008), cash used for our acquisitions, cash used to repay $1.0 billion

of our Senior Notes that matured in May 2009 and the reclassification of $1.0 billion of our Senior Notes due

May 2010 as a current liability, cash used to pay dividends to our stockholders for the first time in our history,

and the decline in value of our net current assets held by certain of our foreign subsidiaries as a result of the

strengthening of the U.S. Dollar during fiscal 2009 (the offset to which is recorded to accumulated other

comprehensive income in our consolidated balance sheet). Our working capital may be impacted by all of the

aforementioned factors in future periods, certain amounts and timing of which are variable.

The increase in working capital as of May 31, 2008 in comparison to May 31, 2007 was primarily due to an

increase in our cash, cash equivalents and marketable securities balances resulting from the issuance of

$5.0 billion of long-term senior notes in April 2008, additional cash and trade receivables generated from our

operations and our adoption of FIN 48, which resulted in $1.3 billion of uncertain tax positions being

prospectively reclassified from current income taxes payable to non-current taxes payable. These increases in

working capital were partially offset by cash used in fiscal 2008 to pay for our acquisitions (primarily BEA)

and to repurchase our common stock.

Cash, Cash Equivalents and Marketable Securities: Cash and cash equivalents primarily consist of deposits

held at major banks, money market funds, Tier-1 commercial paper, U.S. Treasury obligations,

U.S. government agency and government sponsored enterprise obligations, and other securities with original

maturities of 90 days or less. Marketable securities primarily consist of time deposits held at major banks,

Tier-1 commercial paper, corporate notes, U.S. Treasury obligations and U.S. government agency and

government sponsored enterprise obligations. The increase in cash, cash equivalents and marketable securities

at May 31, 2009 in comparison to May 31, 2008 was due to an increase in cash generated from our operating

activities. Cash, cash equivalents and marketable securities include $11.3 billion held by our foreign

subsidiaries as of May 31, 2009. The amount of cash, cash equivalents and marketable securities that we

report in U.S. Dollars for a significant portion of the cash held by these subsidiaries is subject to translation

adjustments caused by changes in foreign currency exchange rates as of the end of each respective reporting

period (the offset to which is recorded to accumulated other comprehensive income on our consolidated

balance sheet). As the U.S. Dollar strengthened against most major international currencies during fiscal

2009, the amount of cash, cash equivalents and marketable securities that we reported in U.S. Dollars for

these subsidiaries declined relative to what we would have reported using a constant currency rate as of

May 31, 2008. Our cash, cash equivalents and marketable securities balances were also partially offset by

cash used for our acquisitions, the repayment of $1.0 billion of senior notes in May 2009, the repurchases of

our common stock (see discussion above), and the payment of cash dividends to our stockholders.

55

Source: ORACLE CORP, 10-K, June 29, 2009 Powered by Morningstar® Document Research℠