Oracle 2008 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2008 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

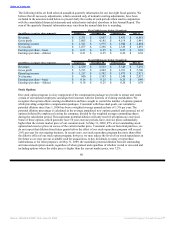

In the fourth quarter of fiscal 2009, we declared and paid our first quarterly cash dividend in our history of

$0.05 per share of outstanding common stock. In June 2009, our Board of Directors declared a quarterly cash

dividend of $0.05 per share of outstanding common stock payable on August 13, 2009 to stockholders of

record as of the close of business on July 15, 2009. Future declarations of dividends and the establishment of

future record and payment dates are subject to the final determination of our Board of Directors.

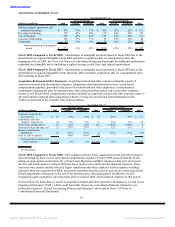

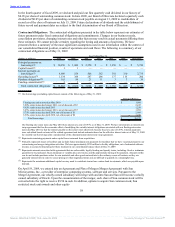

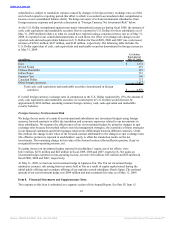

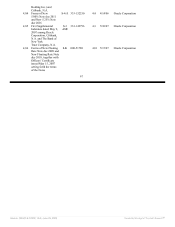

Contractual Obligations: The contractual obligations presented in the table below represent our estimates of

future payments under fixed contractual obligations and commitments. Changes in our business needs,

cancellation provisions, changing interest rates and other factors may result in actual payments differing from

these estimates. We cannot provide certainty regarding the timing and amounts of payments. We have

presented below a summary of the most significant assumptions used in our information within the context of

our consolidated financial position, results of operations and cash flows. The following is a summary of our

contractual obligations as of May 31, 2009:

Year Ending May 31,

(Dollars in millions) Total 2010 2011 2012 2013 2014 Thereafter

Principal payments on

borrowings(1) $ 10,250 $ 1,000 $ 2,250 $ — $ 1,250 $ — $ 5,750

Capital leases(2) 1 1 — — — — —

Interest payments on

borrowings(1) 4,909 554 506 392 392 330 2,735

Operating leases(3) 1,334 388 287 206 137 116 200

Purchase obligations(4) 165 88 21 11 3 3 39

Funding commitments(5) 3 3 — — — — —

Total contractual obligations $ 16,662 $ 2,034 $ 3,064 $ 609 $ 1,782 $ 449 $ 8,724

