Oracle 2008 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2008 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

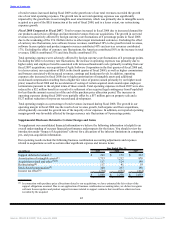

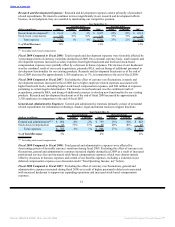

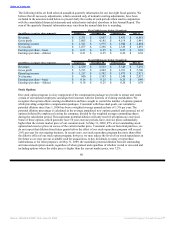

Amortization of Intangible Assets:

Year Ended May 31,

Percent Change Percent Change

(Dollars in millions) 2009 Actual Constant 2008 Actual Constant 2007

Software support agreements and

related relationships $ 549 37% 37% $ 402 25% 25% $ 321

Developed technology 722 40% 40% 515 45% 45% 355

Core technology 255 43% 44% 178 34% 34% 133

Customer relationships 150 77% 77% 85 93% 93% 44

Trademarks 37 16% 16% 32 28% 28% 25

Total amortization of intangible

assets $ 1,713 41% 42% $ 1,212 38% 38% $ 878

Fiscal 2009 Compared to Fiscal 2008: Amortization of intangible assets increased in fiscal 2009 due to the

amortization of acquired intangibles from BEA and other acquisitions that we consummated since the

beginning of fiscal 2008. See Note 6 of Notes to Consolidated Financial Statements for additional information

regarding our intangible assets (including weighted average useful lives) and related amortization.

Fiscal 2008 Compared to Fiscal 2007: Amortization of intangible assets increased in fiscal 2008 due to the

amortization of acquired intangibles from Hyperion, BEA and other acquisitions that we consummated since

the beginning of fiscal 2007.

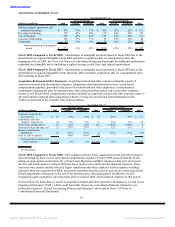

Acquisition Related and Other Expenses: Acquisition related and other expenses primarily consist of

in-process research and development expenses, integration related professional services, stock-based

compensation expenses, personnel related costs for transitional and other employees, certain business

combination adjustments after the purchase price allocation period has ended, and certain other expenses

(income), net. Stock-based compensation expenses included in acquisition related and other expenses relate to

unvested options assumed from acquisitions whereby vesting was accelerated upon termination of the

employees pursuant to the original terms of those options.

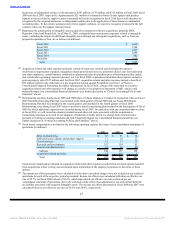

Year Ended May 31,

Percent Change Percent Change

(Dollars in millions) 2009 Actual Constant 2008 Actual Constant 2007

In-process research and

development $ 10 -58% -58% $ 24 -84% -84% $ 151

Transitional and other

employee related costs 45 41% 34% 32 34% 33% 24

Stock-based compensation 15 -87% -87% 112 1,144% 1,144% 9

Professional fees and other, net 25 257% 257% 7 -13% -13% 8

Business combination

adjustments 22 267% 267% 6 111% 111% (52)

Gain on sale of property — -100% -100% (57) * * —

Total acquisition related and

other expenses $ 117 -6% -4% $ 124 -11% -12% $ 140

*Not meaningful

Fiscal 2009 Compared to Fiscal 2008: On a constant currency basis, acquisition related and other expenses

decreased slightly due to lower stock-based compensation expenses in fiscal 2009 caused primarily by the

timing of stock option accelerations for certain former Hyperion and BEA employees that were incurred in

the first and fourth quarters of fiscal 2008 and lower in-process research and development expenses. These

decreases were almost entirely offset by higher transitional and other employee related expenses resulting

primarily from our acquisition of BEA, an increase in professional fees and an increase in certain acquisition

related adjustments subsequent to the end of the purchase price allocation period. In addition, we also

recognized a gain on property sale (described above) in fiscal 2008, which reduced expenses in that period.

In fiscal 2010, the items that we record to acquisition related and other expenses will change as a result of our

adoption of Statement 141(R), which could materially impact our consolidated financial statements (see

further discussion in “Critical Accounting Policies and Estimates” above and in Note 1 of Notes to

Consolidated Financial Statements).

52

Source: ORACLE CORP, 10-K, June 29, 2009 Powered by Morningstar® Document Research℠