Oracle 2008 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2008 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2009

Tax Benefits from Option Exercises

Total cash received as a result of option exercises was approximately $696 million, $1.2 billion and

$873 million for fiscal 2009, 2008 and 2007, respectively. The aggregate intrinsic value of options exercised

was $807 million, $2.0 billion and $986 million for fiscal 2009, 2008 and 2007, respectively. In connection

with these exercises, the tax benefits realized by us were $252 million, $588 million and $338 million for

fiscal 2009, 2008 and 2007, respectively. Of the total tax benefits received, we classified excess tax benefits

from stock-based compensation of $97 million, $454 million and $259 million as cash flows from financing

activities rather than cash flows from operating activities for fiscal 2009, 2008, and 2007 respectively. To

calculate the excess tax benefits available for use in offsetting future tax shortfalls as of our Statement 123(R)

adoption date, which also affects the excess tax benefits from stock-based compensation that we reclassify as

cash flows from financing activities, we adopted the alternative transition method as prescribed under FASB

Staff Position FAS 123R-3, Transition Election to Accounting for the Tax Effects of Share-Based Payment

Awards.

Employee Stock Purchase Plan

We have an Employee Stock Purchase Plan (Purchase Plan) and have amended the Purchase Plan such that

employees can purchase shares of common stock at a price per share that is 95% of the fair value of Oracle

stock as of the end of the semi-annual option period. As of May 31, 2009, 78 million shares were reserved for

future issuances under the Purchase Plan. We issued 3 million shares under the Purchase Plan in each of fiscal

2009, 2008 and 2007.

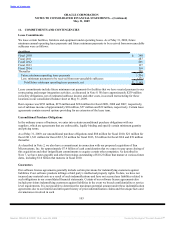

Defined Contribution and Other Postretirement Plans

We offer various defined contribution plans for our U.S. and non-U.S. employees. Total defined contribution

plan expense was $258 million, $234 million and $198 million for fiscal 2009, 2008 and 2007, respectively.

The number of plan participants in our defined contribution plans has generally increased in recent years

primarily as a result of additional eligible employees from our acquisitions.

In the United States, regular employees can participate in the Oracle Corporation 401(k) Savings and

Investment Plan (Oracle 401(k) Plan). Participants can generally contribute up to 40% of their eligible

compensation on a per-pay-period basis as defined by the plan document or by the section 402(g) limit as

defined by the United States Internal Revenue Service (IRS). We match a portion of employee contributions,

currently 50% up to 6% of compensation each pay period, subject to maximum aggregate matching amounts.

Our contributions to the plan, net of forfeitures, were $78 million, $80 million and $67 million in fiscal 2009,

2008 and 2007, respectively.

We also offer non-qualified deferred compensation plans to certain key employees whereby they may defer a

portion of their annual base and/or variable compensation until retirement or a date specified by the employee

in accordance with the plans. Deferred compensation plan assets and liabilities were approximately

$176 million and $210 million as of May 31, 2009 and 2008, respectively, and are presented in other assets

and other non-current liabilities in the accompanying consolidated balance sheets.

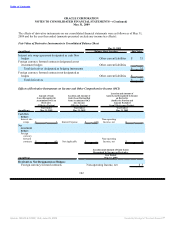

14. INCOME TAXES

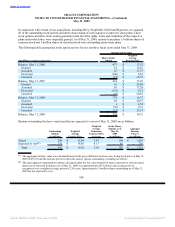

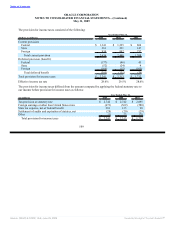

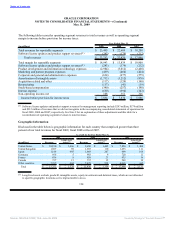

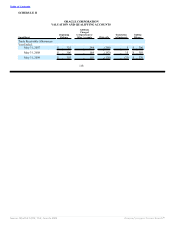

The following is a geographical breakdown of income before the provision for income taxes:

Year Ended May 31,

(in millions) 2009 2008 2007

Domestic $ 3,745 $ 3,930 $ 3,302

Foreign 4,089 3,904 2,684

Total income before provision for income taxes $ 7,834 $ 7,834 $ 5,986

108

Source: ORACLE CORP, 10-K, June 29, 2009 Powered by Morningstar® Document Research℠