Oracle 2008 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2008 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2009

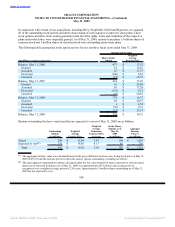

In connection with certain of our acquisitions, including BEA, PeopleSoft, Siebel and Hyperion, we assumed

all of the outstanding stock options and other stock awards of each acquiree’s respective stock plans. These

stock options and other stock awards generally retain all of the rights, terms and conditions of the respective

plans under which they were originally granted. As of May 31, 2009, options to purchase 53 million shares of

common stock and 1 million shares of restricted stock were outstanding under these plans.

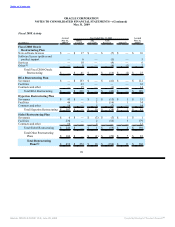

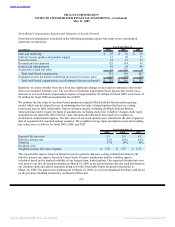

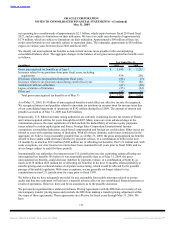

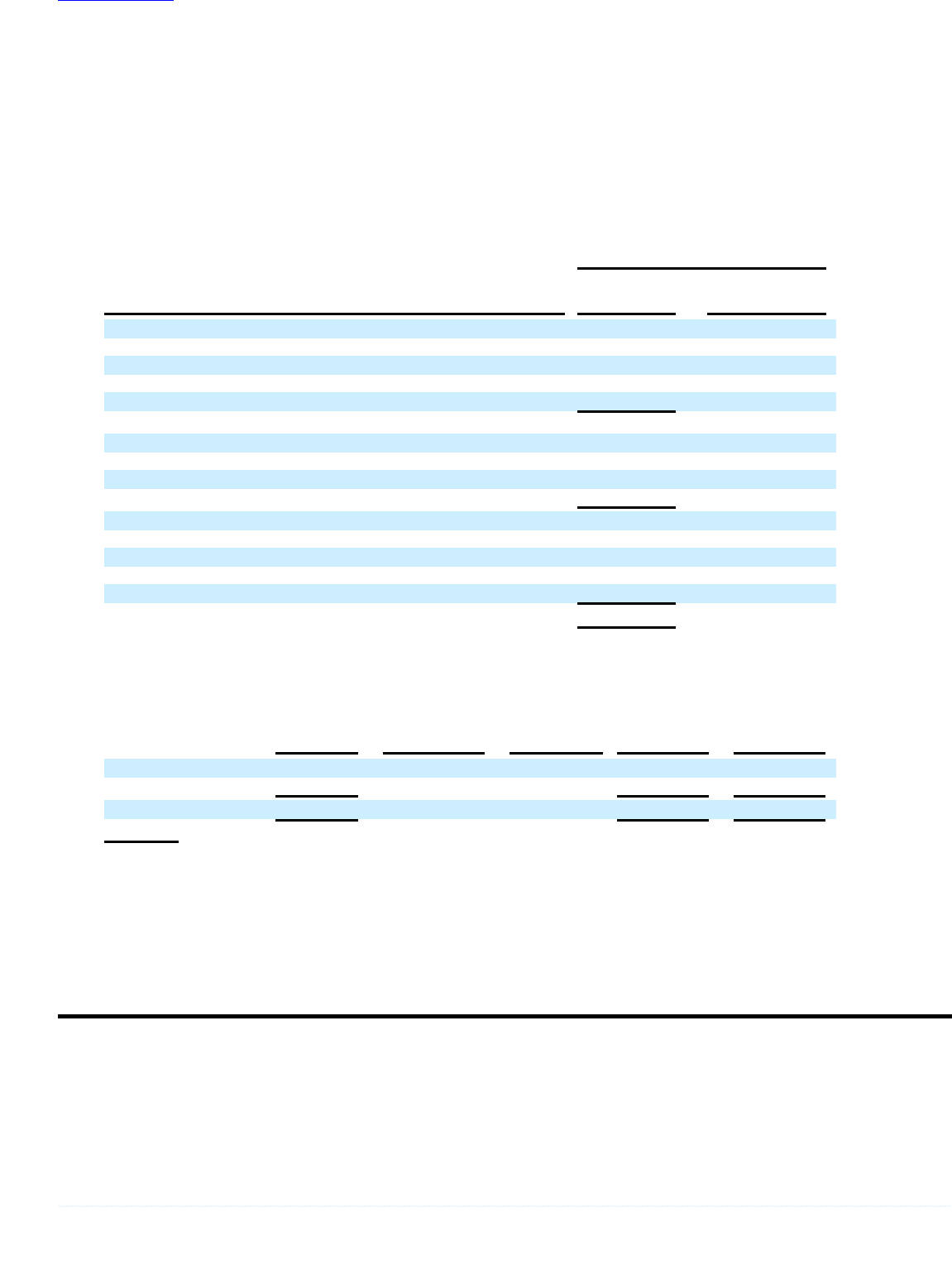

The following table summarizes stock option activity for our last three fiscal years ended May 31, 2009:

Options Outstanding

Weighted

Shares Under Average

(in millions, except exercise price) Option Exercise Price

Balance, May 31, 2006 473 $ 13.25

Granted 61 $ 14.81

Assumed 25 $ 11.27

Exercised (106) $ 8.22

Canceled (19) $ 34.57

Balance, May 31, 2007 434 $ 13.65

Granted 61 $ 20.49

Assumed 36 $ 17.24

Exercised (135) $ 9.12

Canceled (18) $ 20.83

Balance, May 31, 2008 378 $ 16.37

Granted 69 $ 20.53

Assumed 1 $ 6.54

Exercised (76) $ 9.31

Canceled (13) $ 25.14

Balance, May 31, 2009 359 $ 18.32

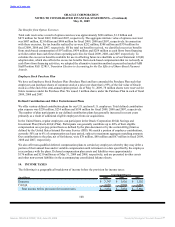

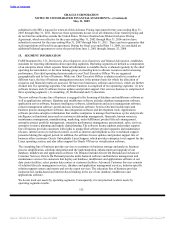

Options outstanding that have vested and that are expected to vest as of May 31, 2009 are as follows:

Weighted In-the-Money

Average Options as of Aggregate

Outstanding Weighted Remaining May 31, Intrinsic

Options Average Contract Term 2009 Value(1)

(in millions) Exercise Price (in years) (in millions) (in millions)

Vested 209 $ 18.04 3.97 149 $ 1,065

Expected to vest(2) 136 $ 18.60 8.13 43 236

Total 345 $ 18.26 5.62 192 $ 1,301

(1) The aggregate intrinsic value was calculated based on the gross difference between our closing stock price on May 31,

2009 of $19.59 and the exercise prices for all in-the-money options outstanding, excluding tax effects.

(2) The unrecognized compensation expense calculated under the fair value method for shares expected to vest (unvested

shares net of expected forfeitures) as of May 31, 2009 was approximately $631 million and is expected to be

recognized over a weighted average period of 2.65 years. Approximately 14 million shares outstanding as of May 31,

2009 are not expected to vest.

106

Source: ORACLE CORP, 10-K, June 29, 2009 Powered by Morningstar® Document Research℠