Oracle 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

subsidiaries is subject to translation variance caused by changes in foreign currency exchange rates as of the

end of each respective reporting period (the offset to which is recorded to accumulated other comprehensive

income on our consolidated balance sheet). We hedge net assets of certain international subsidiaries from

foreign currency exposure and provide a discussion in “Foreign Currency Net Investment Risk” below.

As the U.S. Dollar strengthened against most major international currencies during fiscal 2009, the amount of

cash, cash equivalents and marketable securities that we reported in U.S. Dollars for these subsidiaries as of

May 31, 2009 declined relative to what we would have reported using a constant currency rate as of May 31,

2008. As reported in our consolidated statements of cash flows, the effect of exchange rate changes on our

reported cash and cash equivalents balances in U.S. Dollars for fiscal 2009, 2008 and 2007 was a (decrease)

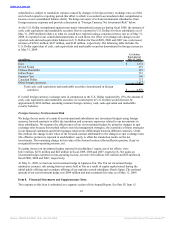

increase of $(501) million, $437 million, and $149 million, respectively. The following table includes the

U.S. Dollar equivalent of cash, cash equivalents and marketable securities denominated in foreign currencies

at May 31, 2009.

U.S. Dollar

Equivalent at

(in millions) May 31, 2009

Euro $ 1,372

British Pound 655

Chinese Renminbi 635

Indian Rupee 333

Japanese Yen 196

Canadian Dollar 171

Other foreign currencies 1,617

Total cash, cash equivalents and marketable securities denominated in foreign

currencies $ 4,979

If overall foreign currency exchange rates in comparison to the U.S. Dollar weakened by 10%, the amount of

cash, cash equivalents and marketable securities we would report in U.S. Dollars would decrease by

approximately $498 million, assuming constant foreign currency cash, cash equivalent and marketable

security balances.

Foreign Currency Net Investment Risk

We hedge the net assets of certain of our international subsidiaries (net investment hedges) using foreign

currency forward contracts to offset the translation and economic exposures related to our investments in

these subsidiaries. We measure the effectiveness of our net investment hedges by using the changes in spot

exchange rates because this method reflects our risk management strategies, the economics of those strategies

in our financial statements and better manages interest rate differentials between different countries. Under

this method, the change in fair value of the forward contract attributable to the changes in spot exchange rates

(the effective portion) is reported in stockholders’ equity to offset the translation results on the net

investments. The remaining change in fair value of the forward contract (the ineffective portion, if any) is

recognized in non-operating income, net.

Net gains (losses) on investment hedges reported in stockholders’ equity, net of tax effects, were

$(41) million, $(53) million and $28 million in fiscal 2009, 2008 and 2007, respectively. Net gains on

investment hedges reported in non-operating income, net were $10 million, $23 million and $28 million in

fiscal 2009, 2008 and 2007, respectively.

At May 31, 2009, we had one net investment hedge in Japanese Yen. The Yen net investment hedge

minimizes currency risk arising from net assets held in Yen as a result of equity capital raised during the

initial public offering and secondary offering of our majority owned subsidiary, Oracle Japan. The notional

amount of our net investment hedge was $694 million and had a nominal fair value as of May 31, 2009.

Item 8. Financial Statements and Supplementary Data

The response to this item is submitted as a separate section of this Annual Report. See Part IV, Item 15.

63

Source: ORACLE CORP, 10-K, June 29, 2009 Powered by Morningstar® Document Research℠