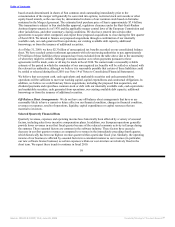

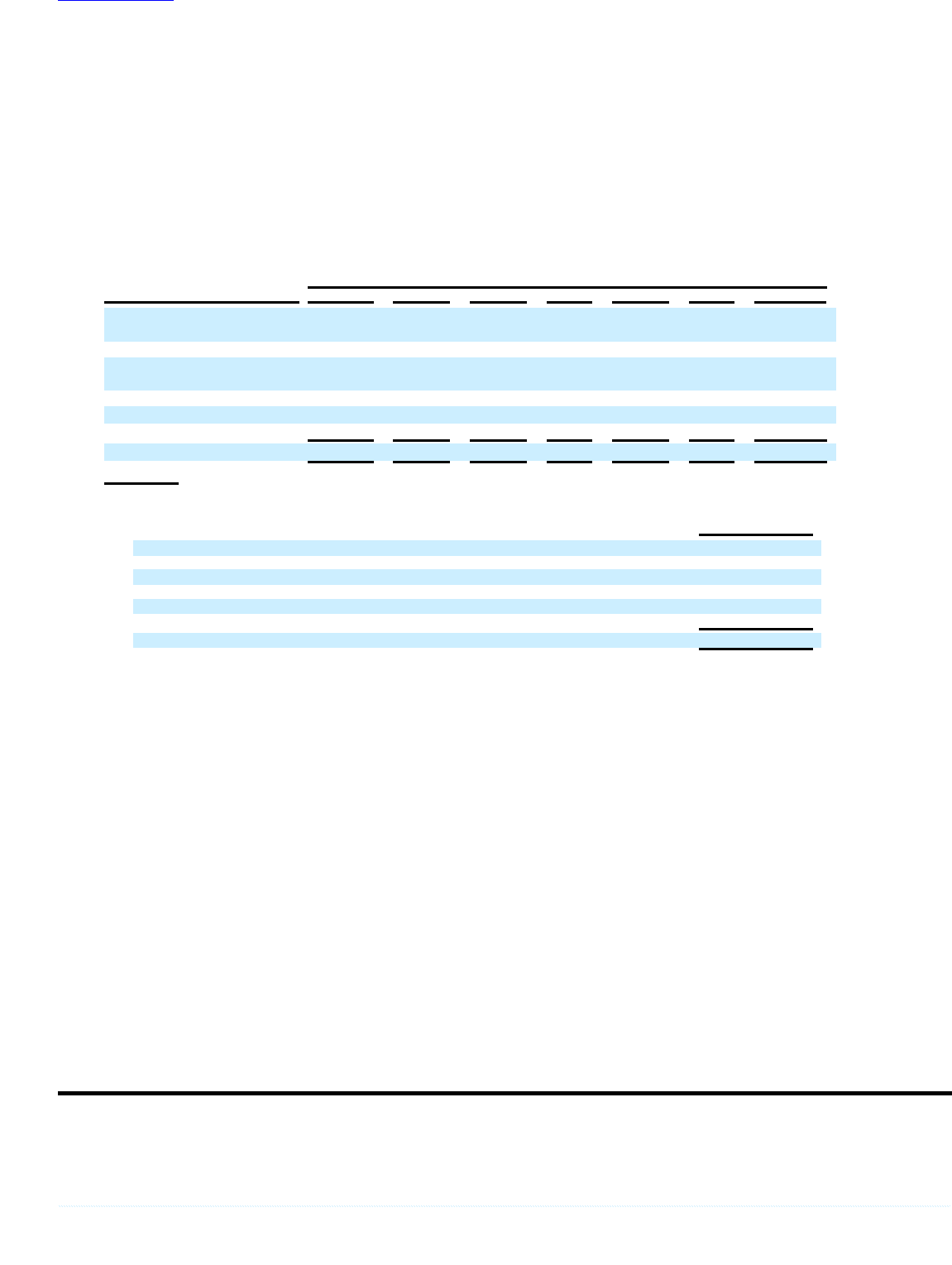

(1) Our borrowings (excluding capital leases) consist of the following as of May 31, 2009:

Principal Balance

Floating rate senior notes due May 2010 $ 1,000

5.00% senior notes due January 2011, net of discount of $3 2,247

4.95% senior notes due April 2013 1,250

5.25% senior notes due January 2016, net of discount of $7 1,993

5.75% senior notes due April 2018, net of discount of $1 2,499

6.50% senior notes due April 2038, net of discount of $2 1,248

Total borrowings $ 10,237

Our floating rate senior notes due May 2010 bore interest at a rate of 0.97% as of May 31, 2009. We have entered into an interest rate

swap agreement that has the economic effect of modifying the variable interest obligations associated with our floating rate senior

notes due May 2010 so that the interest payable on the senior notes effectively became fixed at a rate of 4.59%. Interest payments

were calculated based on terms of the related agreement and include estimates based on the effective interest rates as of May 31, 2009

for variable rate borrowings after consideration of the aforementioned interest rate swap agreement.

(2) Represents remaining payments under capital leases assumed from acquisitions.

(3) Primarily represents leases of facilities and includes future minimum rent payments for facilities that we have vacated pursuant to our

restructuring and merger integration activities. We have approximately $259 million in facility obligations, net of estimated sublease

income, in accrued restructuring for these locations in our consolidated balance sheet at May 31, 2009.

(4) Represents amounts associated with agreements that are enforceable, legally binding and specify terms, including: fixed or minimum

quantities to be purchased; fixed, minimum or variable price provisions; and the approximate timing of the payment. Amounts in this

row do not include purchase orders for raw materials and other goods entered into in the ordinary course of business as they are

generally entered into in order to secure pricing or other negotiated terms and are difficult to quantify in a meaningful way.

(5) Represents the maximum additional capital we may need to contribute toward our venture fund investments, which are payable upon

demand.

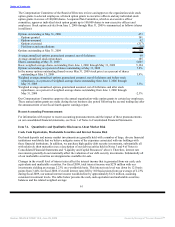

On April 19, 2009, we entered into an Agreement and Plan of Merger (Merger Agreement) with Sun

Microsystems, Inc., a provider of enterprise computing systems, software and services. Pursuant to the

Merger Agreement, our wholly owned subsidiary will merge with and into Sun and Sun will become a wholly

owned subsidiary of Oracle. Upon the consummation of the merger, each share of Sun common stock will be

converted into the right to receive $9.50 in cash. In addition, options to acquire Sun common stock, Sun

restricted stock unit awards and other equity-

58

Source: ORACLE CORP, 10-K, June 29, 2009 Powered by Morningstar® Document Research℠