Oracle 2008 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2008 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2009

statements of operations based on their fair values and the estimated number of shares we ultimately expect

will vest. In addition, we have applied certain of the provisions of the SEC’s Staff Accounting

Bulletin No. 107 (Topic 14), as amended, in our accounting for Statement 123(R). We recognize stock-based

compensation expense on a straight-line basis over the service period of the award, which is generally four

years. The fair value of the unvested portion of share-based payments granted prior to June 1, 2006 (our

adoption date of Statement 123(R)) is recognized using the accelerated expense attribution method, net of

estimated forfeitures.

We record deferred tax assets for stock-based awards that result in deductions on our income tax returns

based on the amount of stock-based compensation recognized and the statutory tax rate in the jurisdiction in

which we will receive a tax deduction.

Advertising

All advertising costs are expensed as incurred. Advertising expenses, which are included within sales and

marketing expenses, were $71 million, $81 million and $91 million in fiscal 2009, 2008 and 2007,

respectively.

Research and Development

All research and development costs are expensed as incurred. Costs eligible for capitalization under FASB

Statement No. 86, Accounting for the Costs of Computer Software to Be Sold, Leased, or Otherwise

Marketed, were not material to our consolidated financial statements in fiscal 2009, 2008 and 2007,

respectively.

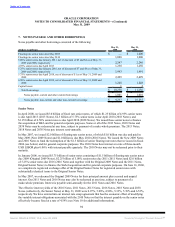

Acquisition Related and Other Expenses

Acquisition related and other expenses consist of in-process research and development expenses, personnel

related costs for transitional and other employees, stock-based compensation expenses, integration related

professional services, certain business combination adjustments after the purchase price allocation period has

ended, and certain other operating expenses (income), net. Stock-based compensation included in acquisition

related and other expenses resulted from unvested options assumed from acquisitions where vesting was

accelerated upon termination of the employees pursuant to the original terms of those options.

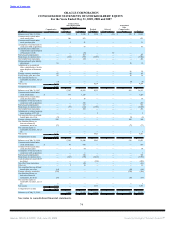

Year Ended May 31,

(in millions) 2009 2008 2007

In-process research and development $ 10 $ 24 $ 151

Transitional and other employee related costs 45 32 24

Stock-based compensation 15 112 9

Professional fees and other, net 25 7 8

Business combination adjustments 22 6 (52)

Gain on sale of property — (57) —

Total acquisition related and other expenses $ 117 $ 124 $ 140

In fiscal 2008, we sold certain of our land and buildings for $153 million in cash. Concurrent with the sale,

we leased the property back from the buyer for a period of up to three years. We have accounted for this

transaction in accordance with FASB Statement No. 28, Accounting for Sales with Leasebacks, FASB

Statement No. 66, Accounting for Sales of Real Estate, and FASB Statement No. 98, Accounting for Leases,

et al. We deferred $19 million of the gain on the sale representing the present value of the operating lease

commitment and recognized a gain of approximately $57 million for fiscal 2008. The deferred portion of the

gain will be recognized as a reduction of rent expense over the operating lease term.

In fiscal 2007, acquisition related and other expenses included a benefit related to the settlement of a lawsuit

filed against PeopleSoft, Inc. on behalf of the U.S. government. This lawsuit was filed in October 2003, prior

to our

84

Source: ORACLE CORP, 10-K, June 29, 2009 Powered by Morningstar® Document Research℠