Oracle 2008 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2008 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Fiscal 2008 Compared to Fiscal 2007: Net cash provided by financing activities in fiscal 2008 increased in

comparison to cash used for financing activities in fiscal 2007 due to the issuance of $5.0 billion of long-term

senior notes, additional proceeds from the exercise of employee stock options and decreased spending on

stock repurchases, and were partially offset by $1.4 billion of net repayments of short-term commercial paper

notes.

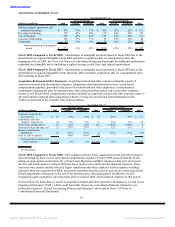

Free cash flow: To supplement our statements of cash flows presented on a GAAP basis, we use non-GAAP

measures of cash flows on a trailing 4-quarter basis to analyze cash flows generated from our operations. We

believe free cash flow is also useful as one of the bases for comparing our performance with our competitors.

The presentation of non-GAAP free cash flow is not meant to be considered in isolation or as an alternative to

net income as an indicator of our performance, or as an alternative to cash flows from operating activities as a

measure of liquidity. We calculate free cash flows as follows:

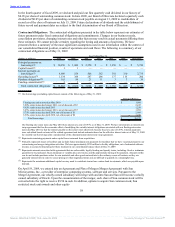

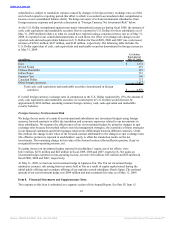

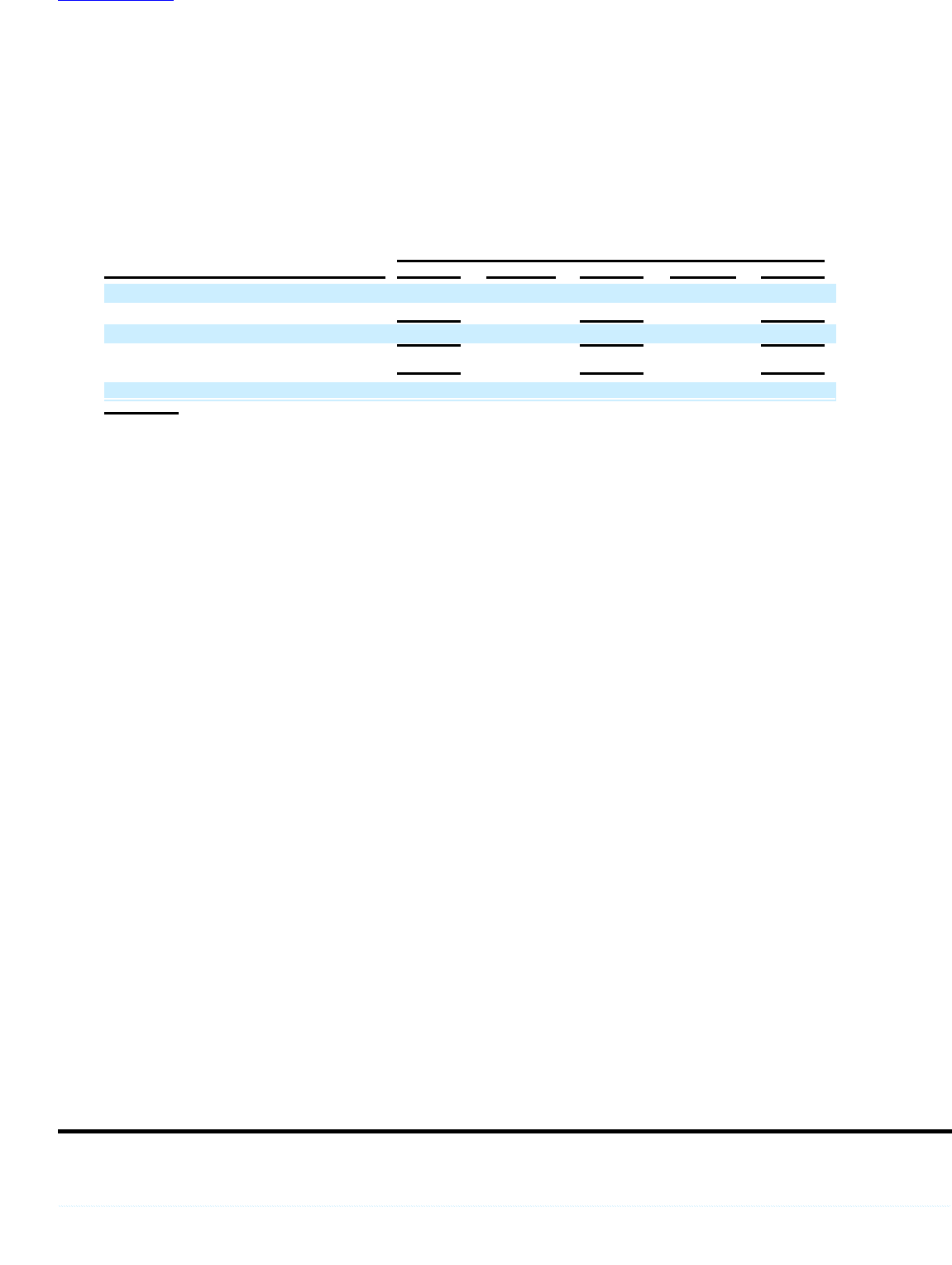

Year Ended May 31,

(Dollars in millions) 2009 Change 2008 Change 2007

Cash provided by operating activities $ 8,255 12% $ 7,402 34% $ 5,520

Capital expenditures(1) (529) 118% (243) -24% (319)

Free cash flow $ 7,726 8% $ 7,159 38% $ 5,201

Net income $ 5,593 1% $ 5,521 29% $ 4,274

Free cash flow as a percent of net income 138% 130% 122%

(1) Represents capital expenditures as reported in cash flows from investing activities in our consolidated statements of cash flows

presented in accordance with U.S. generally accepted accounting principles.

Long-Term Customer Financing: We offer certain of our customers the option to acquire our software

products and service offerings through separate long-term payment contracts. We generally sell contracts that

we have financed on a non-recourse basis to financial institutions. We record the transfers of amounts due

from customers to financial institutions as sales of financial assets because we are considered to have

surrendered control of these financial assets. In fiscal 2009, 2008 and 2007, $1.4 billion, $1.1 billion and

$891 million or approximately 19%, 15% and 15%, respectively, of our new software license revenues were

financed through our financing division.

Recent Financing Activities: In recent years, we have issued long-term senior notes to fund our acquisitions

