Oracle 2008 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2008 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2009

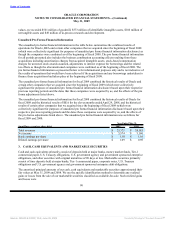

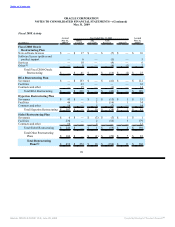

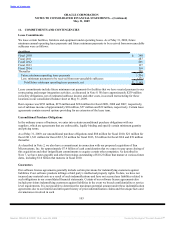

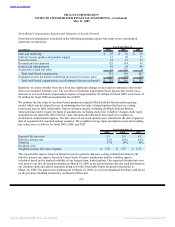

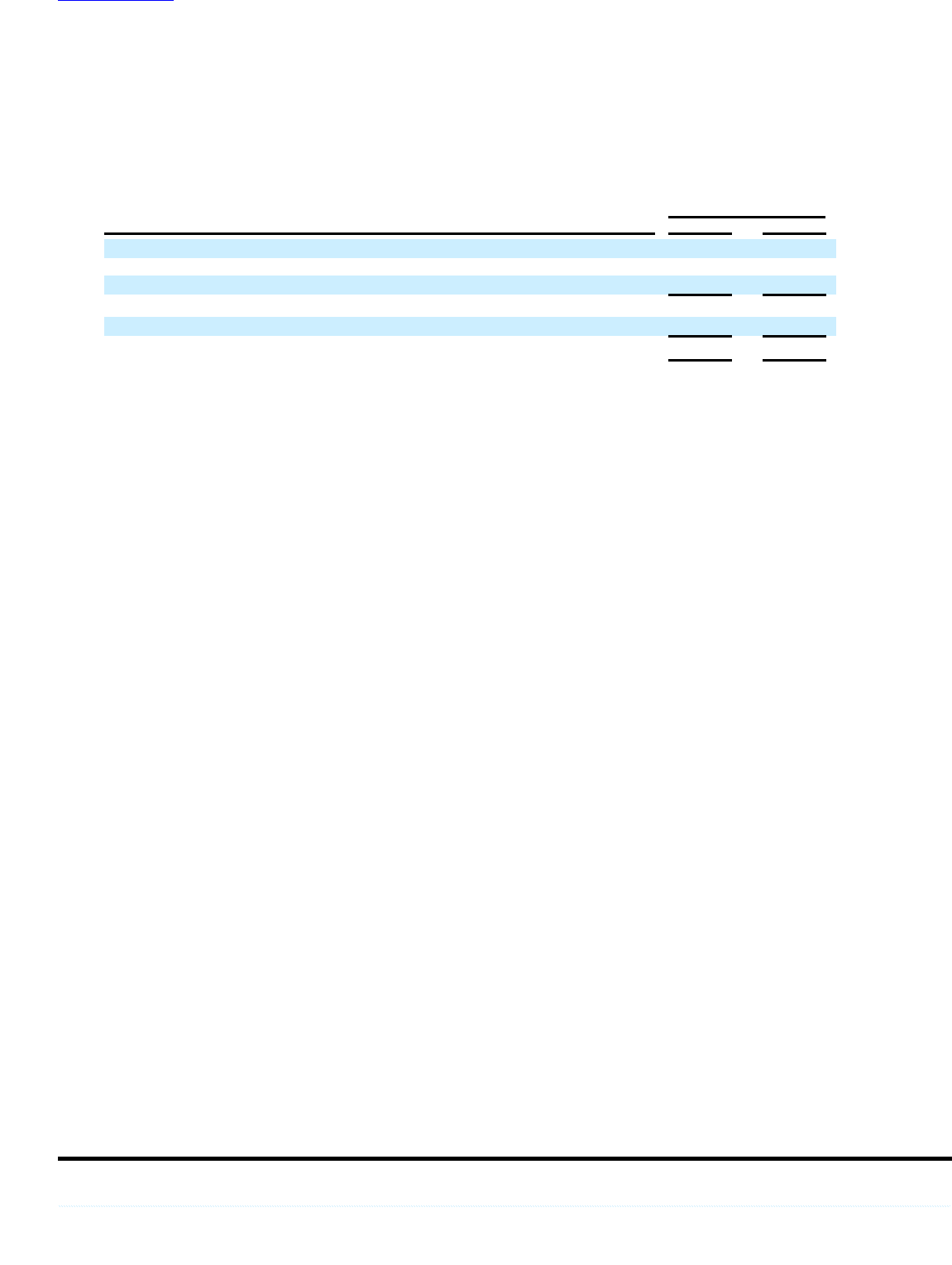

9. DEFERRED REVENUES

Deferred revenues consisted of the following:

May 31,

(in millions) 2009 2008

Software license updates and product support $ 4,158 $ 3,939

Services 243 333

New software licenses 191 220

Deferred revenues, current 4,592 4,492

Deferred revenues, non-current (in other non-current liabilities) 204 262

Total deferred revenues $ 4,796 $ 4,754

Deferred software license updates and product support revenues represent customer payments made in

advance for annual support contracts. Software license updates and product support contracts are typically

billed on a per annum basis in advance and revenues are recognized ratably over the support periods. Deferred

service revenues include prepayments for consulting, On Demand and education services. Revenue for these

services is recognized as the services are performed. Deferred new software license revenues typically result

from undelivered products or specified enhancements, customer specific acceptance provisions, software

license transactions that cannot be segmented from consulting services or certain extended payment term

arrangements.

In connection with the purchase price allocations related to our acquisitions, we have estimated the fair values

of the support obligations assumed. The estimated fair values of the support obligations assumed were

determined using a cost-build up approach. The cost-build up approach determines fair value by estimating

the costs relating to fulfilling the obligations plus a normal profit margin. The sum of the costs and operating

profit approximates, in theory, the amount that we would be required to pay a third party to assume the

support obligations. These fair value adjustments reduce the revenues recognized over the support contract