and for general corporate purposes. During fiscal 2009, we repaid $1.0 billion of senior notes that matured in

May 2009. As of May 31, 2009, we have $10.2 billion of senior notes outstanding, including $1.0 billion that

matures in May 2010. We have also, on occasion, issued short-term commercial paper notes in recent years

pursuant to our commercial paper program to assist with the short-term financing for certain of our

acquisitions and for other general corporate purposes. Typically, we have repaid these liabilities within

12 months or less from their issuance date. We also have entered into certain revolving credit agreements to

back-stop any commercial paper notes we may issue and for other general corporate purposes. As of May 31,

2009, we have no commercial paper notes or amounts under our credit agreements outstanding. If we issue

commercial paper notes in the future, we would most likely use our revolving credit agreements as a

back-stop to these notes and we therefore consider that we have a total of $4.9 billion of capacity available to

us pursuant to our credit agreements and commercial paper program as of May 31, 2009. Additional details of

our various debt facilities and obligations are included in the “Contractual Obligations” section below and in

Note 7 of Notes to Consolidated Financial Statements and risks associated with our debt obligations and any

future debt issuances are included in Risk Factors (Item 1A).

Our Board of Directors has approved a program for us to repurchase shares of our common stock. On

October 20, 2008, our Board of Directors expanded our repurchase program by $8.0 billion and as of May 31,

2009, $6.3 billion was available for share repurchases pursuant to our stock repurchase program. We

repurchased 225.6 million shares for $4.0 billion, 97.3 million shares for $2.0 billion, and 233.5 million

shares for $4.0 billion in fiscal 2009, 2008 and 2007, respectively. Our stock repurchase authorization does

not have an expiration date and the pace of our repurchase activity will depend on factors such as our working

capital needs, our cash requirements for acquisitions and dividend repayments, our debt repayment

obligations (as described below), our stock price, and economic and market conditions. Our stock repurchases

may be effected from time to time through open market purchases or pursuant to a Rule 10b5-1 plan. Our

stock repurchase program may be accelerated, suspended, delayed or discontinued at any time.

57

Source: ORACLE CORP, 10-K, June 29, 2009 Powered by Morningstar® Document Research℠