term of our acquired contracts and, as a result, we did not recognize software license updates and product

support revenues related to support contracts assumed from our acquisitions in the amount of $243 million,

$179 million and $212 million in fiscal 2009, 2008 and 2007, respectively which would have been otherwise

recorded by our acquired businesses as independent entities.

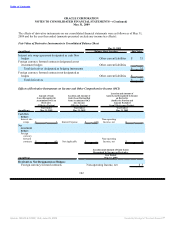

10. DERIVATIVE FINANCIAL INSTRUMENTS

On December 1, 2008, we adopted FASB Statement No. 161, Disclosures about Derivative Instruments and

Hedging Activities, an amendment of FASB Statement 133. The adoption of Statement 161 had no financial

impact on our consolidated financial statements and only required additional financial statement disclosures.

We have applied the requirements of Statement 161 on a prospective basis. Accordingly, disclosures related

to prior fiscal years have not been presented.

Interest Rate Swap Agreement

We use an interest rate swap agreement to manage the economic effect of variable interest obligations

associated with our 2010 Notes so that the interest payable on the 2010 Notes effectively becomes fixed at a

rate of 4.59%, thereby reducing the impact of future interest rate changes on our future interest expense. We

do not use interest rate swap agreements for trading purposes. The critical terms of the interest rate swap

agreement and the 2010 Notes match, including the notional amounts, interest rate reset dates, maturity dates

and underlying market indices. Accordingly, we have designated this swap agreement as a qualifying

instrument and are accounting for it as a cash flow hedge pursuant to FASB Statement No. 133, Accounting

for Derivative Instruments and Hedging Activities. The unrealized losses on this interest rate swap agreement

are included in accumulated other comprehensive income and the corresponding fair value payables are

included in other current liabilities in our consolidated

100

Source: ORACLE CORP, 10-K, June 29, 2009 Powered by Morningstar® Document Research℠